Finally, Larry Fink has recognized the flaw in his aggressive ESG rhetoric. Maybe he knew this all along, but it is good to see him step into the debate in favor of not crippling the fossil fuel industry by denying it access to capital and investors too quickly. However, that boat may have sailed, with investors like Engine No. 1 feeling empowered by their win over ExxonMobil and raising more money as a consequence. We have covered this subject at length in our ESG and climate weekly this week: Big Oil’s Big Problem – Hard To Find A Favorable Scenario – maybe Larry read it!

Larry Fink Finally Gets It! And The Carbon Value Of LNG

Jun 4, 2021 12:00:51 PM / by Graham Copley posted in ESG, LNG, Coal, fossil fuel, carbon footprint, ESG Rhetoric, Power Plants, Larry Fink, carbon credit, carbon value

Can Big Oil Do Anything To Change It's Image - We Doubt It

Jun 2, 2021 1:29:12 PM / by Graham Copley posted in ESG, Oil Industry, IEA, Oil

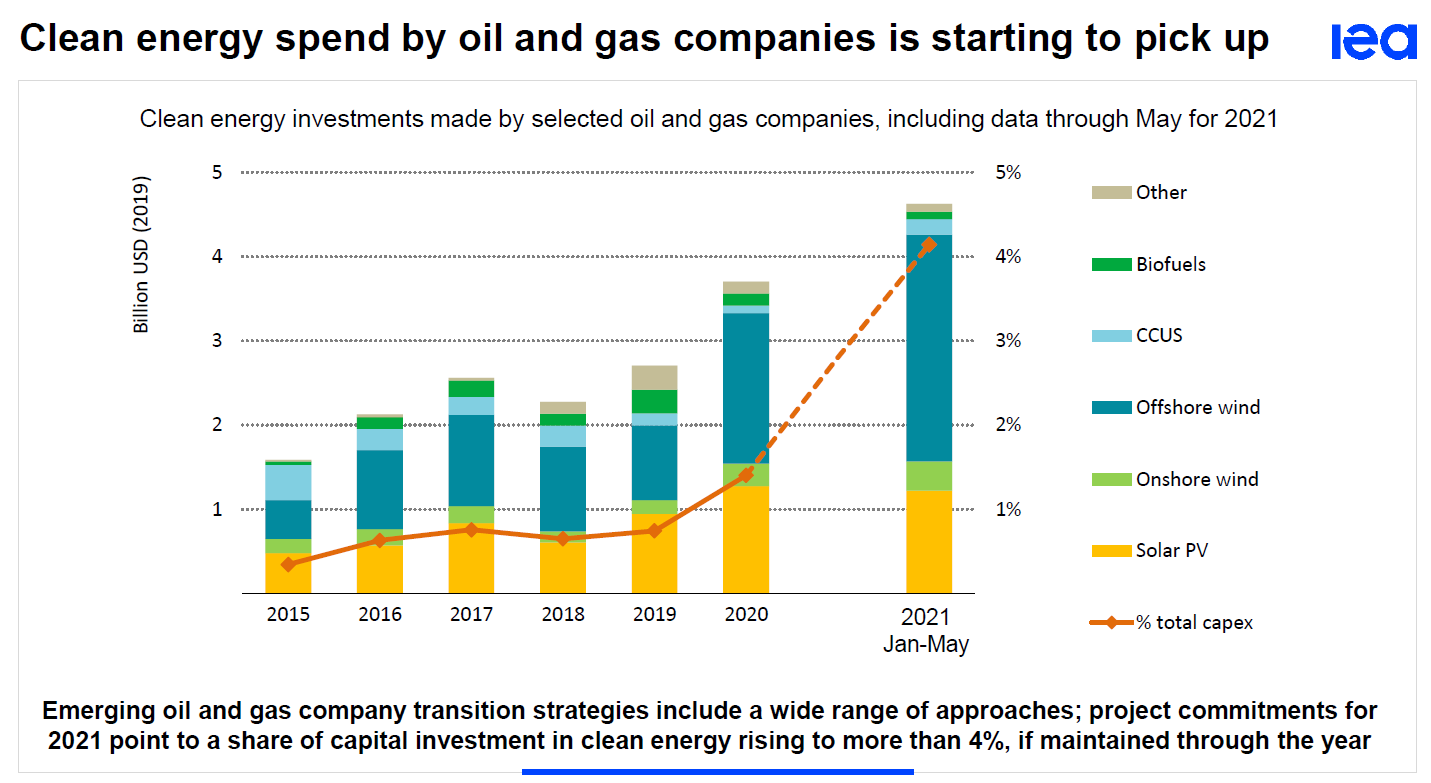

In today's ESG and Climate report we discuss the issues facing the oil industry and present several possible scenarios focused around activist behavior and government behavior – none of the outcomes are pretty and the most likely one is quite concerning. The activists seem to be laser-focused on reducing the production of fossil fuel, but they are arguing for a timeline that is impractical and very inflationary – right now they are winning and they are changing the hearts and minds of investors, both public and in some cases private, but perhaps more important, they are influencing insurers. The fossil fuel industry needs to clean up its act, no doubt, and based on the chart below it is trying harder, but a transition period is necessary to prevent hyper-inflation not just in fossil fuel prices but also in renewables, as they would not be able to keep up with an aggressive cut back in fossil fuel production today – which is what activists are pushing for.

Will ExxonMobil Activists Change Anything?

May 26, 2021 1:24:39 PM / by Graham Copley posted in ESG, Carbon Capture, Energy, ESG Investing, ExxonMobil, carbon footprint, ESG Fund, bp

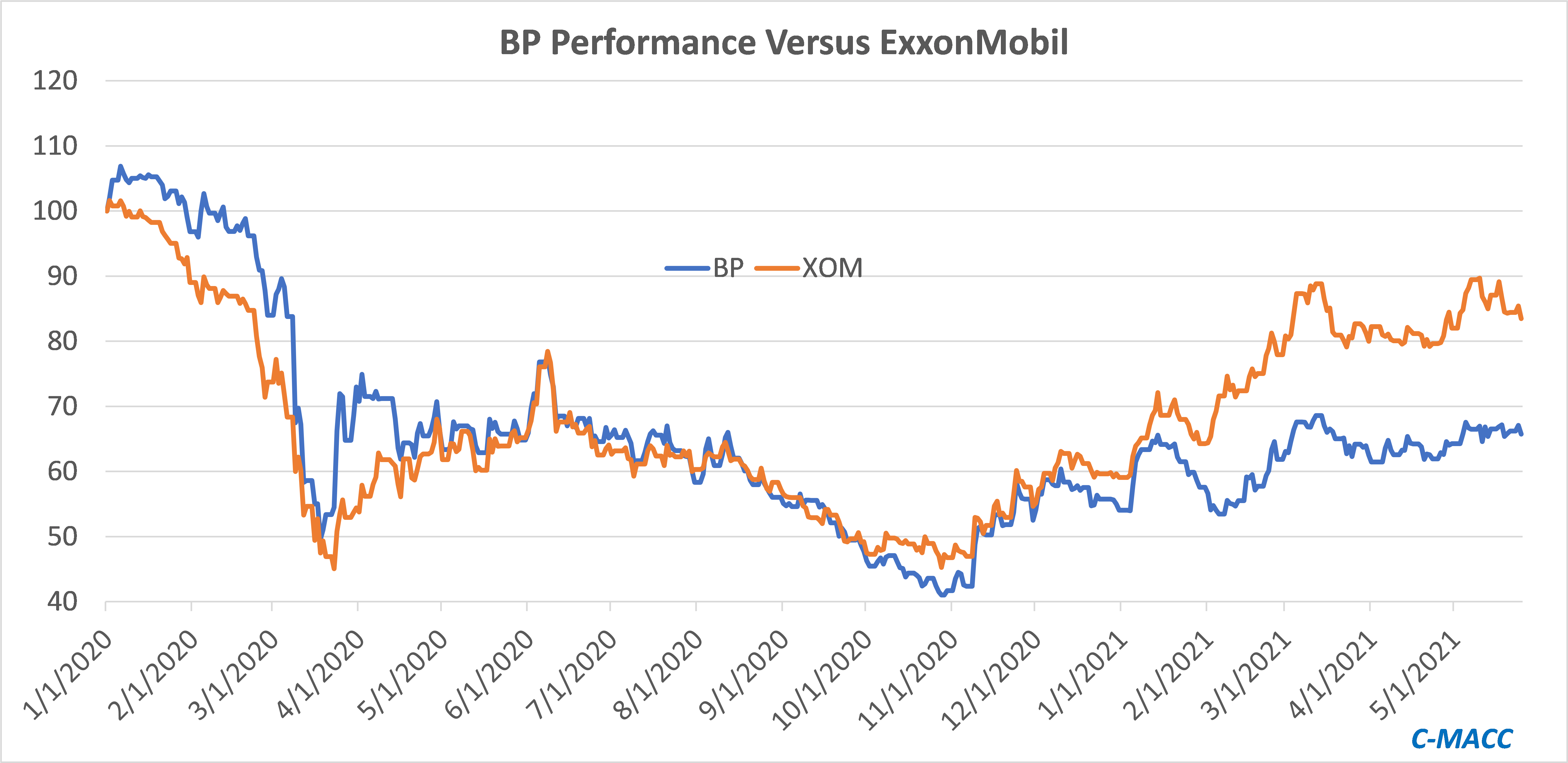

With little chemical corporate news of note, we will focus on ExxonMobil today. The shareholder activism may be high but it is unclear to us what the activists hope to achieve, even if they are successful at the annual meeting. The ESG investment group has largely given up on energy and even if ExxonMobil changes strategy and agrees to spend more on carbon abatement it is unlikely that new investors will show up, especially if the new strategy is more costly. Despite all of its directional change and rhetoric, bp has underperformed ExxonMobil since Mr. Looney took the helm in early 2020. If ExxonMobil were to follow the bp playbook, it is not clear that shareholders would benefit.

ESG Friday Question: Can Technology Keep Pace?

May 21, 2021 1:12:36 PM / by Graham Copley posted in ESG, Carbon Capture, Ethylene, Emissions, Net-Zero, IEA, Dow, propane, Technologies, ethane dehydrogenation, carbon footprint, BASF

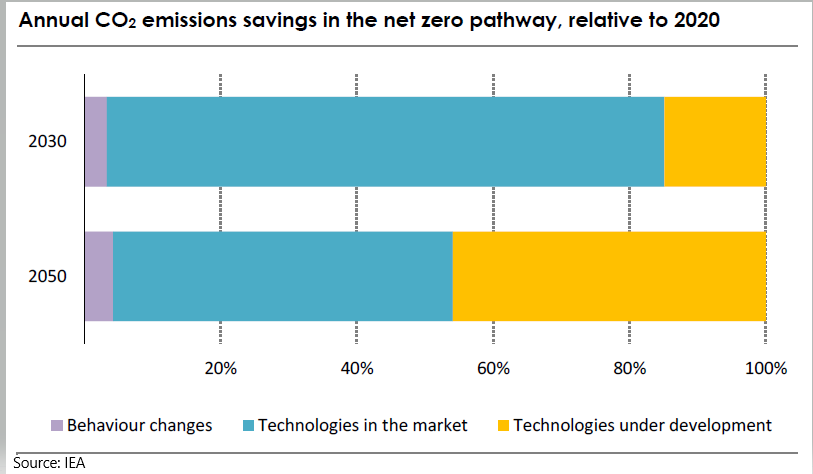

There is a broad technology theme to the articles that we have chosen today, which is in keeping with one of the core conclusions of the IEA report earlier this week. The IEA is estimating that roughly half of the path to net-zero will require technologies still in the test phase, or in some cases still conceptual. The Dow headline around ethane dehydrogenation and electric furnaces is a good example. Both technologies could lower the carbon footprint of making ethylene, but the dehydrogenation route will require some catalyst or other breakthrough as current propane dehydrogenation technologies require a lot of heat. The electric furnace idea is complex and would require extremely high levels of power, all of which would have to be renewable for the carbon footprint to fall – this type of technology is likely implied in the BASF announcement today. The IEA talked about some of the transition moves required to allow the technology advances time to become either commercial or cost effective, or both. Carbon capture features meaningfully in the IEA plans, but the study has carbon capture volume rising through 2050, which we find odd. The idea of carbon capture is to act as a bridge between where we are today and where we could be once new technology is developed – therefore, while companies like Dow should be aiming for technologies that lower the carbon production of its processes, carbon capture should be an almost immediate bridge to lower emissions while both the technology is developed, and its costs are reduced. Carbon capture needs should then decline. View today's Daily Report for more.

The IEA Sets Out A Plan But Ignores Inflation

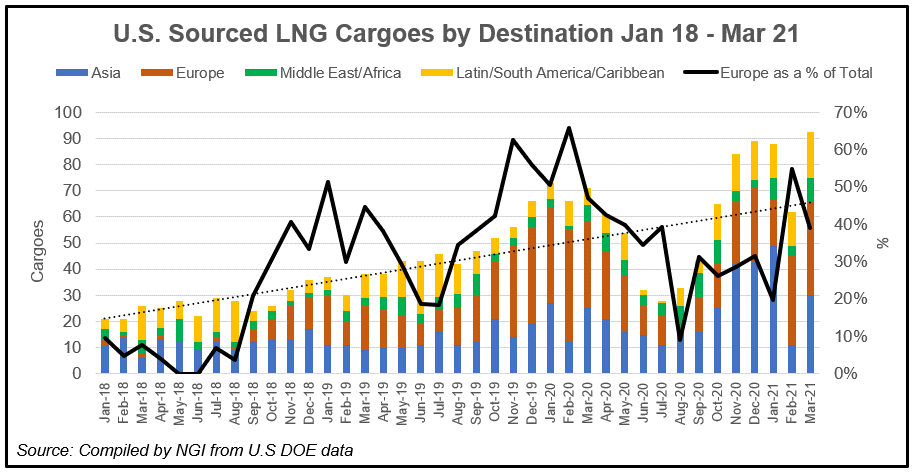

May 18, 2021 11:50:10 AM / by Graham Copley posted in ESG, LNG, CCS, Renewable Power, ESG Investing, Materials Inflation, Net-Zero, Industrial Sector, fossil fuel, fuel alternatives, decarbonization

There are too many important topics to choose from today and we will cover many of these in our ESG and Climate report tomorrow. Here we focus on the IEA report published this week, which shows a path to net-zero on a global scale and looks at both the fossil fuel consuming sectors and the rate at which each must change (they are different by sector) and what fuel alternatives will be needed to replace them. Our review of the work would suggest the following:

The Friday Question: What is the Primary Role of an ESG Investor?

May 14, 2021 11:49:05 AM / by Graham Copley posted in ESG, ESG Investing, Corporates, ESG metric, fund manager

We have decided to change up our blogs, at least once a week and each Friday, to pose a question rather than throw out opinions.

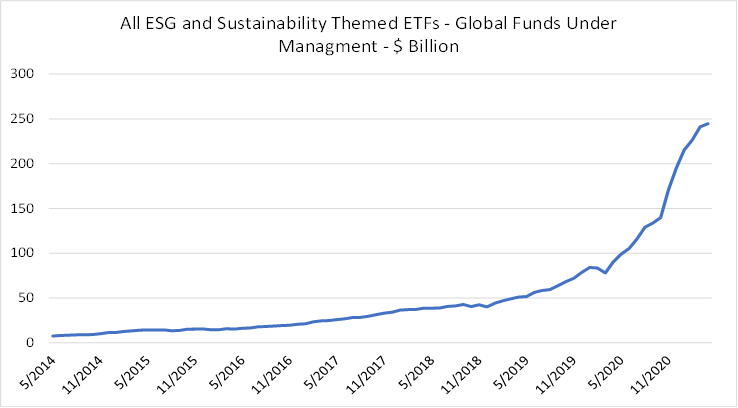

Today we should focus on the very good FT article linked here, which discusses in detail many of the issues facing both ESG investors and corporates concerning the lack of standards in ESG metric providers and the data provided by companies. It is a subject that we have been writing on for a couple of years – before C-MACC – because it is a potential dark stain on ESG investing and has turned (in some cases) a progressive move by the investment community into something that lacks a clear standard empirical base and is currently open to manipulation. The article highlights the ability of corporates to change the ESG metric providers that they use for internal measures and external reporting based on which provider sheds them in a more positive light. It also allows ESG funds to hold stocks that other ESG funds would not because they are not working off the same definitions. The flow of funds into this segment makes oversight critical (see chart below).

We would like thoughts, in the hope of starting an interesting dialogue on what you think the primary role of an ESG fund manager should be – to maximize returns, to promote change, to attract funds, etc.

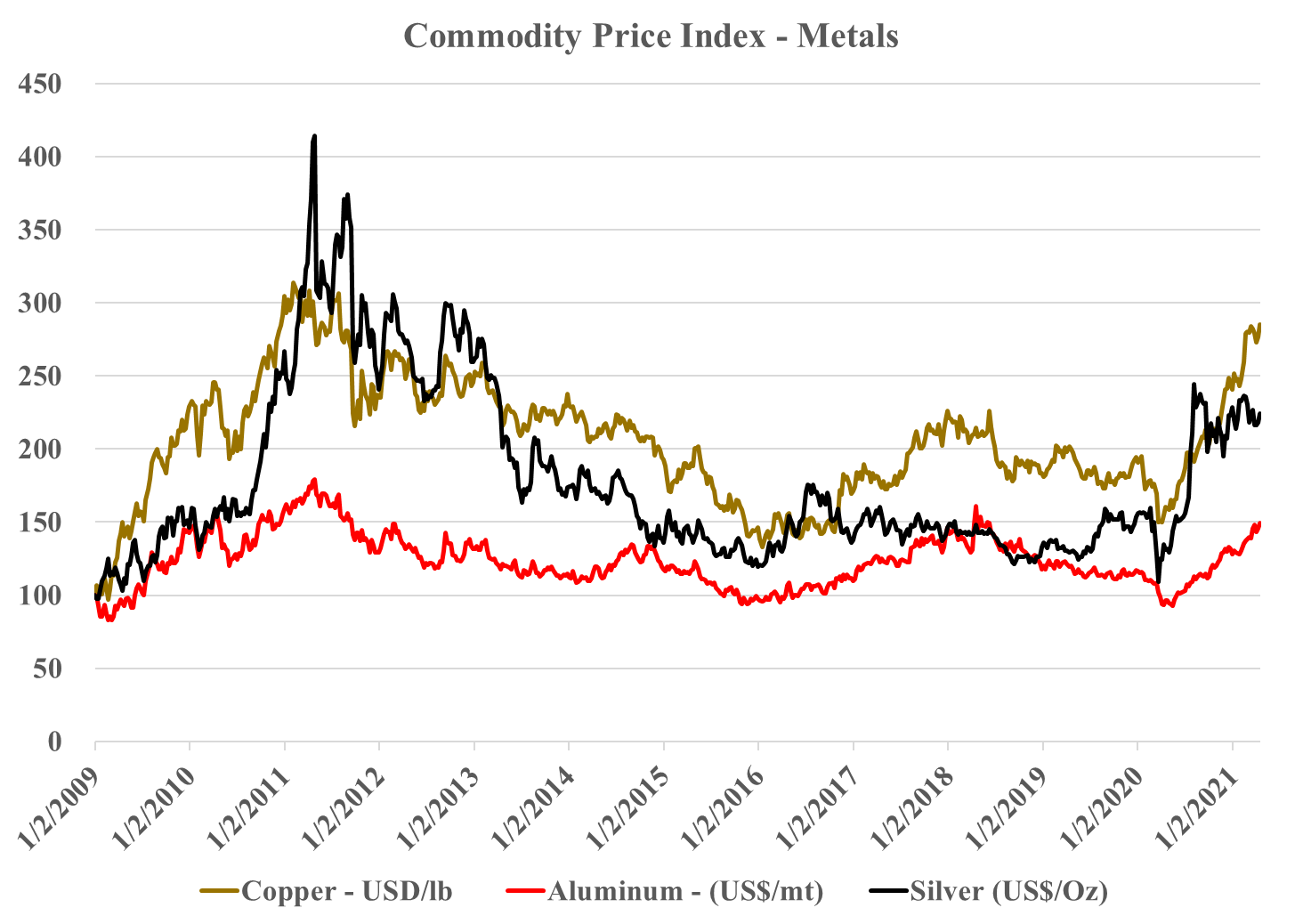

Raw Materials Inflation Deserves Another Mention

May 6, 2021 1:17:54 PM / by Graham Copley posted in ESG, Renewable Power, Metals, Materials Inflation, Raw Materials

Source: Bloomberg, C-MACC Analysis, May 2021

Not Enough EVs To Make A Difference Yet...

May 4, 2021 1:39:12 PM / by Graham Copley posted in ESG, Electric Vehicles, Fuel Cell, Materials Inflation

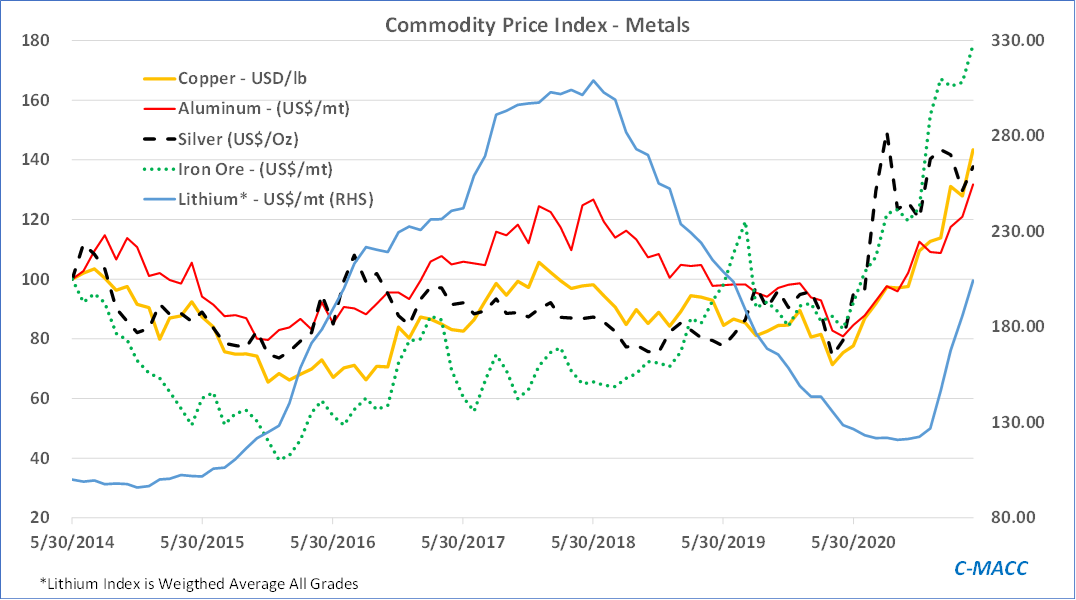

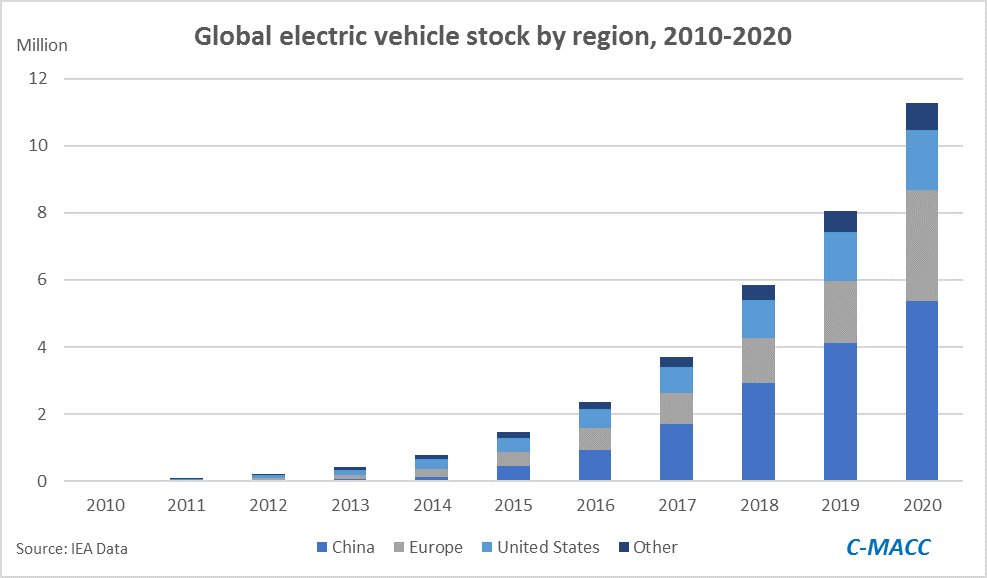

If you read our ESG and climate report which focused on the Biden agenda - The Biden Plan: Taking The Harder Path, Limiting Odds Of Success – you will understand how underwhelming the EV data is in the exhibit below. For the US to reduce its automotive transport carbon footprint to the proposed 2030 goals, the country would need to replace over 130 million ICE vehicles with EV or fuel cell-powered vehicles – 12x the total number of EVs in the world today and more than 100x the number currently in the US. This is a challenge that has almost zero chance of being met unless the benefit of switching is so high or the cost of not switching so high that consumers want to make the change – and – there are enough vehicles to buy. Both of these are remote possibilities today, but likely why we see increased focus on lithium, batteries, and faster roll-out of EVs from the majors as they attempt to do their part to move in the right direction. One unintended consequence that we have discussed at length and will cover in tomorrow's ESG and Climate report is inflation in materials, which will not be helped if the ESG lobby will not support the industries that need to provide the materials and the interlinking infrastructure investment.

Don't Dismiss A Good Idea Just Because You Don't Like Who Said It

Apr 29, 2021 1:15:43 PM / by Graham Copley posted in ESG, Metals, ESG Investing

We return to a theme we have covered at length in several prior reports – the idea that the baby gets thrown out with the bathwater as politicians, regulators, and investors make decisions around what is best from a climate perspective and what is best from an ESG investing perspective. In many cases, the short-term noise and politics is masking some of the larger challenges and is likely to result in the wrong decisions, and potentially creating damaging inflation. See metals pricing chart below and today's daily report.

The Hard Math Behind The Biden Agenda

Apr 28, 2021 11:41:54 AM / by Graham Copley posted in ESG, CO2, Emissions

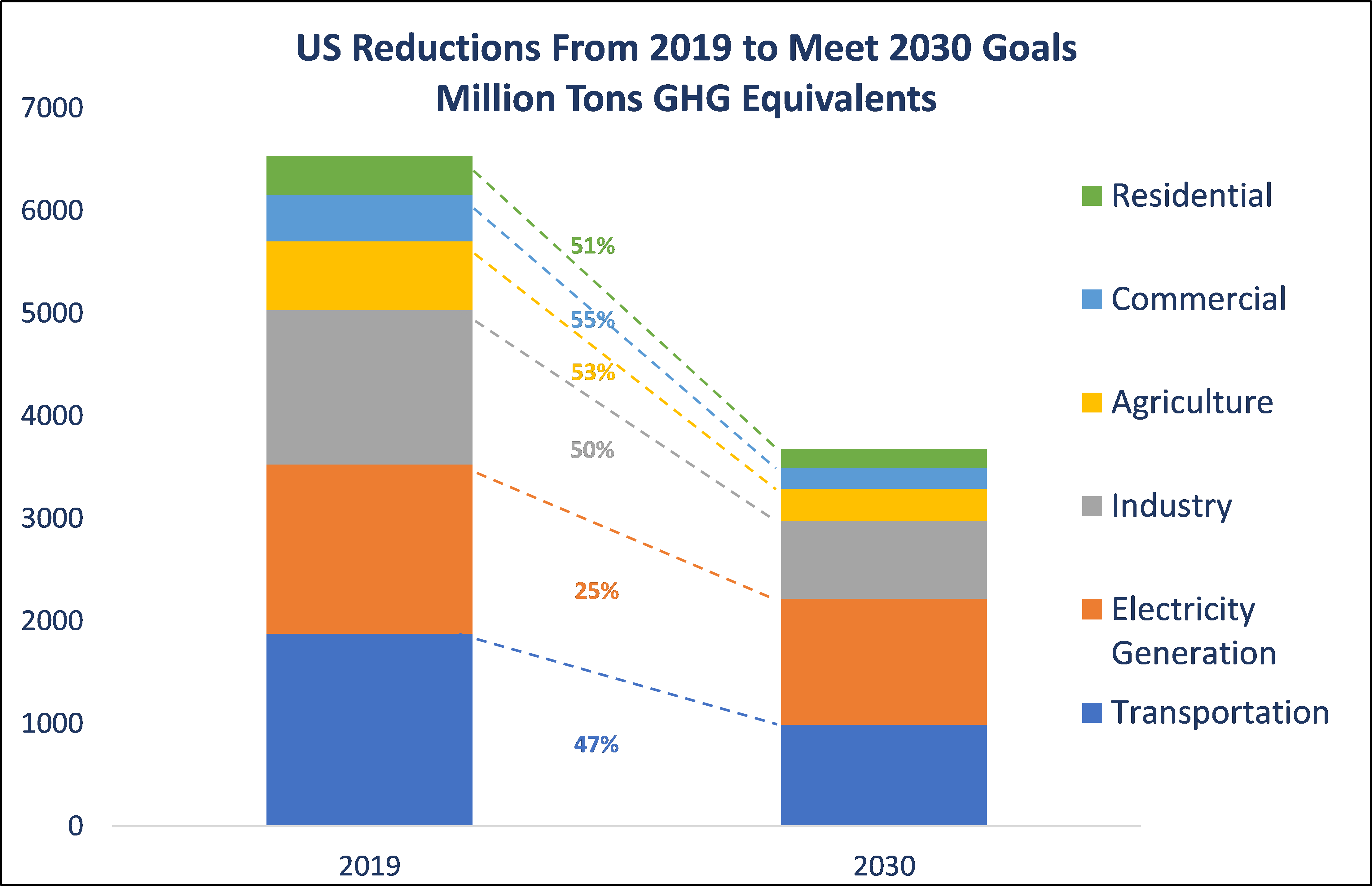

The exhibit below shows in stark terms what would be required. The column on the left is 50% of the sector emissions from 2005 according to the EPA, and this what we need to get to by 2030 to meet the pledge. It is only the Power Generation sector that has seen meaningful reductions since 2005 and consequently a 50% target from 2019 is the average needed from the other segments. We discuss the challenges (which are significant) and some possible solutions in today's ESG & Climate Report

%20(1).png?width=6000&height=6000&name=New%20C-MACC%20Logo%20-%20Final%20-%20Transparent%20(2000%20%C3%97%202000%20px)%20(1).png)