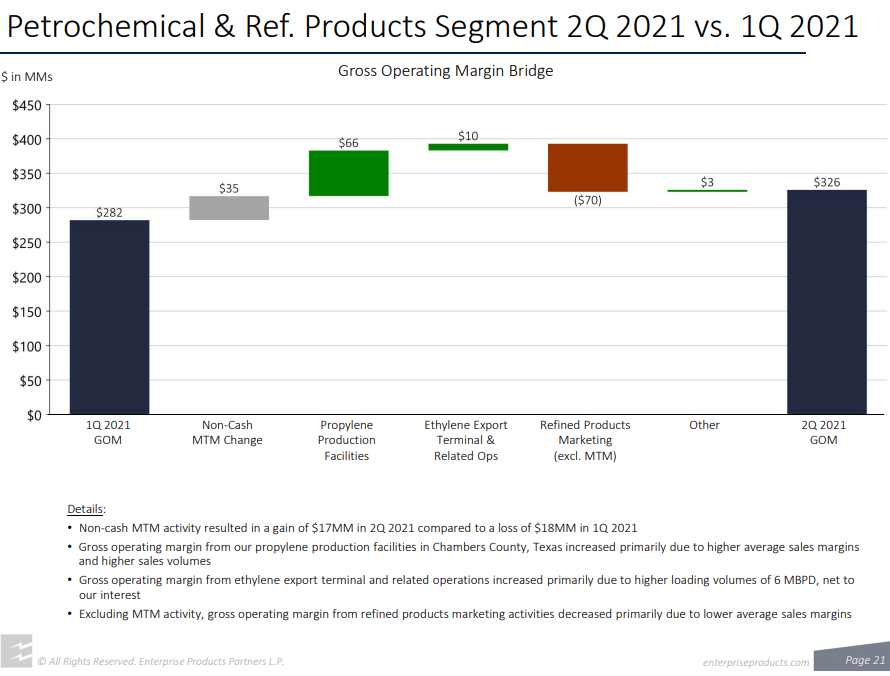

The Enterprise Products propylene numbers are impressive when you considering that its PDH facility was closed for a significant portion of the quarter, and while this likely contributed to tightness in the market, the company could have made even more money in 2Q. The results show the clear tightness in the propylene market in the US and reflect the very strong momentum in propylene derivatives, which is broad-based although we have tended to focus on polypropylene in recent work. See more in today's daily report.

Propylene: Market Tightness and Derivatives Momentum

Jul 28, 2021 12:57:41 PM / by Cooley May posted in Chemicals, Propylene, petrochemicals, Propylene Derivatives, Enterprise Products, PDH

ExxonMobil, SABIC JV Petrochemical Project Runs Ahead of Schedule

Jul 27, 2021 3:41:21 PM / by Cooley May posted in Chemicals, Polyethylene, Ethylene, Styrene, ExxonMobil, petrochemicals, petrochemical capacity, Dow, Sabic, Gulf Coast Growth Ventures, Aramco, Motiva, NPV, chemical plant, ethylene plant

ExxonMobil Chemicals has announced that its Corpus Christi JV project with SABIC is ahead of its original schedule – ExxonMobil is now targeting a start-up in 2H21, ahead of its previously targeted 1H22 expectation. It is unusual for projects in the US to be ready ahead of schedule these days, and start-up delays tend to be the norm. We also take a positive view of this development upon comparison to the Shell Pennsylvania project, which still has a vague 2022 start-up expectation though its construction began before ExxonMobil. One could argue that the remoteness of the location – well away from petrochemical infrastructure has been a constraint for Shell, but the Corpus Christi location is also a greenfield project for ExxonMobil/SABIC. This will be the largest ethylene plant built in the US, though it is likely that the recent 1.5 million ton units (Dow, ExxonMobil, CP Chem) are expandable to 2.0 million tons. Dow is already discussing such a move with a new polyethylene facility at Freeport. It will be interesting to see what impact this ExxonMobil/SABIC facility has on both the USGC ethane market and the polyethylene market – 1.3 million tons of polyethylene is a large increment and SABIC will have half of the capacity and will be a new market entrant with on-shore production. Aramco has ethylene, through Motiva’s purchase of Flint Hills, and SABIC owns half of the Cosmar styrene plant in Louisiana.

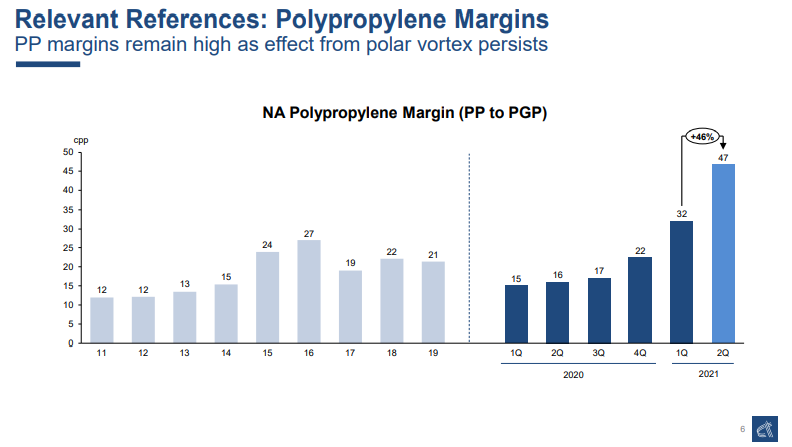

Great North American Polypropylene Margins Despite New Capacity

Jul 22, 2021 12:07:14 PM / by Cooley May posted in Chemicals, Propylene, Polypropylene, Supply Chain, Capacity, cyclical demand, polypropylene margins, Braskem

The much higher polypropylene margins in the US come despite very high propylene pricing, and the whole chain did well in the first half of the year. Demand for polypropylene has been significantly stronger than most expected year to date, although production outages have helped the market, and what we had expected to be a surplus in the US in 2021, precipitated by the Braskem start-up has turned out to be production coming online just in time and prices might have been higher still had the Braskem plant not been there. We see some of the demand as cyclical - in response to consumer durables, though there has been lower use in the auto industry because of the production cutbacks. See more in today's daily report.

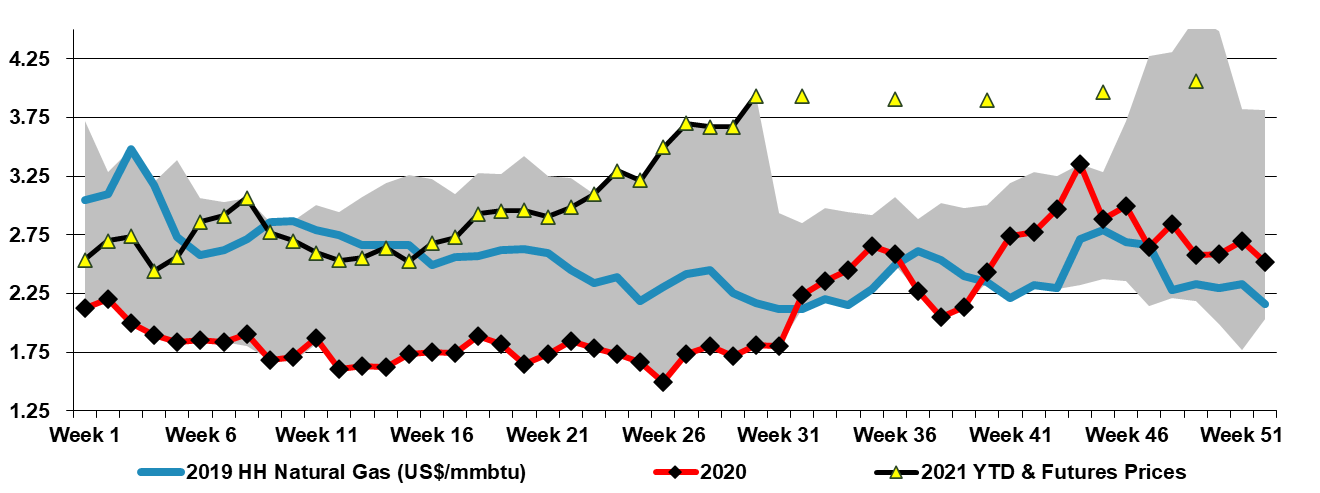

More Oil and Gas Activity Does Not Mean Lower Prices

Jul 21, 2021 1:38:26 PM / by Cooley May posted in ESG, Chemicals, Oil Industry, Energy, Oil, natural gas, natural gas prices, Halliburton

The Halliburton forecast of an upcycle for oil services likely needs to be put into context, as while activity should rise in the sector with higher oil and gas prices, it is unlikely that we will see a major boom. The uncertainty in the energy market, coupled with ESG pressure and borrowing constraints means that the oil industry will likely focus on its lowest hanging fruit first and may hold off on secondary opportunities completely. The oil service guys will benefit because the more productive shale wells can require longer laterals, deeper wells, and more fracking pressure, but it will likely be quality over volume when it comes to drilling activity, in keeping with what we have seen year to date.

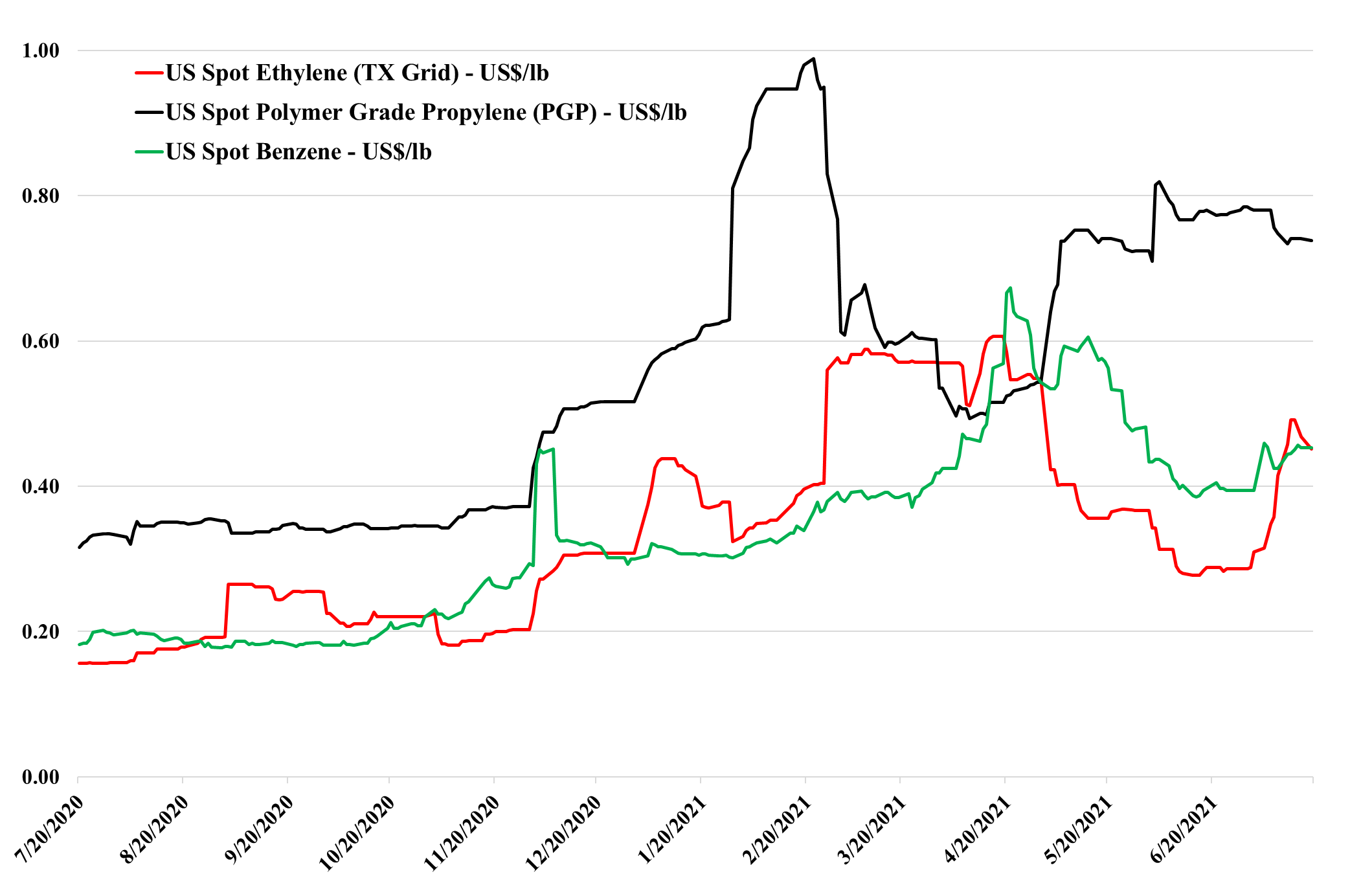

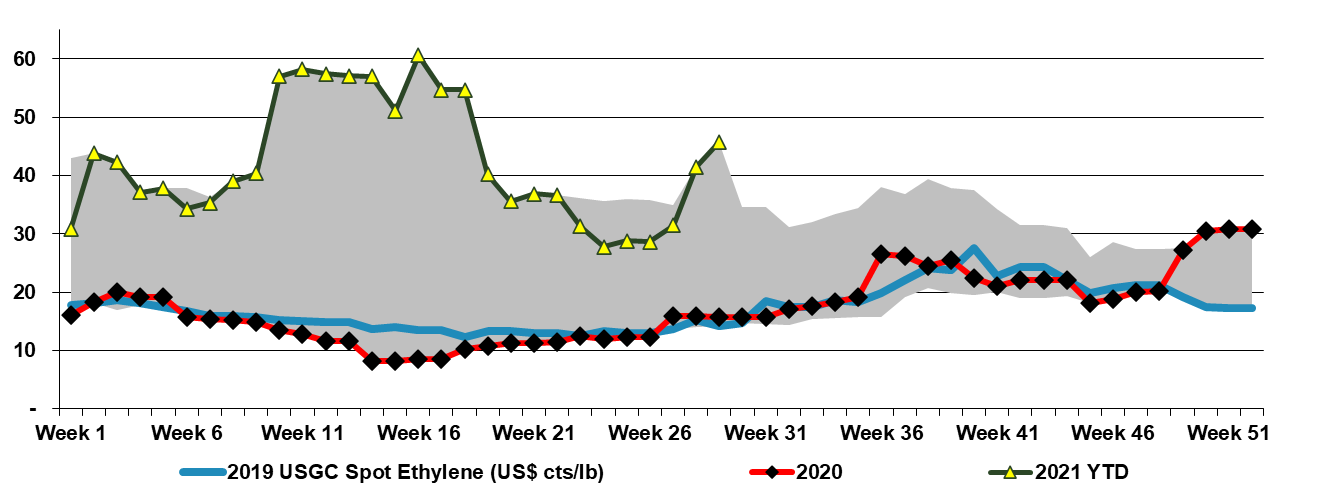

US Ethylene: The Volatility Continues

Jul 20, 2021 3:29:38 PM / by Cooley May posted in Chemicals, Ethylene, supply and demand, volatility

We note the volatility in ethylene in the chart below and point out that ethylene sits in a precarious no-mans-land in the US with pricing neither reflecting costs nor incremental value in use. The downside to generating buying interest in Asia is significant – more than 25% - but an incremental buyer in the US could pay much more than the current price – in many cases to meet export obligations, let alone for domestic sales. We would expect the volatility to continue, with a downside from better production rates and upside from more constraints – demand fluctuations are likely immaterial relative to the impact that supply moves could have. See more in today's daily report.

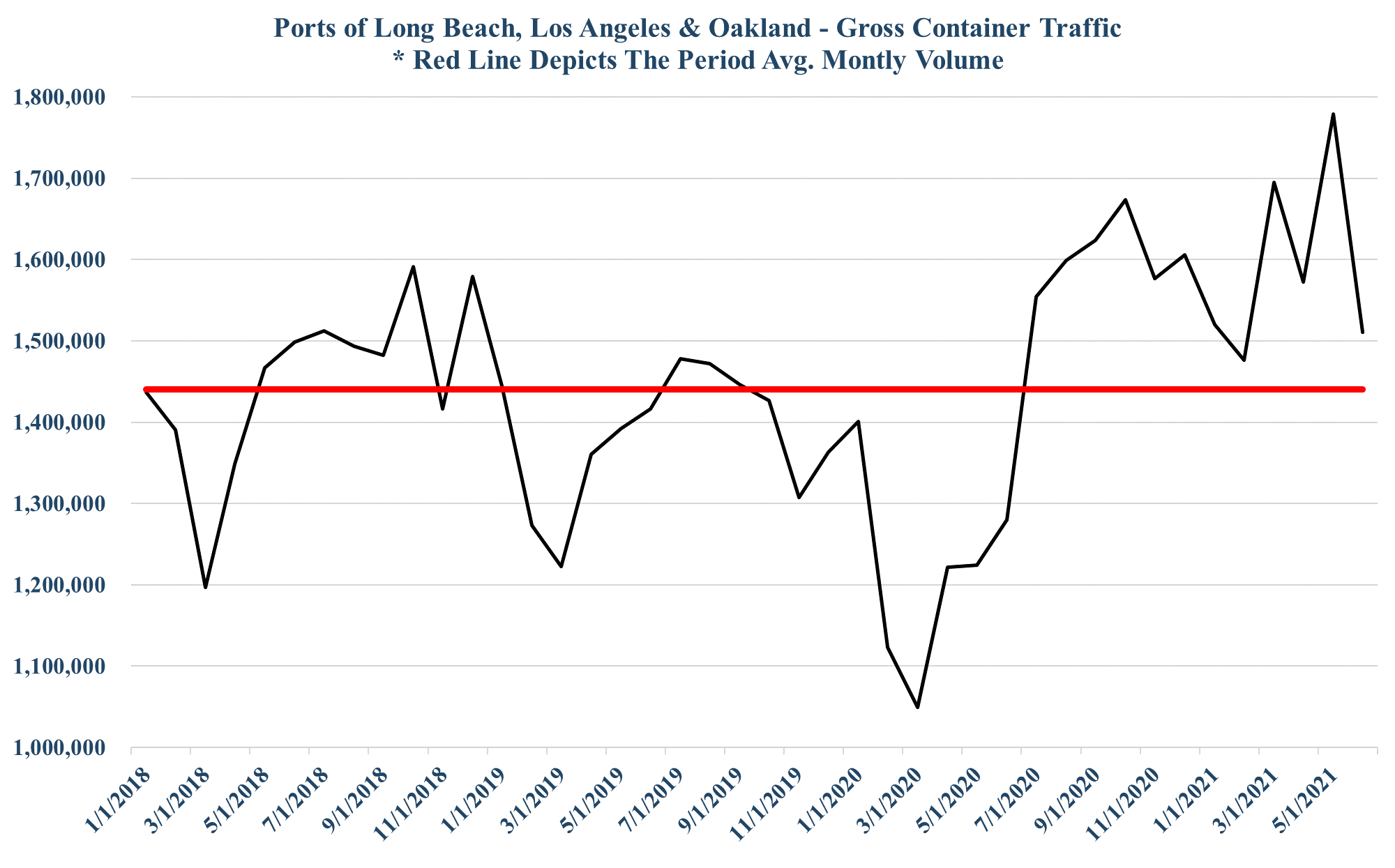

Logistic Issues Are Far From Over For Chemicals and Plastics

Jul 16, 2021 2:05:21 PM / by Cooley May posted in Chemicals, Plastics, Supply Chain, Logistics

We talk at length about the weather risks in the US following multiple extreme weather events during the last 12 months, but we forget that other regions are equally susceptible. Not only are there many chemical facilities on the riverways impacted by the floods in Germany but a significant volume of chemical trade takes place by barge on the rivers for both gases and liquids. We do not have an industry impact assessment for this tragedy in Germany, Belgium, and the Netherlands, but on-site flooding, especially any flooding that impacts electrics, can result in extended shutdowns for repairs, as we have seen in the past in the US.

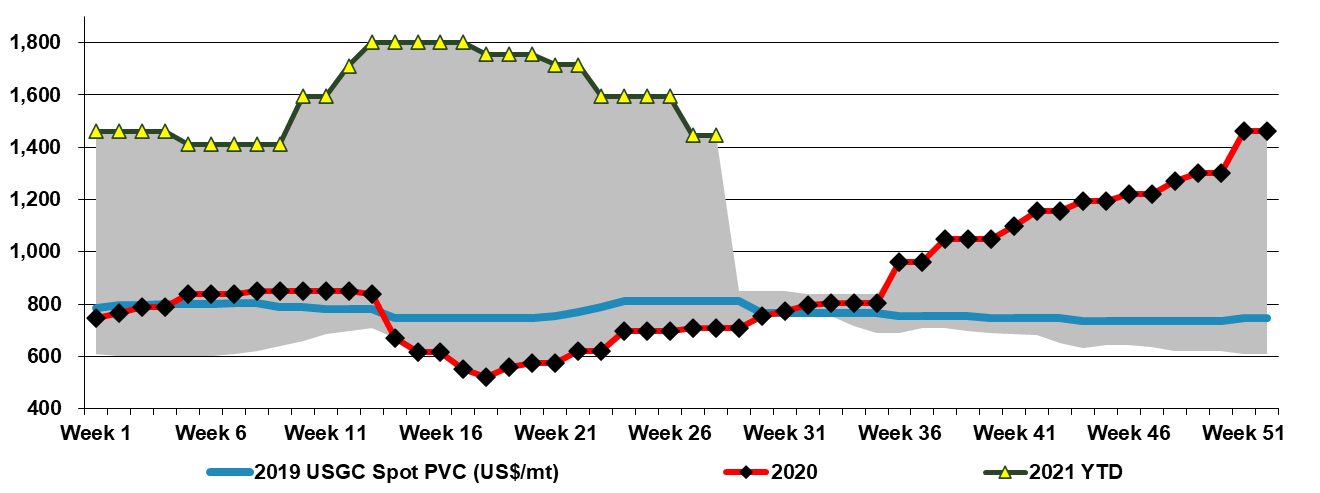

PVC: Some Signs Of Weakening Near Term, But Still Better Positioned Than Most Peer Polymers Long Term, In Our View

Jul 15, 2021 2:01:06 PM / by Cooley May posted in Chemicals, PVC, Ethylene, PVC price, chlorine, EDC

Regional PVC price movements are interesting as the World is trying to find balance. Incremental ethylene and chlorine economics in Asia pushed the local spot prices for EDC so low as to shut out US EDC exports – the net result has been more PVC production in the US and a decline in US spot prices. While it is likely that the Asia incremental pricing will improve as some sellers will be losing money and may need to cut back rates, the US will not enjoy a better export market without the acceptance of much lower netbacks, which will maintain negative pressure on domestic prices. That said, PVC is very levered to economic, construction, and housing investment in Asia and there is likely some pent-up COVID-related demand in the region – the oversupplied market may not last for long. We still see a better medium-term outlook for PVC than for other major polymers. There's more detail and coverage on today's daily report linked here.

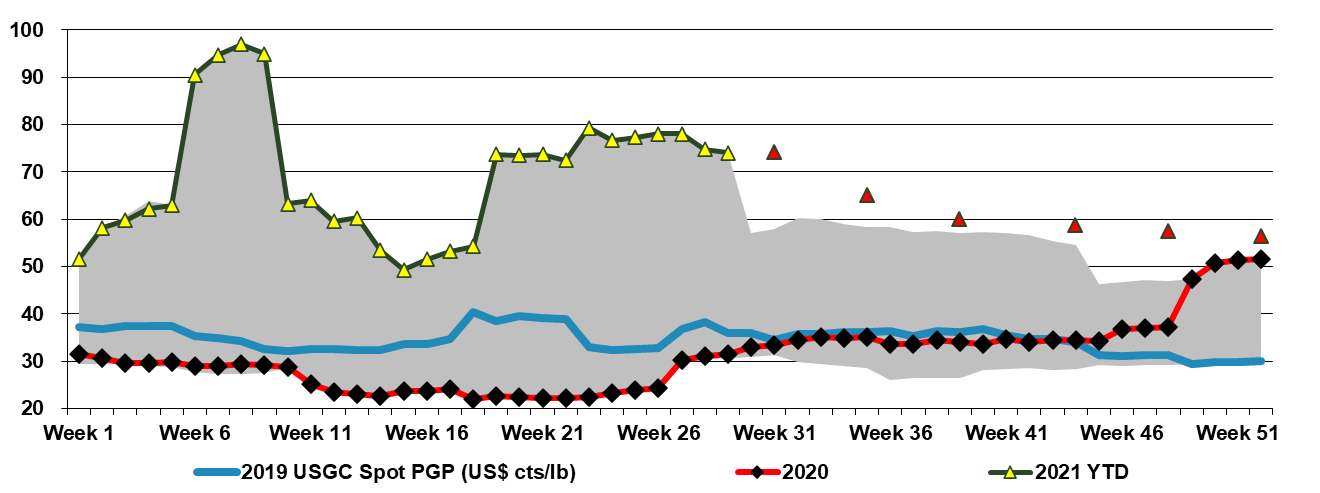

Propylene: 2H21 Volatility Likely Much More Than The Forward Curve Suggests

Jul 14, 2021 11:29:04 PM / by Cooley May posted in Chemicals, Propylene, Ethylene, polymer grade propylene, PGP

Polymer grade propylene in the US is weakening, albeit slowly, but remains very high versus history, versus ethylene and incremental costs of production. Propylene has the same volatile dynamic that ethylene has today in that if short, consumers can pay a lot more, and if long the price was a long way down to reach any cost hurdle. Just like ethylene we expect the market to show meaningful volatility in 3Q 2021 unless we get a storm effect in the US that impacts production more than demand. The futures market for propane and propylene expects propylene to fall relative to propane and barring weather events this is probably a reasonable view. See more in today's daily report.

US Ethylene: A Slight Imbalance Drives Significant Volatility

Jul 13, 2021 12:52:23 PM / by Cooley May posted in Chemicals, Ethylene, Ethylene Price, US ethylene surplus, Westlake, derivative prices, PVC producer

Spot prices for ethylene have surged in the US in the last week (chart below) – especially for delivery to Louisiana, where Westlake has a production outage. The price increase has completely removed the brief export arbitrage to Asia that lasted for a few weeks in late May and early June (Exhibit 5 in today's daily report). As we discussed on Sunday, ethylene is in a very wide no-mans-land in the US as it is not in sufficient surplus to drive pricing down to costs, and would likely be supported well above US costs and more by Asia costs in the current market, but if the market becomes short, buyers can pay a lot more for it as derivative prices are so high. If a PVC producer, such as Westlake, is buying, they can afford to pay significant premiums given that ethylene is less than 50% of the PVC molecule.

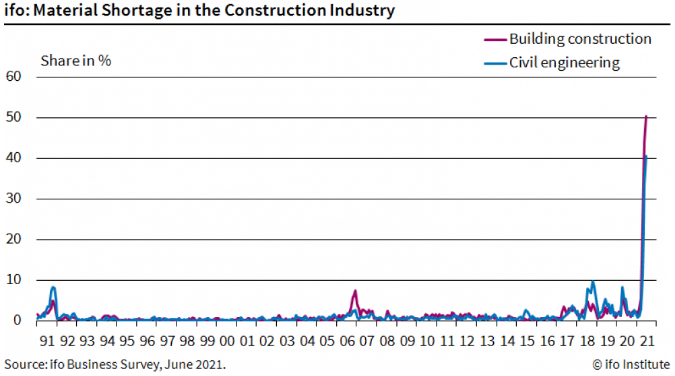

Construction Material Shortages Break Records

Jul 9, 2021 12:54:09 PM / by Cooley May posted in Chemicals, Polymers, Raw Materials, Supply Chain, freight, Base Chemicals, Basic Chemicals, construction material

The German materials shortage chart below is certainly eye-catching. There is nothing even remotely close in 30 years of history. We see this as further confirmation that we should continue to expect high shipping rates and congested ports until surveys like this show significantly better results and it is also further supportive of inflation. While it is extremely difficult to forecast from here, we would use the pendulum or spring metaphor – the further you pull either in one direction, the further they swing or spring back. The current dislocation is so extreme that everyone in the chain is likely acting instinctively and working to find greater supply and greater supply security. At some point, both end-demand and demand to fill inventories will normalize – either back to trend or back to a higher trend, but the inventory build piece will end and we will either get a gradual retreat in the scary data – such as the spike in the chart below – or we will see an equally quick collapse, at which point pricing will likely take a hit down the chain, with basic chemicals particularly vulnerable because the world has been adding substantial new capacity over the last several years in the US and China. More investment may be needed to keep up with higher trend demand in many intermediate or end-products that consume base chemicals and this could keep pricing supported, but basic chemicals and polymers look especially vulnerable to a reversal in the supply chain build we have seen for the last 9 months. For more see today's daily report.

%20(1).png?width=6000&height=6000&name=New%20C-MACC%20Logo%20-%20Final%20-%20Transparent%20(2000%20%C3%97%202000%20px)%20(1).png)