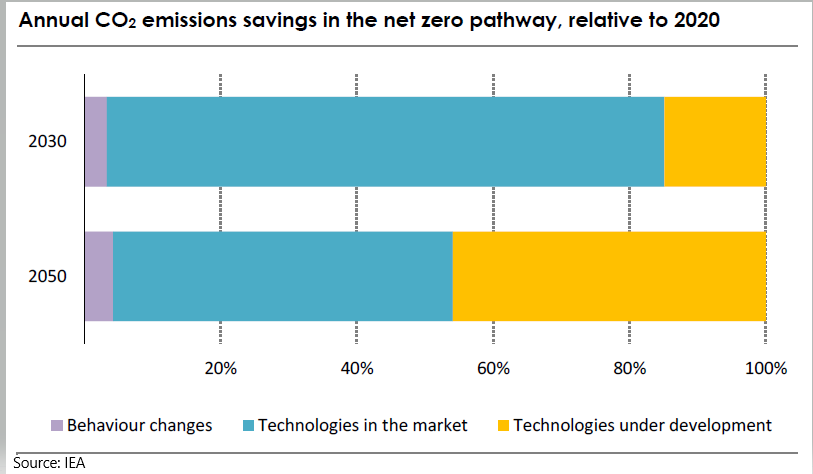

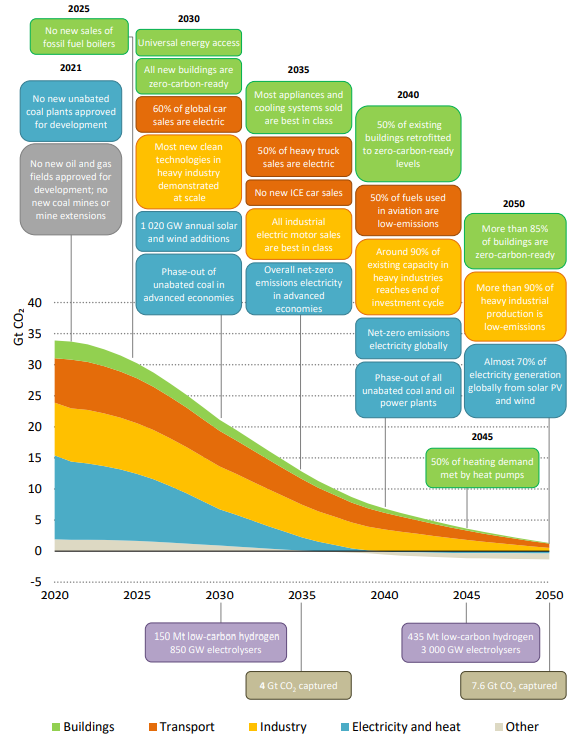

There is a broad technology theme to the articles that we have chosen today, which is in keeping with one of the core conclusions of the IEA report earlier this week. The IEA is estimating that roughly half of the path to net-zero will require technologies still in the test phase, or in some cases still conceptual. The Dow headline around ethane dehydrogenation and electric furnaces is a good example. Both technologies could lower the carbon footprint of making ethylene, but the dehydrogenation route will require some catalyst or other breakthrough as current propane dehydrogenation technologies require a lot of heat. The electric furnace idea is complex and would require extremely high levels of power, all of which would have to be renewable for the carbon footprint to fall – this type of technology is likely implied in the BASF announcement today. The IEA talked about some of the transition moves required to allow the technology advances time to become either commercial or cost effective, or both. Carbon capture features meaningfully in the IEA plans, but the study has carbon capture volume rising through 2050, which we find odd. The idea of carbon capture is to act as a bridge between where we are today and where we could be once new technology is developed – therefore, while companies like Dow should be aiming for technologies that lower the carbon production of its processes, carbon capture should be an almost immediate bridge to lower emissions while both the technology is developed, and its costs are reduced. Carbon capture needs should then decline. View today's Daily Report for more.

ESG Friday Question: Can Technology Keep Pace?

May 21, 2021 1:12:36 PM / by Graham Copley posted in ESG, Carbon Capture, Ethylene, Emissions, Net-Zero, IEA, Dow, propane, Technologies, ethane dehydrogenation, carbon footprint, BASF

More From The IEA; Expensive Hydrogen & Carbon Capture

May 19, 2021 1:44:48 PM / by Graham Copley posted in Hydrogen, Carbon Capture, Green Hydrogen, CCS, Blue Hydrogen, Inflation, IEA, Ammonia

We discussed the IEA report yesterday at some length, but in such a comprehensive report we missed a couple of things that are probably worth noting today. See more in our ESG Report today.

Another Expensive CCS Project With Limited Capacity

May 11, 2021 11:39:27 AM / by Graham Copley posted in Hydrogen, Chemicals, Carbon Capture, Climate Change, CCS, Emissions, Shell, Air Products, Air Liquide, ExxonMobil, Industrial Gas, Gulf Coast Sequestration, Emission Goals

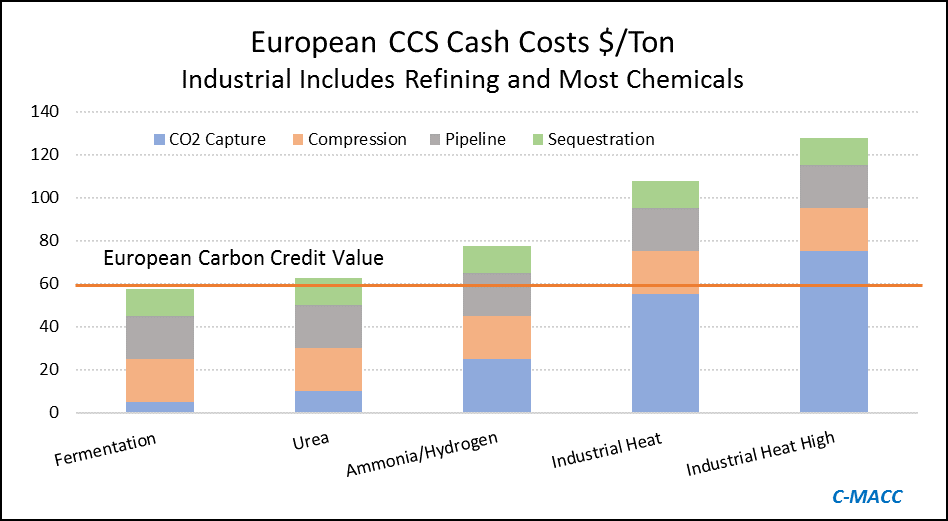

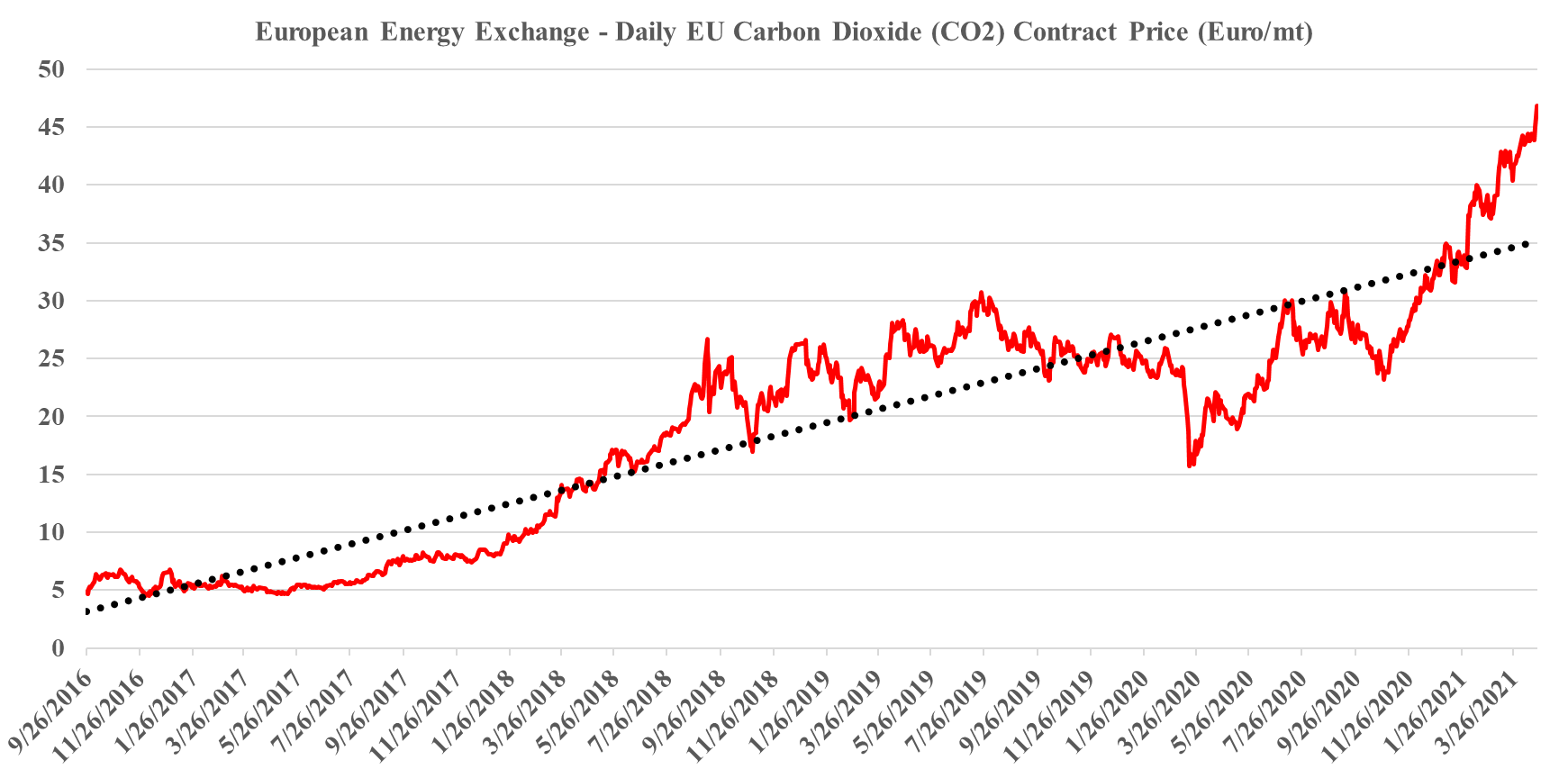

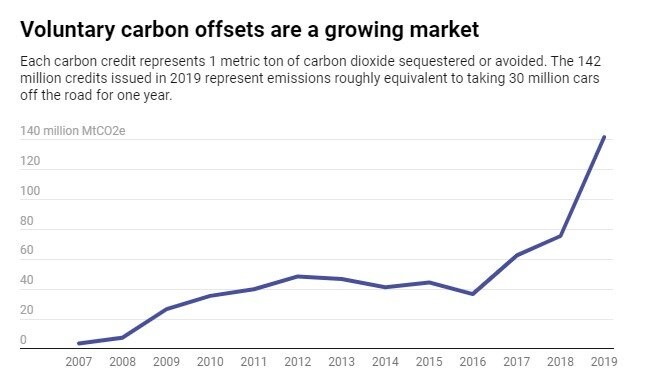

The big news of the day is the massive grant that the Dutch government approved yesterday for an offshore carbon capture project that will be focused on the operations of Shell, ExxonMobil, Air Products, and Air Liquide. This looks to be focused within the Port of Rotterdam, where both of the oil majors operate large refineries, Shell also operates a large chemical site and the industrial gas companies have significant hydrogen capacity. The Dutch government believes that the country cannot achieve its emission goals without carbon capture as it has one of the largest refining and chemical footprints in Europe and the 2.4 billion grant (likely achieved through a series of subsidies) is an indication that the country is willing to invest to make its emission goals a reality. The grant is likely aimed to help close the gap between the current European carbon price – which is just over $60 per ton today and what is estimated to be the full cost of capture and storage under the North Sea, which the linked article suggests is closer to $100 per ton, but this likely underestimates the capture costs –see chart below - even if the CO2 streams are pooled and treated as one stream. Interestingly, despite the high level of subsidy, this project is estimated to store only 2.5 million tons a year and will only last 15 years (likely because of the capacity of the offshore reservoir).

Source: Global CCS Institute, C-MACC Analysis, 2021

This is another example of a grossly inflated project, in terms of costs and while it may be the best option for the Port of Rotterdam we would make the following observations.

- It will consume a fraction of the CO2 in the local area

- It might give the Dutch operators a competitive edge over other European companies – either because they can produce low carbon fuel or hydrogen or other chemicals (which may get a premium price), or because they avoid paying the carbon prices. This may cause issues within the EU

- It might artificially lower the European carbon price by creating (subsidized) credits – if this project and other government-backed projects (the UK and Scandinavia so far) overwhelm the credit market, they may depress carbon values and discourage other moves to lower CO2 footprints

- Note that we expect a potential fly up in European carbon prices near-to-medium-term, and these mega-projects will not come into operation for a couple of years

- Like the ExxonMobil proposal for Houston, the implied cost per sequestered ton of CO2 is extremely high and while it might reflect problems with land rights, pipeline “right of ways” and other constraints specific to The Netherlands, it is multiples of the cost that we would expect US for on-shore sequestration and we would encourage all to check out the plans (currently with the EPA) that Gulf Coast Sequestration has in Louisiana.

Embracing Different Ways of Achieving Emission Goals

May 7, 2021 1:19:47 PM / by Graham Copley posted in Hydrogen, Carbon Capture, Recycling, CO2, Renewable Power, Emissions, Carbon Neutral

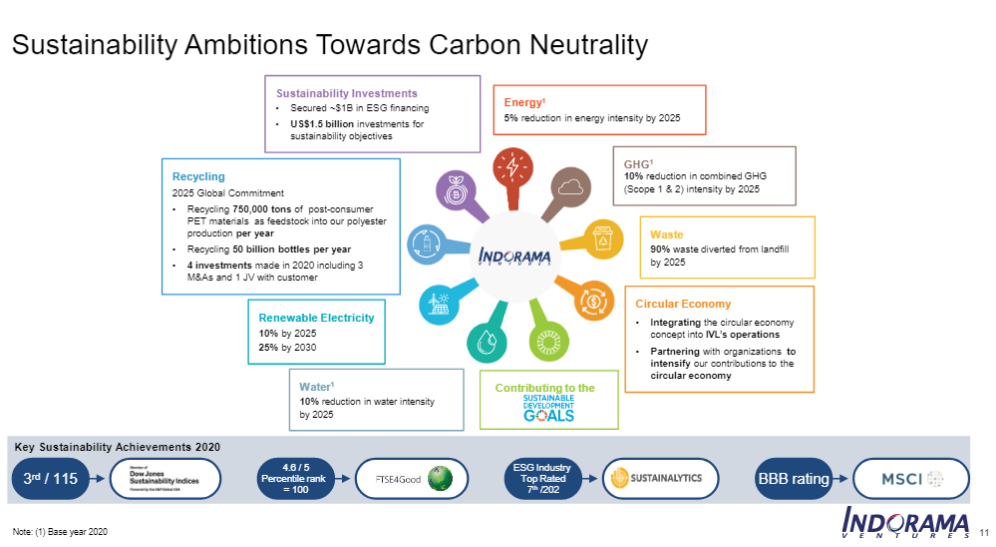

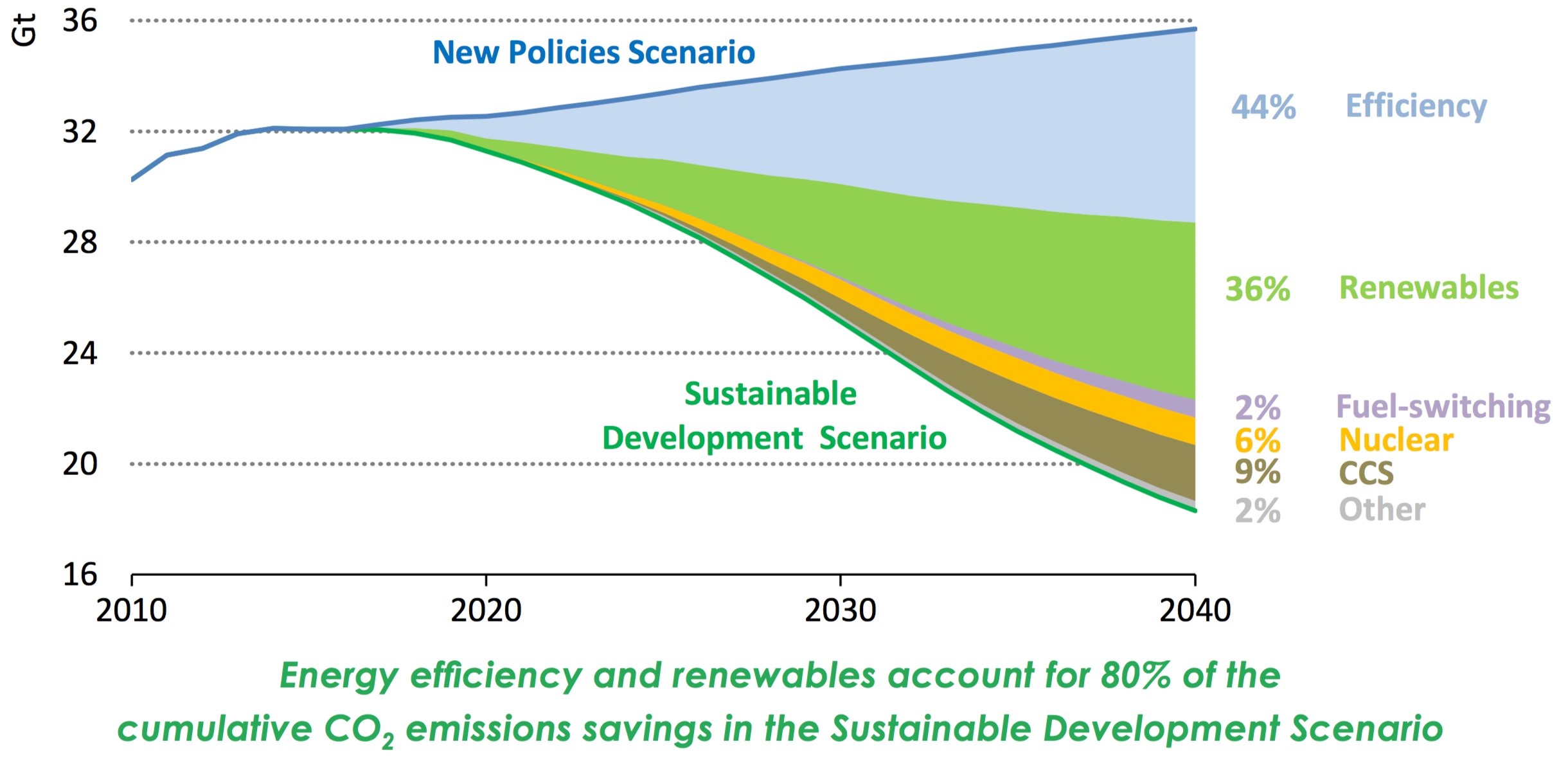

The headlines in today's daily report are interesting as they discuss a large number of different initiatives in recycling, carbon use, and capture, routes to hydrogen, etc. Each initiative is small, but the collective news is encouraging as it suggests that the mood might be changing from one which focuses on only a handful of tools to meet emission goals – which in turn are already helping to driven materials inflation - to a much broader approach that recognizes, or at least beings to recognize, that we need to try everything. We need to experiment with new approaches to recycling; we need more use for CO2 than simply pushing it all underground (but we must still push a lot underground), and we need to try multiple routes to hydrogen, not just those that need to consume vast amounts of renewable power. We need more partnerships – several listed this week - and we need government support where it can be most effective. The headlines today are far more heterogeneous, which is a good sign. One company's view of the solution is show in the chart below.

A 50% Emissions Reduction In 10 Years; Very Much A Stretch Goal

Apr 22, 2021 11:59:26 AM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Emissions

The focus for today and tomorrow in this section as well as the focus of next week’s ESG and climate piece will be the environmental summit that is being held today and tomorrow and the possible ramifications of pledges that will inevitably come from it. We must start with President Biden’s emissions pledge: “This is the decisive decade,” Biden said at the summit on Thursday morning. “This is the decade that we must make decisions to avoid the worst consequences of the climate crisis.” The administration put forward a goal of reducing US emissions by 50% by 2030. “This is a moral imperative. An economic imperative. A moment of peril, but also a moment of extraordinary possibilities,” the president said.

ExxonMobil CCS; The Right Idea, The Wrong Company Perhaps?

Apr 20, 2021 12:36:56 PM / by Graham Copley posted in ESG, Carbon Capture, CCS

The ExxonMobil carbon capture announcement has stolen some of the thunder from the weekly ESG and Climate piece we have lined up for tomorrow, where we focus on what is ideal versus what is “good enough”. While CCS allows the fossil fuel industry to keep operating for longer, and in pockets possibly permanently, the ideas that we should move straight to renewable power and hydrogen are extremely naïve in their expectations around timing. We fully agree with ExxonMobil that CCS is the most logical and fastest way to make a meaningful dent in carbon emissions, especially in the US, quickly. This has been a consistent message in our work, and you can read more about it tomorrow.

Climate Dreamers: Big Hats No Cattle

Apr 15, 2021 2:14:18 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change

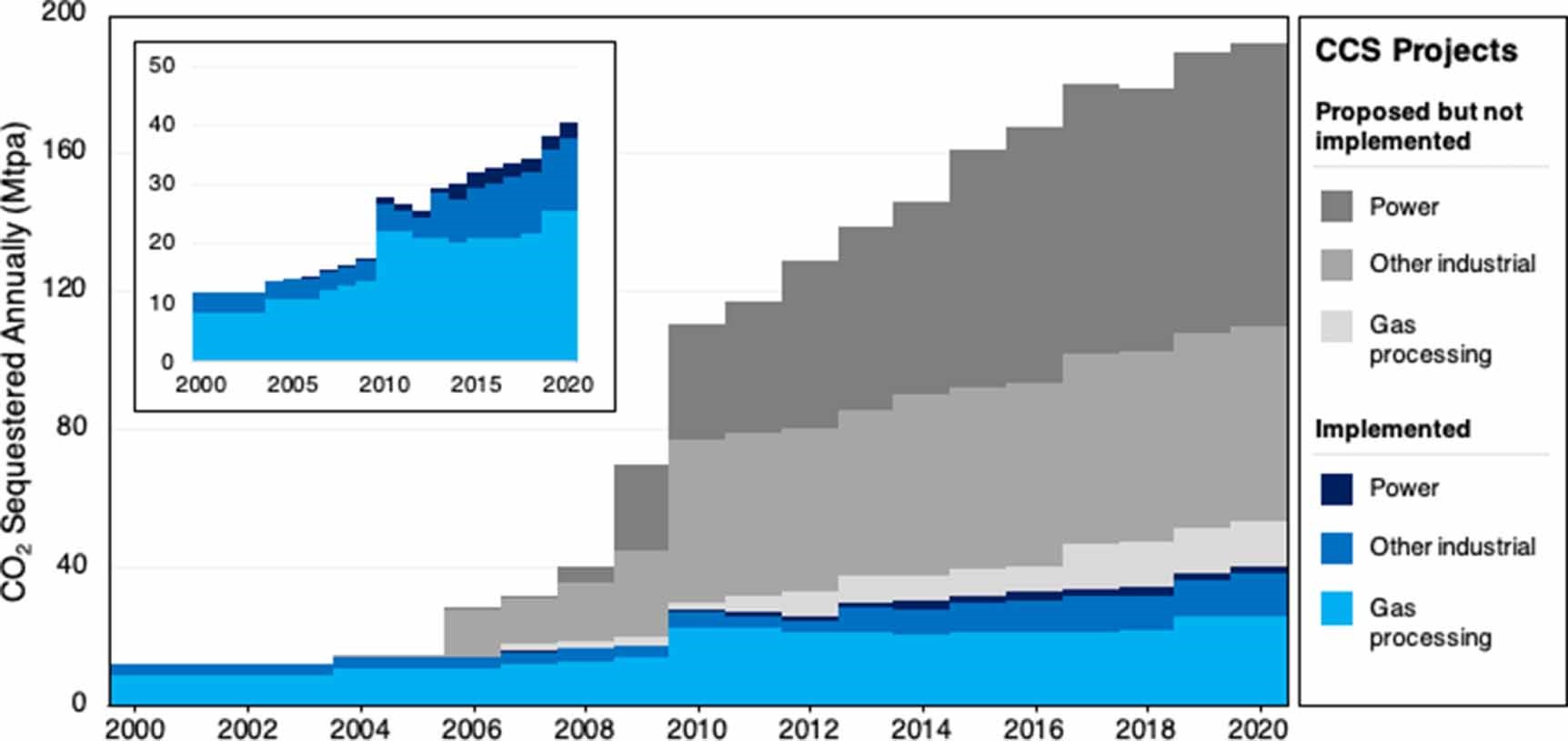

In the UK we have the phrase “all mouth and no trousers”. When moving to Texas I was delighted to find their own phrase “big hat – no cattle”. They mean the same thing – all talk and no action. The chart in the Exhibit below is supposed to be about carbon capture, but it is a much better illustration of “big hat – no cattle”, and we think that it is very relevant today, not just for carbon capture but for many of the other energy transition announcements that we see – especially for hydrogen. In the chart, the carbon capture projects announced by 2020 called for 200 million tons of sequestered carbon, while less than 40 million tons have been implemented (20%), and almost all of that in enhanced oil recovery (EOR).

Higher Incentives Needed to Drive Carbon Capture

Mar 30, 2021 12:59:25 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability

Anyone reading our ESG and climate work will know that a very limited number of producers of CO2 in the US can make money from the 45Q credit and the linked article is also technically wrong in its definition. 45Q is a tax credit and will create no revenue for those able to apply for the credit. It will create a tax saving, but there are very few situations in which the tax credit is high enough to cover the CCS costs. It will work where CO2 streams are pure (fermentation would be a good example – but so would gas clean up for LNG), and where there is low-cost sequestration capacity local to the source. Cleaning up a dilute CO2 stream is very expensive – and incentives close to $100 per ton would be needed to get immediate movement (45Q peaks at $50 per ton in 2026). Even with a clean stream, compression costs are high but would depend on the dynamics of the pore space being used for sequestration.

It is a timely headline – even if it is largely inaccurate – because we have bills in both the Senate and the House that focus on CCS. We need to find either an incentive program that raises the interest in CCS and whether it is a higher tax credit, or an additive carbon tax, or some sort of carbon offset scheme, a further kick start is needed. There is a strong consensus building – something we have been talking about since September 2020 that you cannot achieve the Sustainable goals suggested below without substantial carbon capture and storage. The incentive landscape needs action soon, as developing sequestration sites could take years, given the need to find the right geologies.

Alignment with API! Who Would Have Guessed...

Mar 26, 2021 11:56:51 AM / by Graham Copley posted in ESG, Carbon Capture

We would like to thank the API for apparently reading all of our research! The proposals announced yesterday, while likely not aggressive enough in their targets for fossil fuel reduction, accurately, in our view, discuss all of the transitionary steps that are needed and advocate carbon capture and use or storage (CCUS) for the production of low carbon fuels as well as blue hydrogen. Implicit in their analysis is the need for further logistic investment in the US in pipelines, either to facilitate more LNG investments or to move CO2 or hydrogen. The document also outlines the basis for a carbon tax (the API calls it a carbon price) and suggests that it should be uncomplicated and broadly administered, flowing through to the end-consumer and impacting all in the carbon production chain. This is something that we agree with also, as it is the most obvious way to create behavioral change – as unpalatable as it may appear in the US, high gasoline taxes in Europe from the 1970s drove the technology to produce higher-powered smaller engines for autos and made them appealing to buyers who wanted to reduce gasoline costs. Also as a consequence, all of Europe has better public transport than the US and public transport is easier to decarbonize, given the ability to run natural gas bus fleets, electric buses, and trains, and eventually, hydrogen-powered buses, trams, and rail.

A US Carbon Tax – How Aligned Would the API be with Something That Worked

Mar 8, 2021 11:19:22 AM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Carbon Tax

The API is suggesting that it would support a carbon tax in the US, but at the same time is suggesting that this would only be supported if it was the only mechanism that regulators used at a Federal level. While both Europe and California have carbon taxes, they have many other regulations and mechanisms to help lower emissions, such as credits for EV use and LCSF in California.

%20(1).png?width=6000&height=6000&name=New%20C-MACC%20Logo%20-%20Final%20-%20Transparent%20(2000%20%C3%97%202000%20px)%20(1).png)

.png)