We note the Blackrock headline below about protecting biodiversity among other things and relate this to a section we wrote in yesterday’s ESG and Climate piece around carbon taxes and staff motivation. Companies are being asked to do too much and address too many issues at once that do not have empirical frameworks:

- Lower your environmental footprint

- Reduce waste

- Increase diversity

- Become more sustainable

- Protect the natural environment

- Oh, and while you are doing it, increase shareholder value!

In response, PR savvy companies are making broad statements around intent, even if they are not sure what to do next or whether it can be measured and valued. In extreme cases, these statements of intent, especially if they are very selective in the data they use or the topics covered, increase the chances that companies get accused of “greenwashing” – note the Chevron news this week and our comments in the report linked above.

But there is a further problem that will be causing major headaches in many companies – how do you motivate staff. Energy, Industrial and Materials companies are under fire, and while some may be putting on a brave and collaborative external face, internally they all have problems, as staff (at all levels) are confused – they see their industry and therefore their jobs at risk and they see new intangible objectives being imposed in the press and in some cases by shareholders that they have no experience and/or no idea how to fix. Plus – there are now too many issues to address and the likelihood that none gets the necessary focus and all fall short is very high. Everything in the list above is important, but there will only be a handful of standouts who over the next 5 years make enough progress on all fronts, and the more progressive management teams in the eyes of the press and the shareholders cannot afford to take their eyes of staff, who they might unconsciously be alienating through their public stance, but without whom they will not be able to get anything done.

As we discussed yesterday, a carbon tax, might be unpopular with politicians, but if I am the CEO of an energy or chemical company, the imposition of something tangible gives me something to rally the troops around. Intangible is much harder and setting tangible internal goals without a tangible external frame of reference other than “do better”, is much harder.

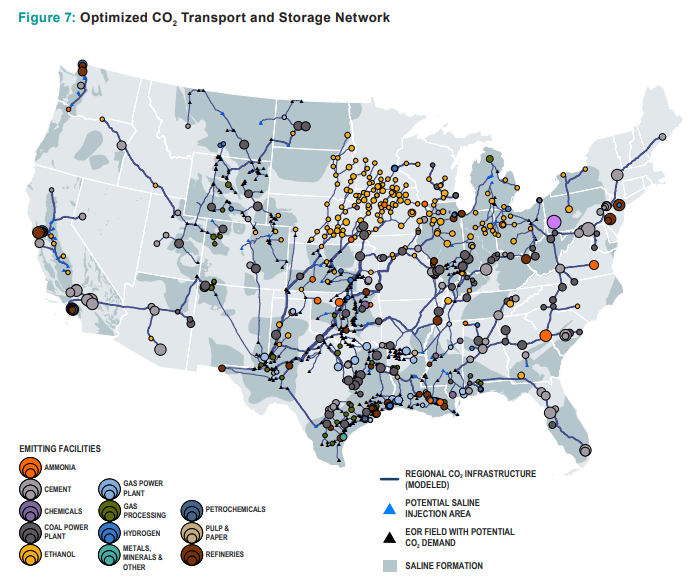

Just taking one example, the map below shows the level of CCS pipeline infrastructure that the US might need for an optimal carbon sequestration model. Almost none of this exist today, but a carbon tax could rally employees around new objectives associated with this.

Source: Carbon Capture Coalition, March 2021

%20(1).png?width=6000&height=6000&name=New%20C-MACC%20Logo%20-%20Final%20-%20Transparent%20(2000%20%C3%97%202000%20px)%20(1).png)

.png)

-1.png)

.png)

-1.png)

.png)