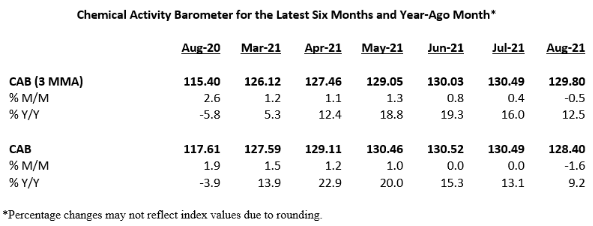

The ACC “chemical activity barometer” shown in the exhibit below is more impressive when you consider that by August of last year the demand recovery was in full swing and operating rates were high. There was some negative impact from the first hurricane, but this hit very late in August 2020 and would not have influenced the ACC reported activity significantly. We focus on price and margin in most of our commodity commentary and this is appropriate, given how much more important they are than incremental volume for all commodities, but it is worth noting that all of the chemical producers get decent cash flow gains from uninterrupted high (optimal) operating rates. The last two years have been a little plagued by more than expected unplanned stoppages, and this has helped keep the US market buoyant, but those that have been able to run at optimized rates for prolonged periods are benefiting. Prices have been the biggest contributor for Dow and ExxonMobil on the integrated polyethylene front in the US this year, but both have had the benefit of very strong operating performance, as have most others with a bias to Texas. Dow and ExxonMobil have large facilities that were in the path of Ida. LyondellBasell and CP Chem do not. See our daily report for more.

US Chemical Strength Persists, Ida Issues Add To Supply Chain Woes

Sep 1, 2021 1:04:08 PM / by Cooley May posted in Chemicals, Commodities, Polyethylene, ExxonMobil, Dow, ACC, Hurricane Ida, CAB, chemical producers

US Polyethylene Prices Reflect Support, In Part Due To High Freight Rates

Aug 31, 2021 2:31:51 PM / by Cooley May posted in Chemicals, PVC, Polyethylene, Ammonia, PE, freight, Polyethylene prices, US Polymers, container freight rates, US polyethylene, spot price, Hurricane Ida, distribution

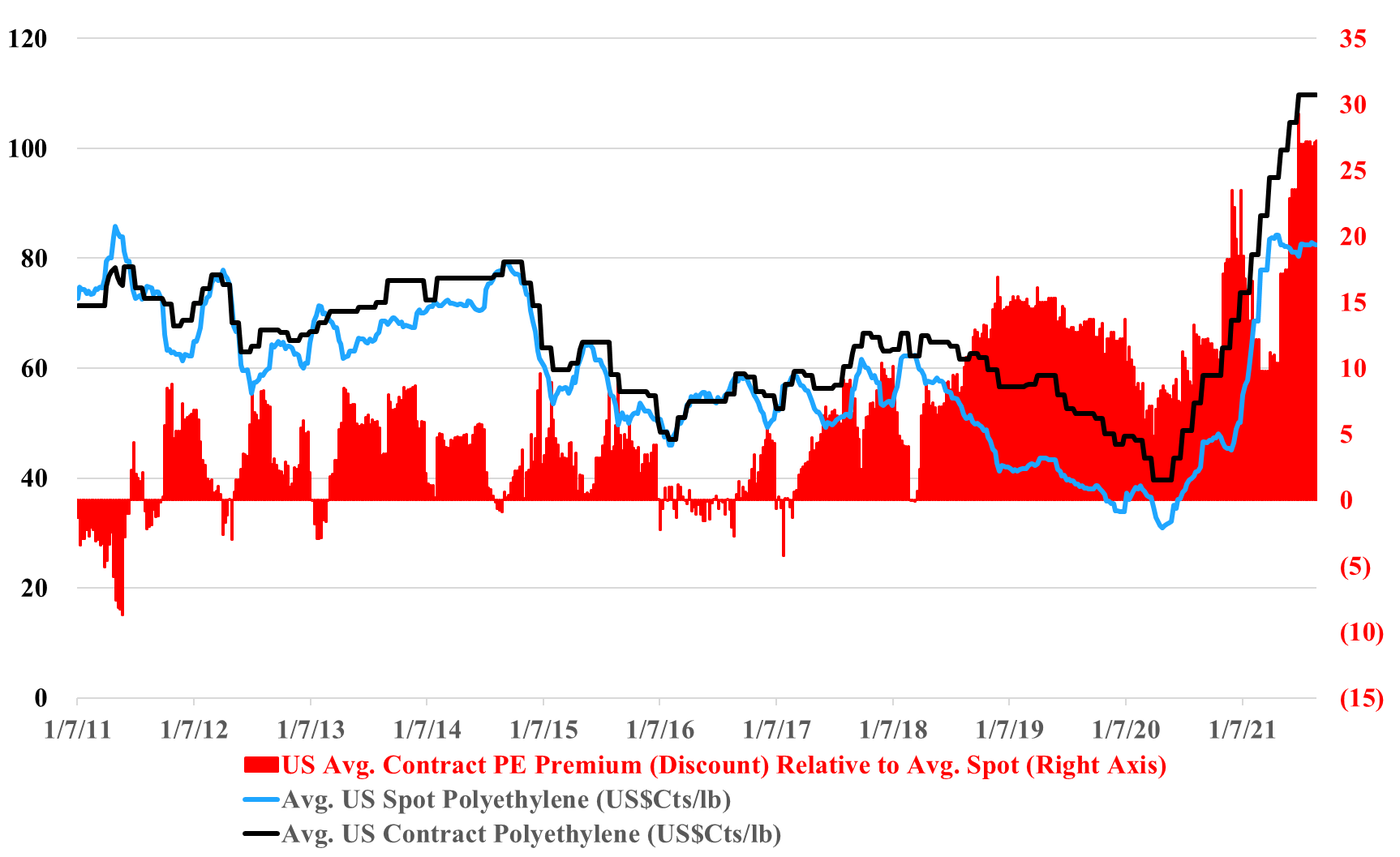

We discuss recent historic highs reached in China to US container freight rates in our daily research today, and (absent Ida) we note that freight charges remain a major component in favor of US polymer price support. With current container rates so high, it is difficult for US consumers to get access to cheaper material from Asia, even if they are willing to try the untested grades in their equipment. Absent the freight extremes today, we would be much more definitive in declaring that the US's record spot/contract polyethylene price difference was unsustainable and would be corrected quickly. While there appear to be some surpluses of US polyethylene today, such that producers are testing the incremental export market, the same producers can hide behind the freight barrier as they make arguments to support domestic pricing. Some US buyers may be getting pricing relief because they have price mechanisms that partly reflect the spot price. It is also possible that large buyer discounts have risen through this period of very high pricing (this has happened before).

Upcoming Polyethylene Capacity Additions Are Unlikely To Go Unnoticed

Aug 27, 2021 12:58:28 PM / by Cooley May posted in Chemicals, Polyethylene, Ethylene, Shell, ExxonMobil, Sabic, Baystar, ACC, Polyethylene Capacity

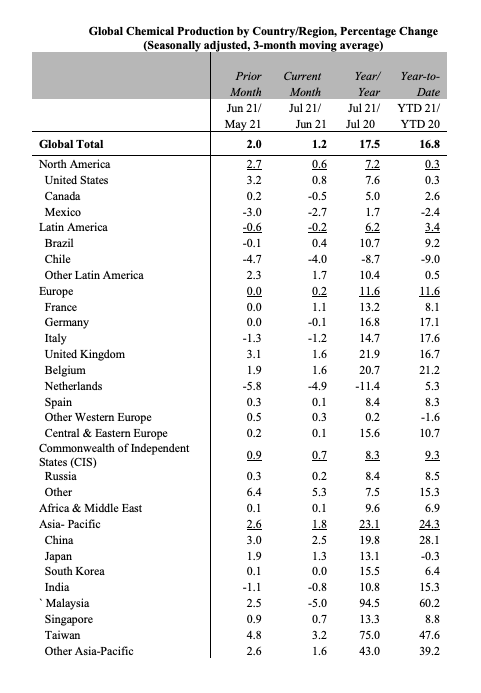

The advanced nature of the ExxonMobil/SABIC project, which we have discussed previously, is another cause for concern around US polyethylene market strength for a couple of reasons. First, it is only the first wave, with Baystar and Shell hot on the heels in 1H 2020. Second, it will add another ethylene seller in the US – SABIC – and this may be enough to cause some ripples. If you look at this in the context of the Asia production growth data provided by the ACC (below) there should be a significant cause for concern around the global balance for many products. Some of the specific Asia country growth, year on year and year to date, is driven by COVID-related shutdowns in 2020 – Taiwan and Malaysia for example – but the bulk of the China growth, which is more significant in absolute volume terms is from new capacity. China’s ability to sell surpluses internationally is hindered by the current logistic problems, but these will not last, and we should also factor in where the material will go that had been imported into China. The global polyethylene market could look very different in 2022, although all eyes will be focused on Hurricane Ida for the next week. See more in today's daily report.

The Tale Of Two Regions: Asia Loose, US Tight

Aug 26, 2021 12:49:40 PM / by Cooley May posted in Chemicals, Polymers, Polyolefins, Propylene, Styrene, PET, Surplus, polymer producers, US Polymers

China trade data for chemicals and polymers points to a dramatic swing in net imports, partly due to the new capacity added over the last 12 months. Imports are down, and exports are up. Despite the logistic challenges of moving the products and the powerful pull on consumer durables from China driven by US and European demand – much of which consume significant volumes of polymers and chemicals locally. The trade swings talk to the significant capacity additions and the relatively sluggish consumer within China, where spending patterns remain subdued because of the Pandemic. Even with a recovery in domestic spending, China has probably added 2 to 3 years of demand growth in current capacity adds – most notably for polyolefins and PET, but also for styrene, where we believe demand growth could be slowing. If logistics improve and container rates come down, the surpluses in China will have a severe negative impact on international prices. This development will likely be seen in either polymer quantities flowing faster/more freely around the globe or because the export rate of consumer durables will pick up even further at the expense of durable producers in the US and Europe.

US Polymers: Are The First Cracks Appearing?

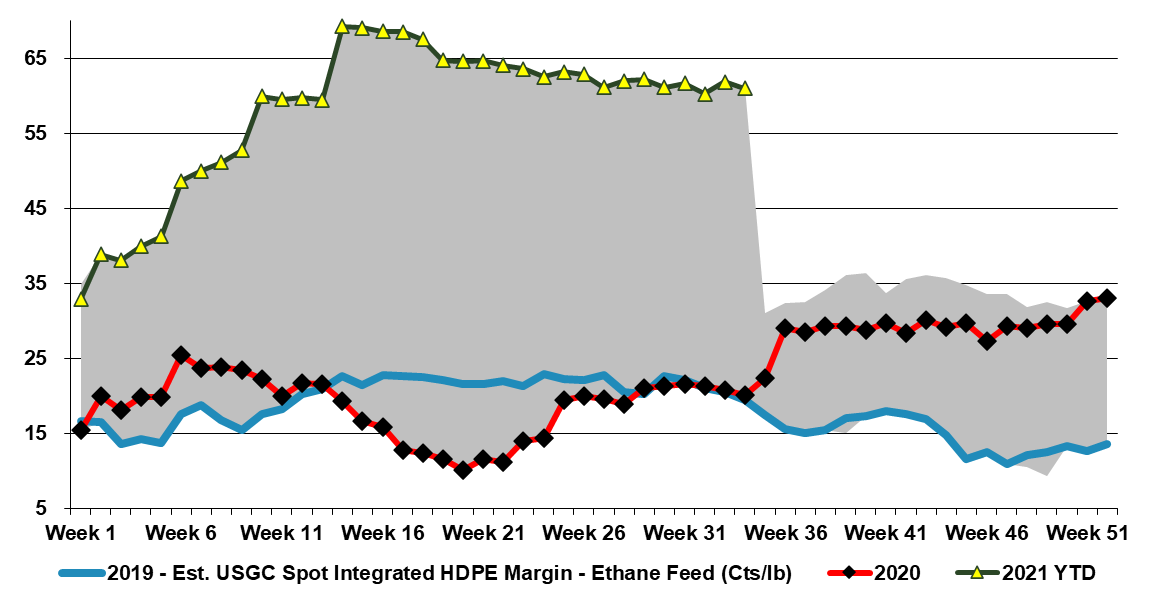

Aug 25, 2021 1:42:34 PM / by Cooley May posted in Chemicals, Polymers, Polyethylene, Ethylene, HDPE, derivatives, ethane feed, US Polymers, LLDPE, LDPE

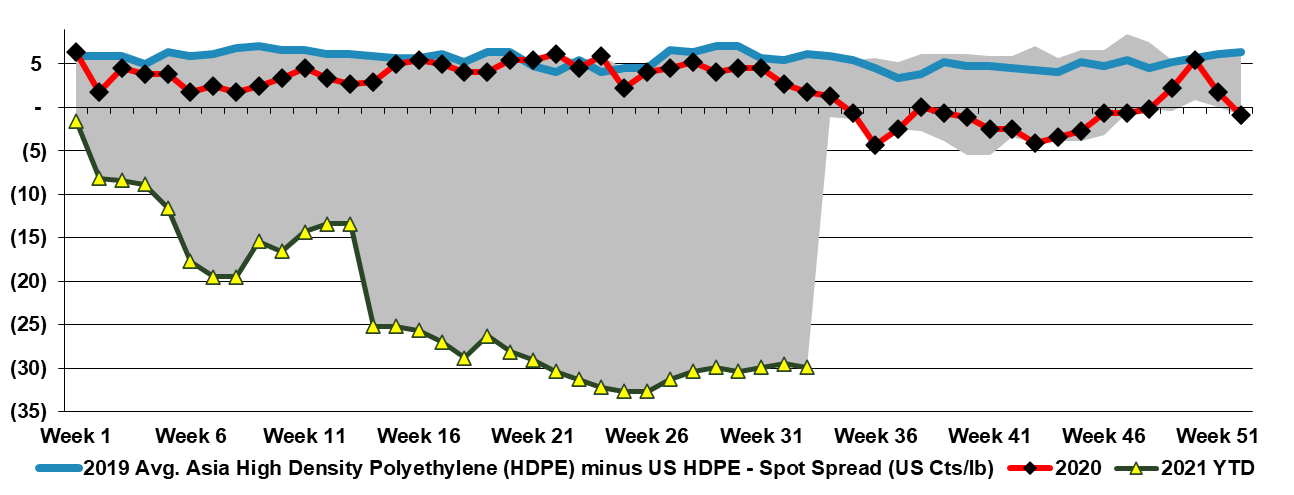

Is this the beginning of the end? The linked report that US traders are struggling to find export homes for incremental HDPE should not be a surprise given the significant price difference between the US domestic price and prices in other markets – Exhibit 1 in today's daily report. HDPE is the more fungible polyethylene, with both LLDPE and LDPE much more grade and application-specific. It is often the first polyethylene grade to spike in a shortage and fall when there is a surplus.

US Ethylene: Flexibility Has Lessened, Despite More Funds Available

Aug 24, 2021 12:59:27 PM / by Cooley May posted in Chemicals, Ethylene, Butadiene, LyondellBasell, Dow, feedstock, ethane, US ethylene, naphtha, ethylene capacity, light naphtha

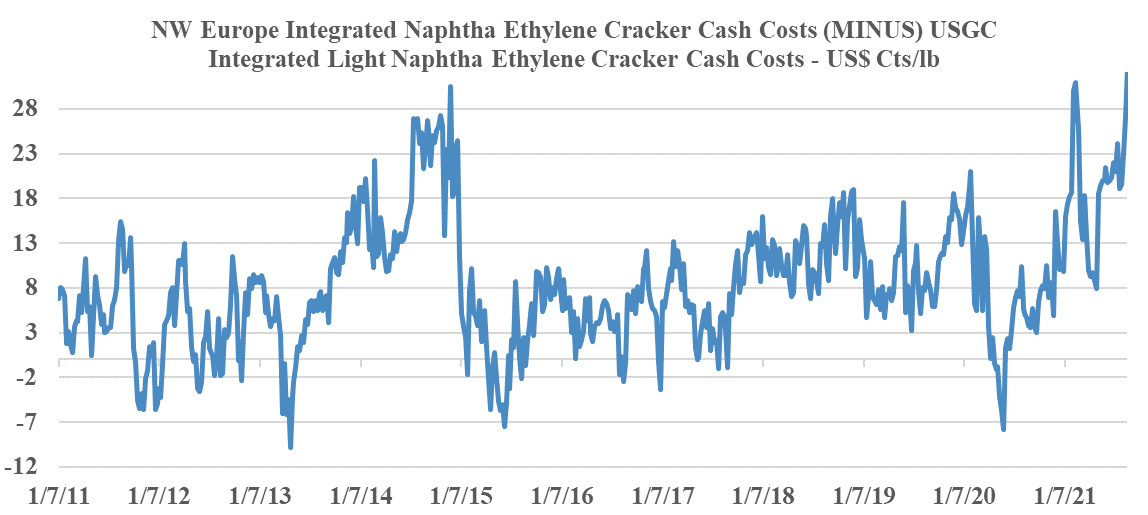

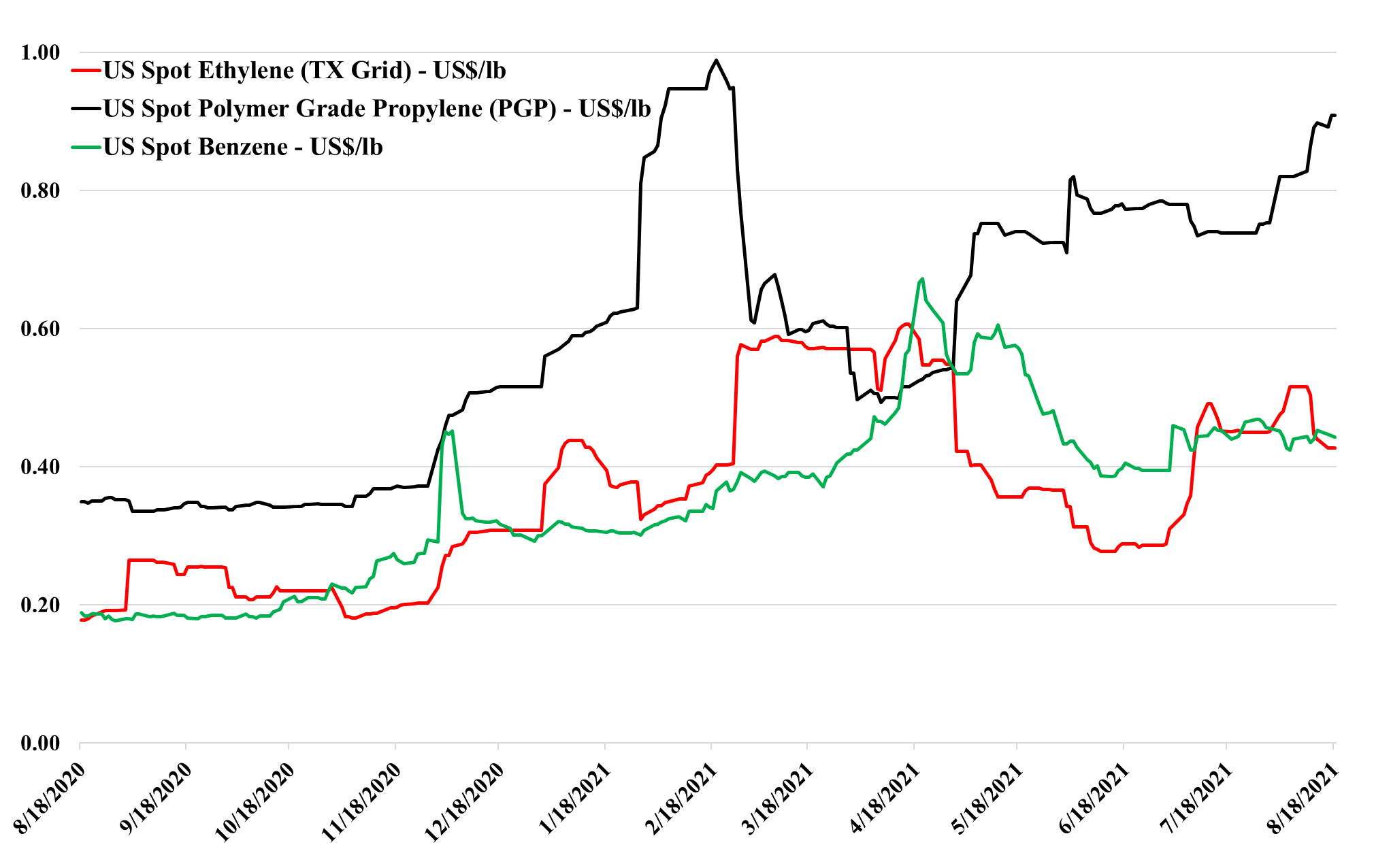

Before the wave on new ethylene capacity came online in the US there were several low-cost expansion projects all of which added the ability to crack ethane and some of which brought constraints around feedstock flexibility. Consequently, it is less clear than it used to be just how much US ethylene capacity can flex to exploit the very attractive light naphtha economics today. Very conservatively, we would estimate that 5-6 million tons of capacity can flex easily and about the same again with some planning and some logistic adjustments. Among the public companies, both Dow and LyondellBasell are well placed, and likely have at least 1 million tons each of flexible capacity – in both cases, there is a need for propylene and LyondellBasell has significant butadiene/C4s capacity. For context, at current prices, both companies are likely looking at an additional ethylene margin benefit in the US of $2.5-3.0 million per week for as long as this opportunity exists. This would be 0.3 cents per share per week for Dow and 0.7 cents per share per week for LyondellBasell – a rounding error in current earning but more free cash regardless. The chart below shows the unprecedented benefit in the US and see our daily report for more.

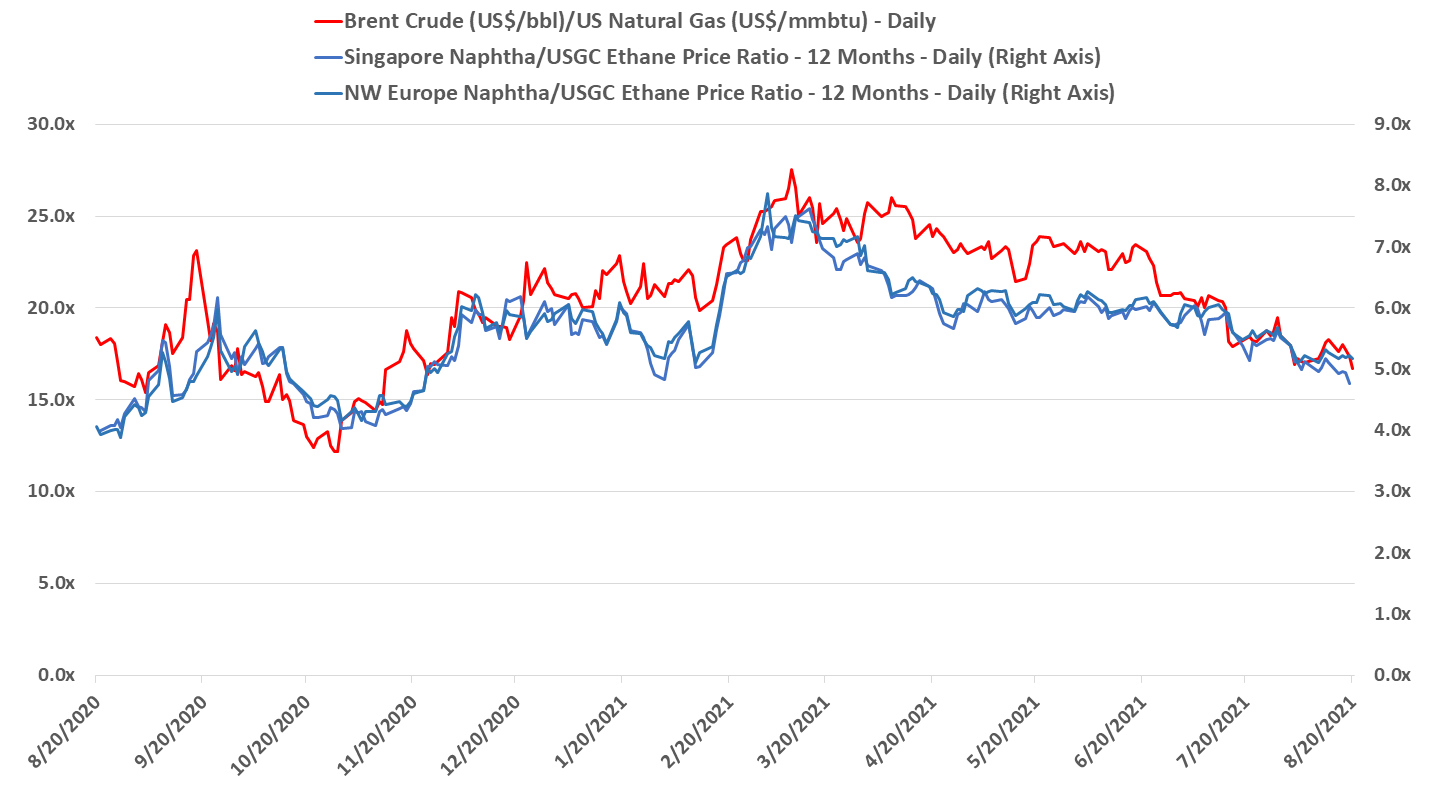

Oil To Gas Ratios Declining But US Competitive Edge Still Intact

Aug 20, 2021 11:51:38 AM / by Cooley May posted in Chemicals, LNG, Energy, Oil, natural gas, US natural gas, Upstream

The slow decline in the oil/natural gas ratio that has persisted through the year continues – this time oil is falling faster than natural gas as both are reacting to slower demand or expectations of slower demand. We are unconvinced that the price declines will continue, but it is much less clear which direction the ratio will move. OPEC+ has far more chance of keeping cash flows high by trimming volume to balance the oil market and the overwhelming strategic logic of such a move means that it is a likely path – there is no 10-20% boost to demand to be found by lowering prices. US natural gas is still on a medium-term demand march higher in our view and more limited E&P spending should keep the market balance quite tight. There are no near-term large increments of new LNG capacity on the horizon and consequently, inventory and pricing will likely bounce around on weather changes for a while. See more in today's daily report.

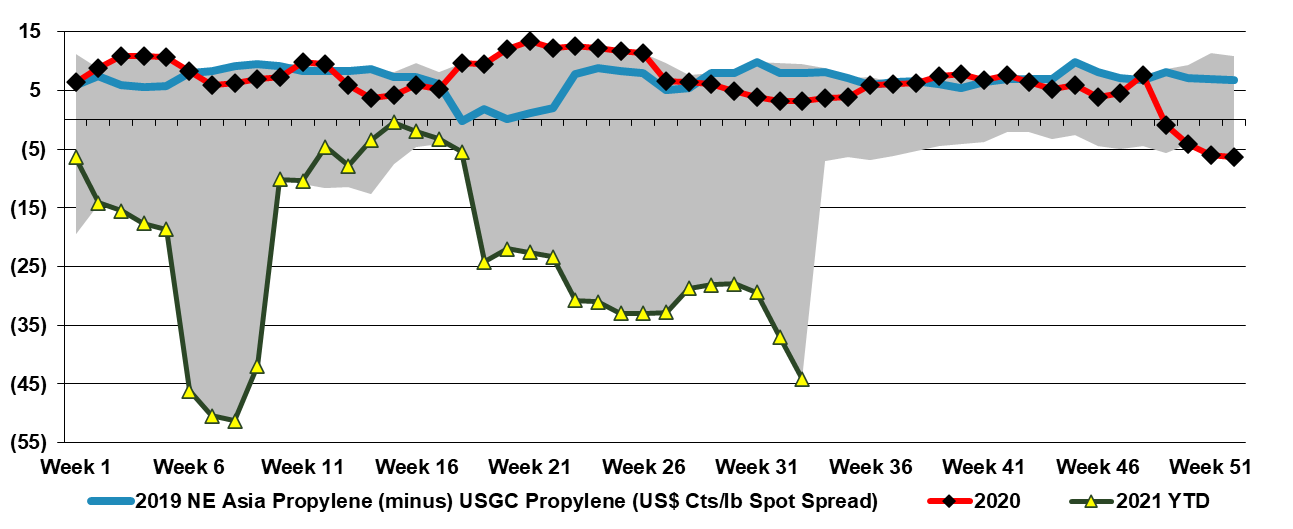

Reasons To Short US Propylene Mount! (If Able To Push Recent History Aside)

Aug 19, 2021 12:32:30 PM / by Cooley May posted in Chemicals, Propylene, propane, PGP, US propylene

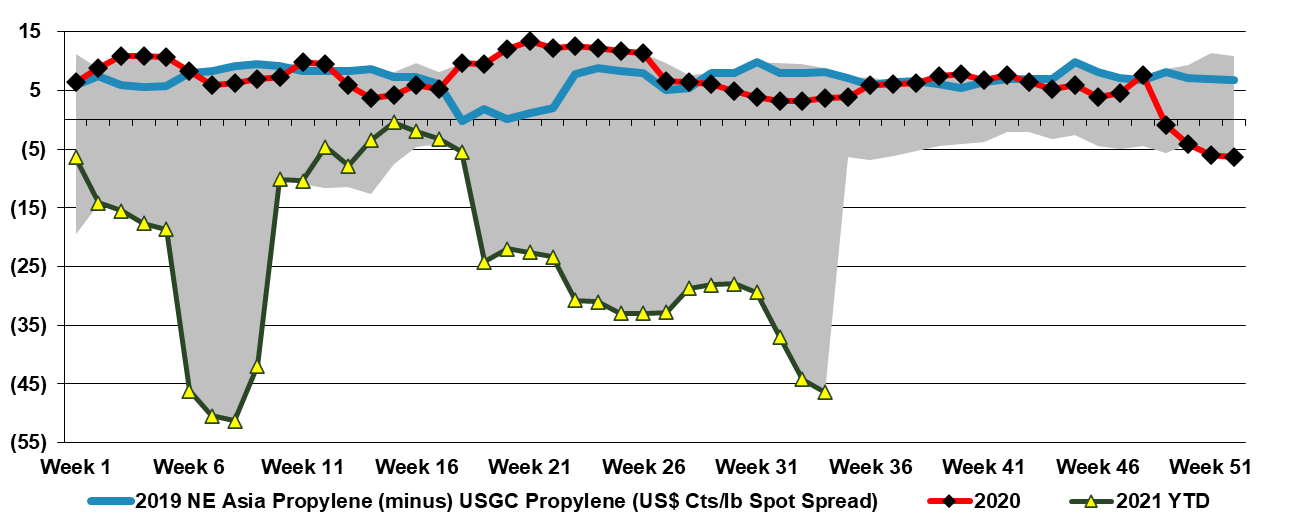

The propylene charts in today's daily and below, show the extreme nature of the US market today – both relative to costs and prices internationally. Despite the very high cost of propane, the US propylene price is high enough to justify shipping propane to Asia – running it through local PDH capacity and shipping the propylene back to the US! This is the definition of unstable, but the logistics would be a constraint as the US does not have ship-based LPG import capability whee it would be needed. While we think propylene (polymer grade) is a compelling “short”, the markets over the last year have been so volatile and unpredictable and the US Hurricane season is far from over, so we would likely not put our money at risk today.

Could Propylene Lose Market Share To Ethylene?

Aug 18, 2021 12:28:03 PM / by Cooley May posted in Chemicals, Propylene, Ethylene, propane, Propylene Derivatives, exports

Propylene prices are rising again in the US, in part because of the propane price increase discussed in today's daily, but also because of reduced availability from other sources. These higher prices maintain upward pressure on propylene derivative pricing and we have to question how markets will adapt to much higher propylene and derivative pricing than ethylene and derivatives. There are several areas of potential overlap, where ethylene derivatives could take share from propylene derivatives and if the price deltas remain high and users become convinced that this could be the norm, it is reasonable to expect that propylene demand growth slows incrementally and ethylene demand growth benefits. In the immediate term, some quick switches could happen, but just as propylene demand marched ahead in the 1990s and 2000s because investments were made to use propylene derivatives instead of ethylene derivatives, we could begin to see investment to reverse the process. This was an incremental process for propylene over decades and we would not expect to see anything less incremental in the other direction, but ultimately this could be good for the more focused US ethylene and derivative markets if it accelerates growth in onshore demand and decreases the reliance on exports.

Polypropylene Should Be Traveling

Aug 17, 2021 6:16:09 PM / by Cooley May posted in Chemicals, Polyolefins, Polyethylene, Polypropylene, Export, arbitrage, polymer

The chasm between US and Asia polyolefins prices remains wide, close to a 5-year high for polyethylene and setting new highs for polypropylene. The polyethylene arbitrage is not large enough to encourage US imports – first Exhibit below – largely because of the very high container rates from China.

%20(1).png?width=6000&height=6000&name=New%20C-MACC%20Logo%20-%20Final%20-%20Transparent%20(2000%20%C3%97%202000%20px)%20(1).png)