The major issue with the higher natural gas prices in Europe (and rising prices globally) is the knock-on inflationary impact it will have on products that have natural gas as a feed, rather than those buying it as a fuel. The fuel buyers will take some of the hit, but will also try to pass on some of the hit, as it is generally a small part of overall product or service costs. The focus has been on ammonia/urea production because of the knock-on effect on food-grade CO2. But other products, such as methanol, would also be impacted, although there is not much methanol capacity in Europe. Higher LNG prices in Asia could encourage more coal-based methanol production, which is precisely what the increased use of LNG was supposed to prevent – replacing a high carbon footprint route with a much lower one. In our view, it is imperative that the attendees of COP26 recognize the need for (cleaner) natural gas and LNG, and enact policies to support it. This inflationary lesson is well-timed.

Natural Gas Short, Ethylene & Propylene Not So Much...

Sep 22, 2021 3:15:00 PM / by Cooley May posted in Chemicals, Propylene, LNG, Methanol, CO2, Ethylene, Ammonia, natural gas

US Polymers Holding On To A More Fragile Premium, Mostly Storm Driven

Sep 21, 2021 2:01:48 PM / by Cooley May posted in Polymers, Polypropylene, polyethylene producers, ethane, natural gas, US polyethylene, US polypropylene, polypropylene arbitrage, spot pricing

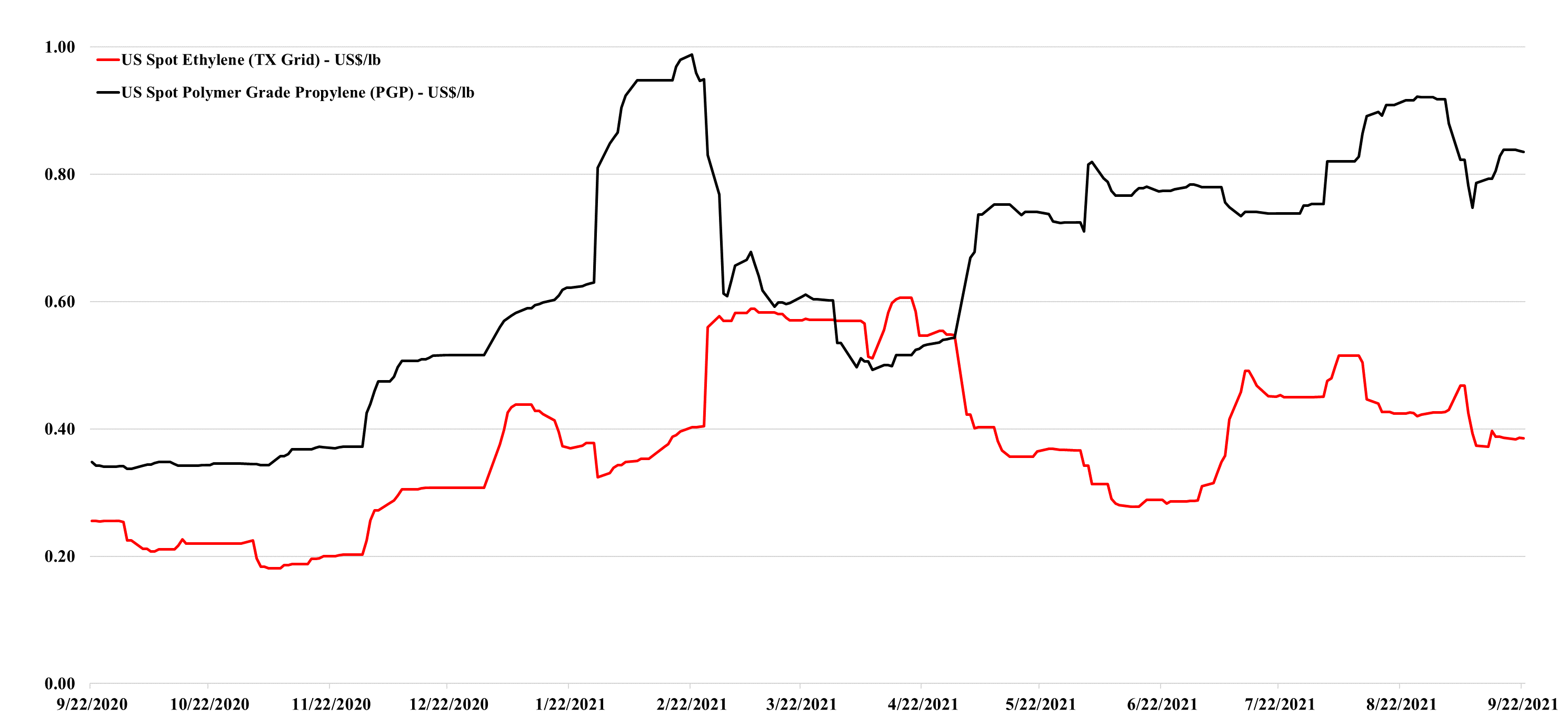

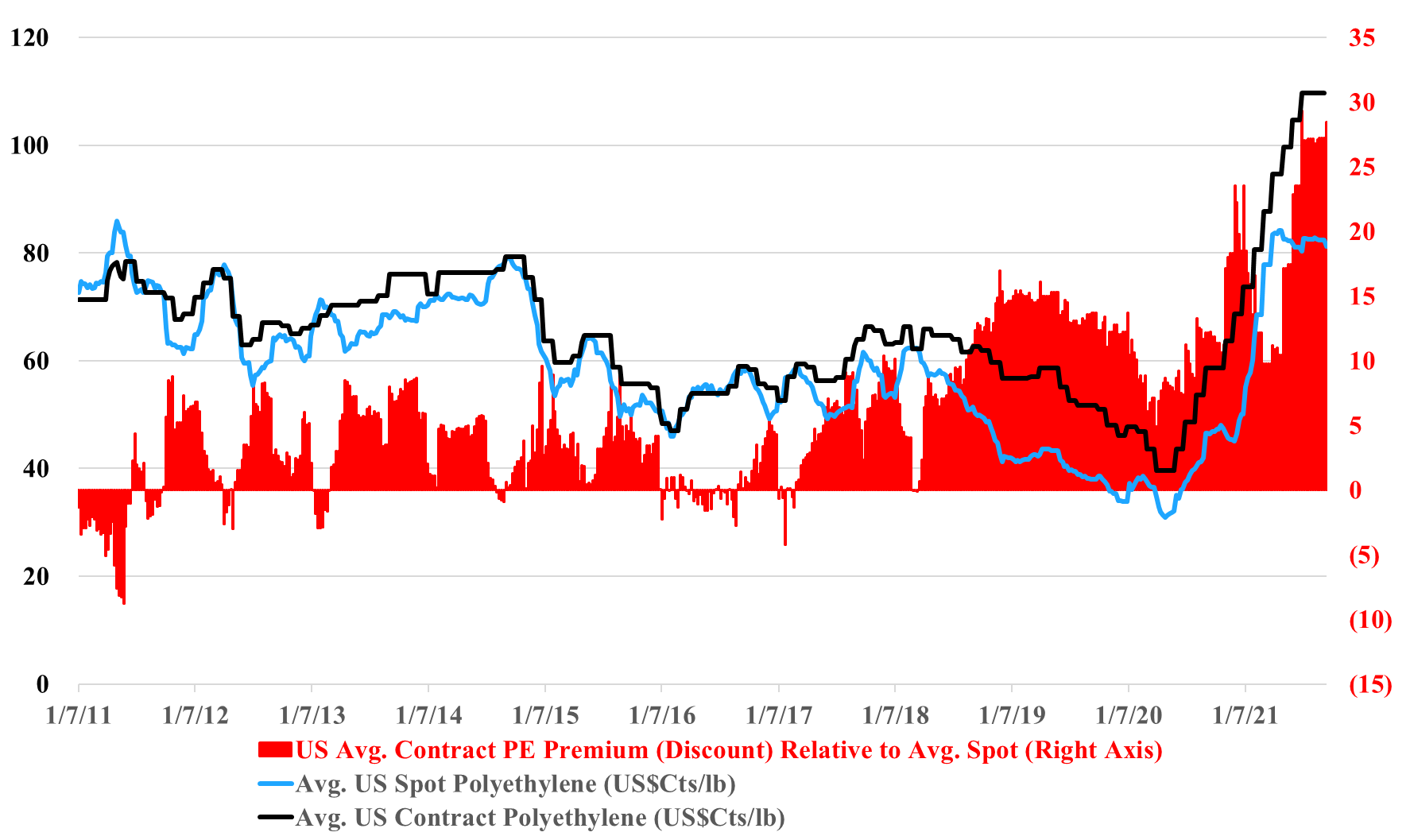

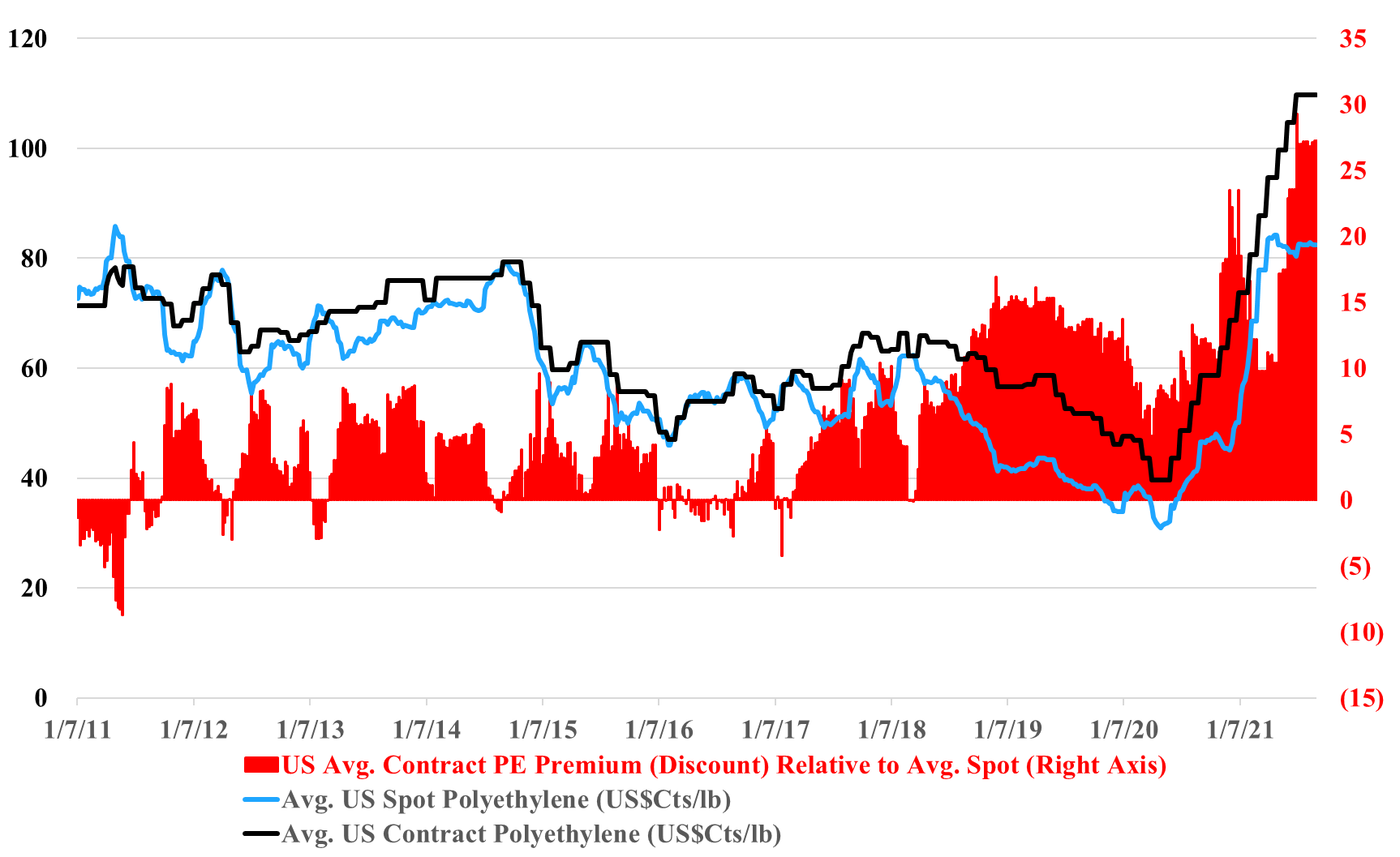

US polyethylene producers are pushing for September price increases and their arguments center around lost production, because of Ida and Nicholas, and rising costs because of the much firmer natural gas and ethane markets. Working against them are the very high margins and what appears to be a stubborn spot market, both covered in the charts below. A contract increase in September would maintain an unprecedented gap between US contract and spot pricing, and while it is likely that the spot market is very thin, it is a very strong push back against producers for a contract hike.

Volatile Pricing Obscures Underlying Direction For Chemicals & Plastics

Sep 17, 2021 12:40:41 PM / by Cooley May posted in Chemicals, Polymers, Polyolefins, Propylene, Plastics, Ethylene, polymer pricing, volatility, US producers

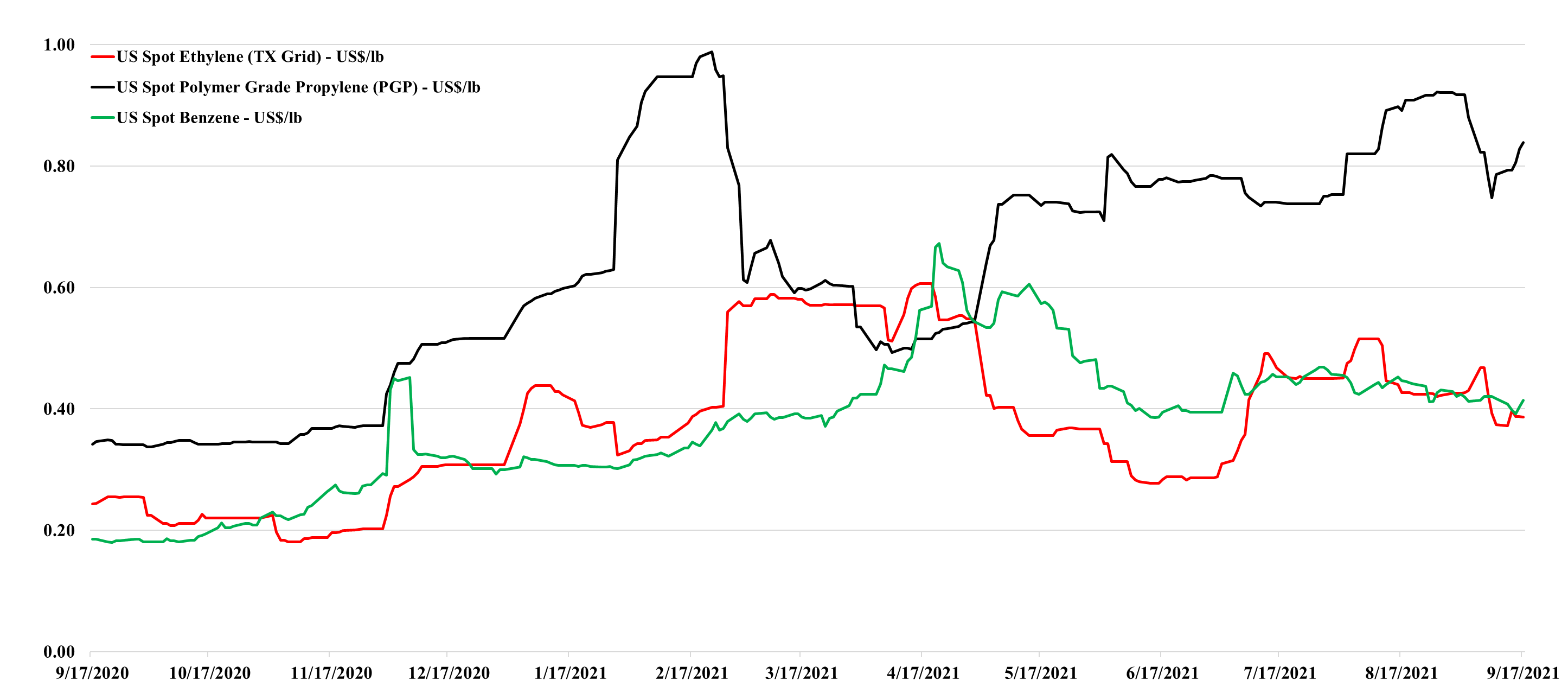

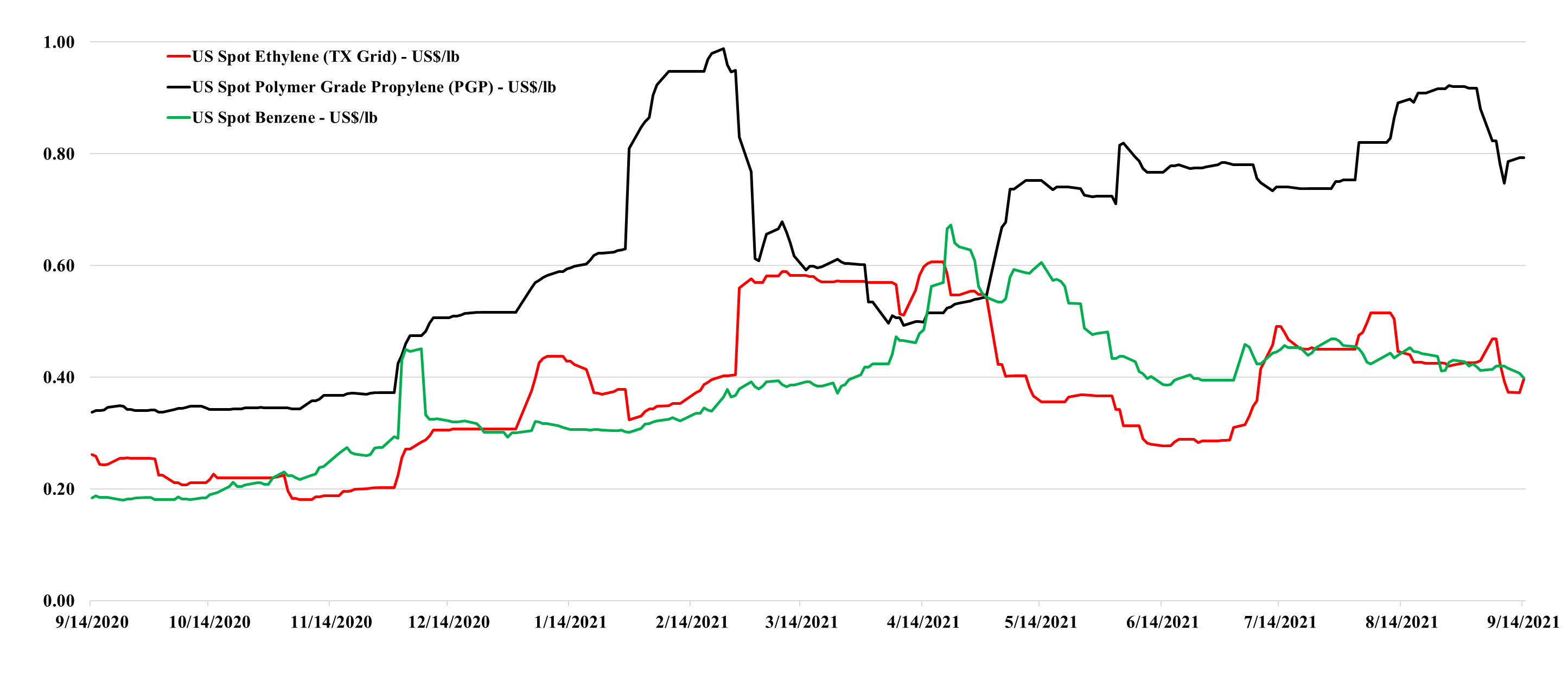

We continue to see significant volatility in US product prices, and this increases uncertainty around the underlying direction of the markets for the balance of the year. The recent storms have likely created enough production interruptions to take any slack that had been developing in August out of play, and while we see that in the most recent moves for ethylene and propylene – Exhibit below - it is likely more interesting to see what happens with polymer pricing as we move through the balance of September – as this will determine profits for most. While we focus on the high prices in the US more than we do the prices in Europe, it is also worth noting that European polyolefin margins remain very high, with one local producer confirming this week that records continue to be set in terms of cash flows and unit profitability. The frustration for the US producers impacted by the storm is that while their plant closures may be contributing to the tight markets, they do not get the benefit of the higher margins on the impacted facilities. While we would expect many to produce extremely high numbers for 3Q – a handful will likely lament how much they could have made had their plants operated fully. See more in today's daily report.

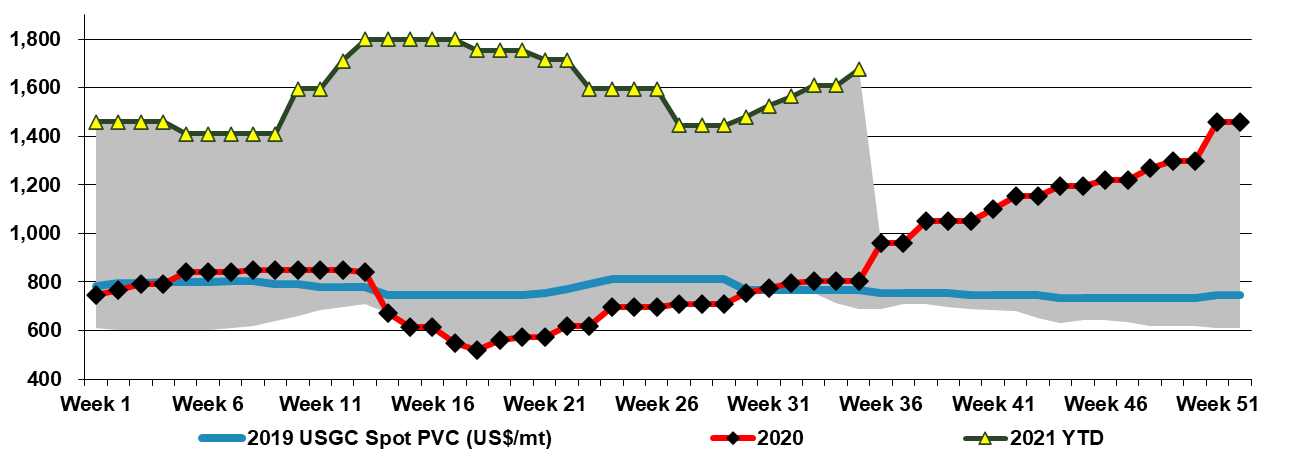

PVC: The Niche Exposure To Packaging Is Growing Quickly

Sep 16, 2021 3:03:25 PM / by Cooley May posted in Chemicals, Polymers, PVC, Plastics, Pyrolysis, packaging, medical devices

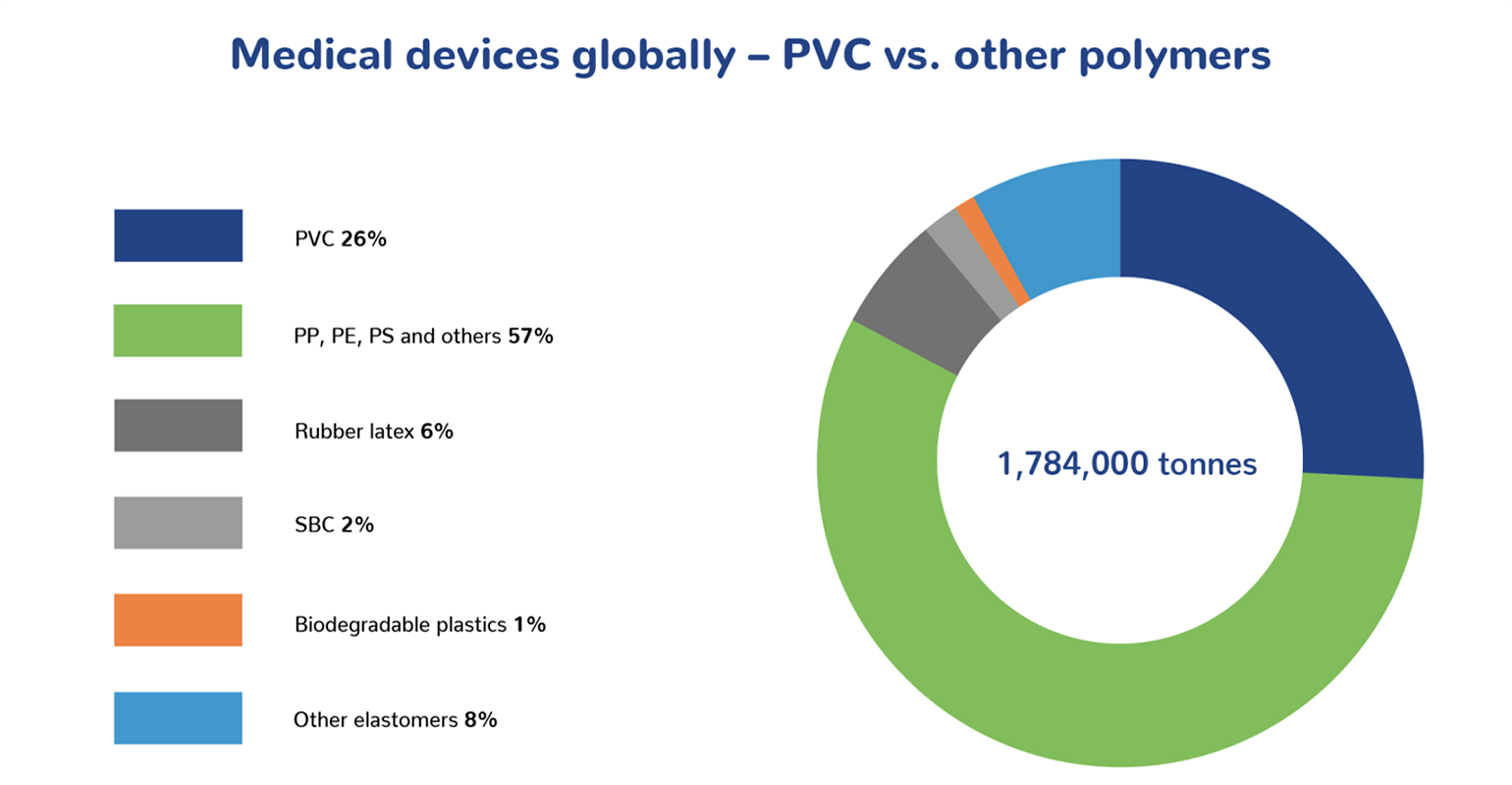

We have talked a lot over the last year about our preference for PVC as likely the better longer-term story within polymers – more stable growth – more limited global investment and less impact from the plastic waste moves, as very little PVC ends up in packaging. The exception is the medical device space, where demand for PVC in single-use applications is growing as illustrated below. While the medical device industry is setting up to use recycled PVC it is going to be hard to close the loop here as medical waste is generally quite contaminated and PVC does not do well in a conventional pyrolysis process because the chlorine molecule is a contaminant. The solution will likely be getting PVC from end-of-life consumer durables and recycling that PVC back into medical applications. Disposal of the medical waste is best done through a pyrolysis or gasification process that includes very high-temperature plasma technology. These facilities exist and operate well outside of the US, and we would expect to see broader acceptance within the US over time. See more in today's daily.

How Durable Is Polypropylene?

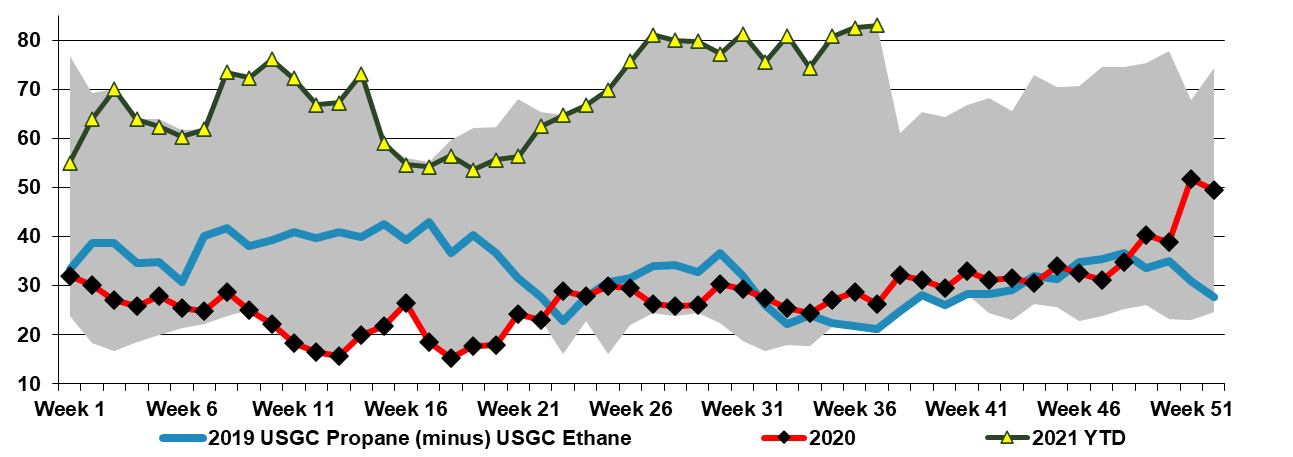

Sep 15, 2021 12:22:50 PM / by Cooley May posted in Chemicals, Propylene, Polypropylene, Surplus, propane, polymer, propane prices, polymer market, ethylene feedstocks, US polypropylene

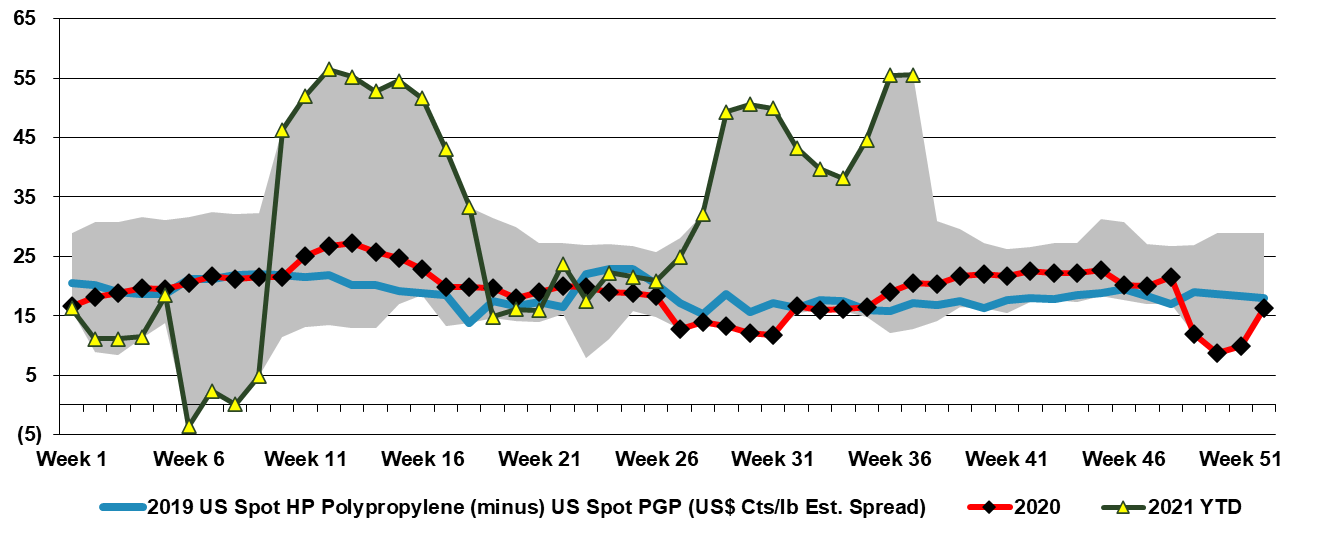

The crack in US polypropylene prices is probably worth some comments as the polymer has shown extraordinary strength since the middle of last year, in the face of new capacity that was expected to push the US market into surplus. In the chart below we show that the spread over propylene has not fallen, but this is because propylene is falling lock-step with polypropylene for the most part. Those companies integrated back to PDH economics will see a significant margins squeeze as polymer prices fall while propane prices increase. We have written recently about a concern that lower auto production rates in the US will back up into parts and that this will impact materials. In the early days of the auto cutbacks, we assumed that the automakers and their suppliers would simply build inventory, with the expectation of a bounce-back in demand once the chip shortage was over. As the chip shortage has dragged on and become more significant, we have likely hit any limit of inventory build, and we are concerned that polypropylene pricing could collapse if auto-related demand does not recover quickly. While autos are not a dominant demand category for polypropylene the sector is certainly large enough to swing the polymer market from shortage to surplus. With the rise in propane prices and other ethylene feedstocks, polypropylene profits could fall meaningfully. See today's daily for more comments on the propane markets.

More Storm Related Volatility For Ethylene

Sep 14, 2021 1:24:12 PM / by Cooley May posted in Chemicals, Ethylene, supply and demand, US ethylene, Nicholas, ethylene production

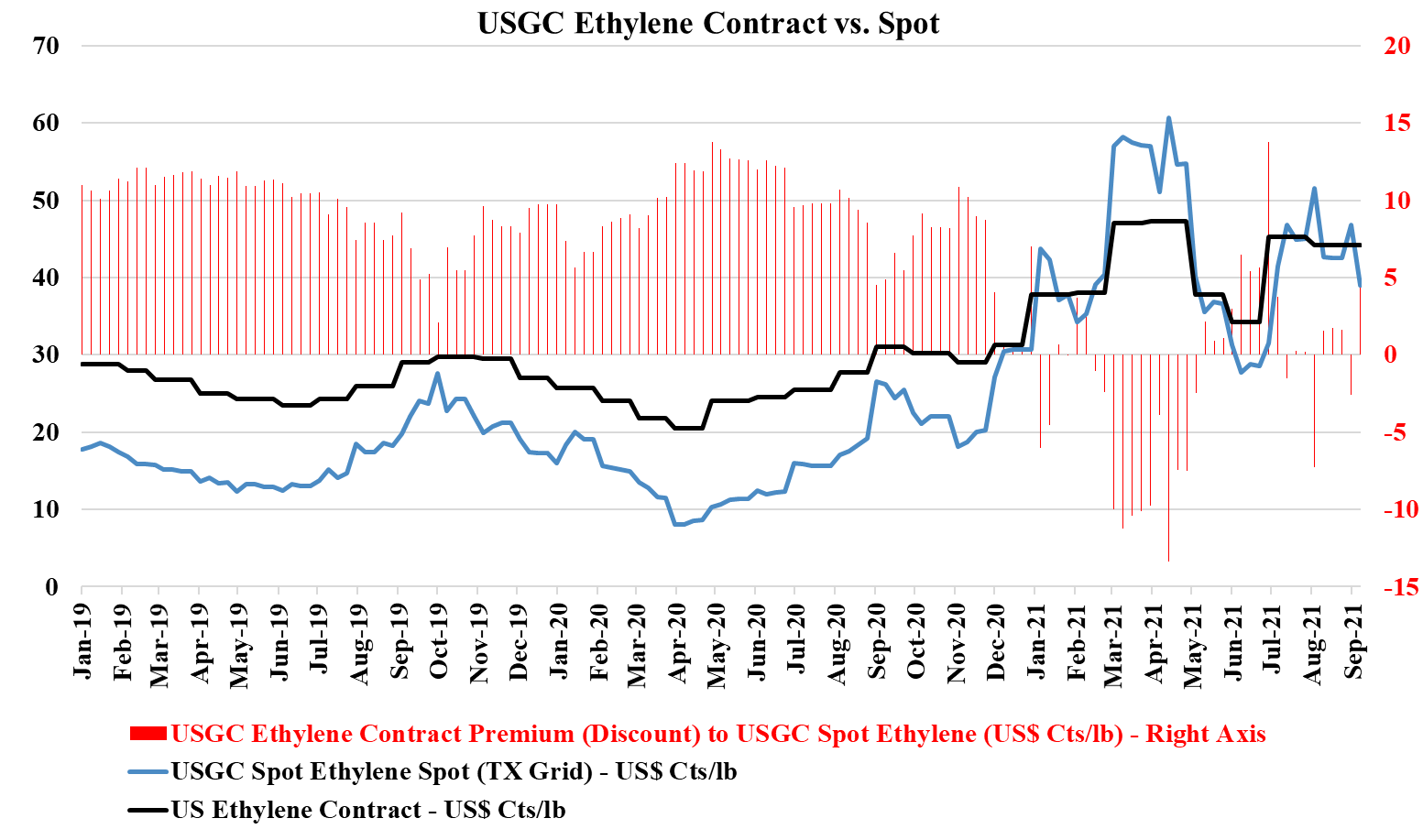

What a difference a day makes – over the weekend we discussed how US ethylene pricing was approaching levels relative to Asia that could restart trade and today prices are jumping again in anticipation of possible lost production from the Tropical Storm. The risk from Nicholas is flooding, but it has already passed much of the South Texas capacity and the larger risk is to the capacity east of Houston and into Western Louisiana at this time. As with Ida, it will take several days to get a read on how much of the chemical and related capacity has been impacted and the likely impacts on supply/demand. See today's daily for more.

US Ethylene and Polyethylene: Instability From Many Directions

Sep 10, 2021 1:54:53 PM / by Cooley May posted in Chemicals, Polymers, Polyethylene, Polypropylene, Ethylene, Styrene, Dow, arbitrage, US ethylene, US polyethylene, ethylene glycol

The gap between the US contract and spot price for polyethylene in the exhibit below looks wrong, and it could be wrong in absolute terms but the trend alone makes a statement. In the past, we have seen a couple of instances where reported contract settlements have drifted further from net transaction prices, either because of larger agreed discounts or because of contract formulae that reflect spot pricing to a greater degree. This tends to work for a while, but ultimately smaller buyers with more limited purchasing power become more disadvantaged and there is a breaking point at which the “contract” price is adjusted downwards by the price reporting services to better reflect what is really going on. The current market feels like the times in the past when an adjustment has been needed.

US Monomer Prices Falling, But Weather Remains A Risk

Sep 9, 2021 4:03:52 PM / by Cooley May posted in Chemicals, Polymers, Propylene, Ethylene, PGP, ethylene producers, US ethylene, Propylene Derivatives, US propylene, Hurricane Ida

We saw the stable to downward trends in both US ethylene and propylene spot prices reverse at the end of 2020, in part because of recovering demand post the initial wave of COVID, but also because of storm-related production constraints in October and early November. The weaker spot markets for both ethylene and propylene today reflect much stronger production for propylene (all PDH capacity running) and Hurricane Ida-related upsets that have left the monomer markets less badly impacted than derivatives. Something similar happened in 2020, especially for ethylene, but the backlog of derivative demand cause a step up in ethylene consumption when everything restarted. This could happen again, and we are earlier in the Hurricane season. See today's daily report for more.

Propane: Pricing Itself Out Of The Chemical Feedstock Market

Sep 8, 2021 2:35:28 PM / by Cooley May posted in Chemicals, Propylene, supply and demand, propane, feedstock, propane prices, feedstock market

It will be interesting to see how US propane prices track this winter as we have low inventories in the US and there will likely be a step up in year-on-year export demand because of investments in Asia to consume imported propane. At some prices level, there will be demand destruction as ethylene and propylene economics are close to break-even in Asia and the region looks over-supplied enough for some producers to consider cutting back or even shutting down – if propane is the least attractive feedstock then the propane-based units will close first. Those producers in the US that have propane flexibility are unlikely to be anywhere near the market today as declining propylene prices in the US only make the feedstock less attractive. We wonder whether some of the traditional propane users in the US Gulf are experimenting with light naphtha/condensate as an alternative, but these feedstocks will also become less attractive as propylene prices fall. See more in today's daily report.

More Examples Emerge Of US Chemical/Polymer Market Tightness Post Ida

Sep 3, 2021 1:18:43 PM / by Cooley May posted in Chemicals, Polymers, Polyolefins, PVC, US Polymer, Ethylene, US Chemicals, olefins, US polyethylene, Hurricane Ida, Chemical pricing, ethylene prices

It is increasingly likely that Hurricane Ida will add another leg of strength to US chemical pricing more broadly, with a host of prolonged production outage news and force majeure notices, giving momentum to some price increase announcements for September, some of which looked very speculative at the time they were made. Buyers will have an eye on continued pockets of supply chain disruption, strong demand in general, particularly for those levered to holiday spending, and the not insignificant fact that we still have almost three months of hurricane season to go! Note that two of the more disruptive storms of 2020 hit in October. We talk specifically about PVC in today's daily - See price chart below.

%20(1).png?width=6000&height=6000&name=New%20C-MACC%20Logo%20-%20Final%20-%20Transparent%20(2000%20%C3%97%202000%20px)%20(1).png)