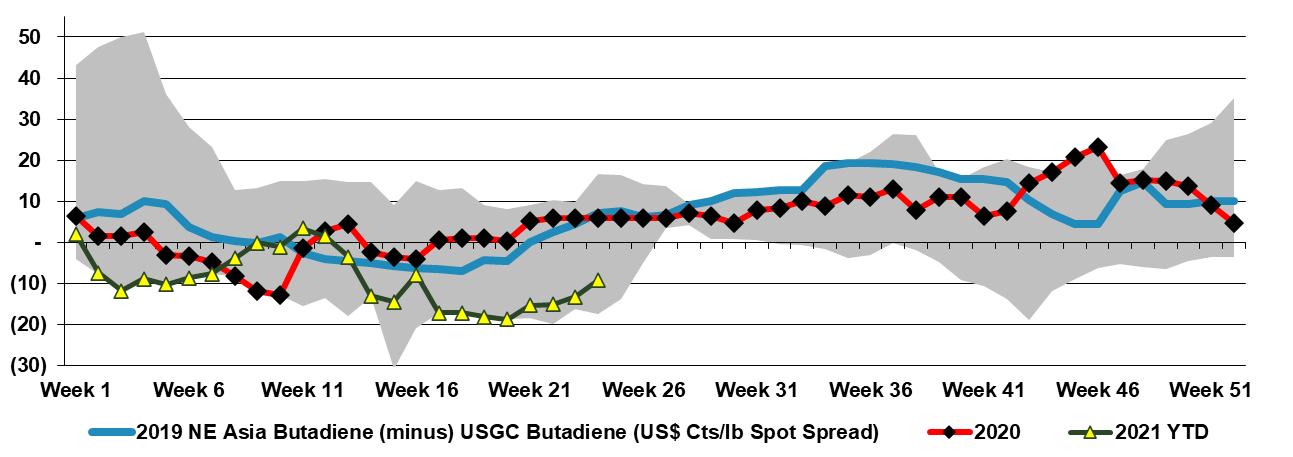

The exhibit below looks at the difference between a strong butadiene market in the US and a much weaker one in Asia. The strength in the US is a function of the stronger US economy and consumer spending as well as logistic issues with products containing butadiene derivatives, but also because there is no incentive to increase heavier cracker feedstock use right now in the US and consequently co-product butadiene supply remains constrained.

Butadiene: Strong Global Demand Overwhelmed By New Asia Production

Jun 18, 2021 4:51:58 PM / by Cooley May posted in Chemicals, Ethylene, supply and demand, Chemical Demand, freight, Asia, butadiene derivatives, butadiane

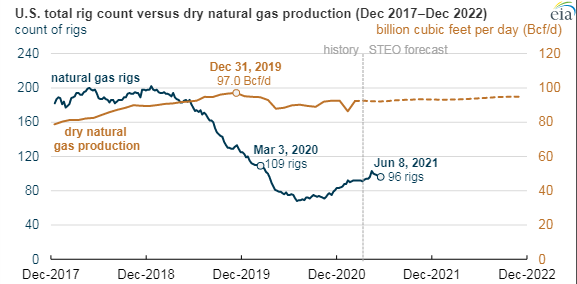

Energy Inflation Coming But Unlikely To Change The Pace Of Renewable Investment

Jun 17, 2021 1:48:57 PM / by Cooley May posted in Chemicals, LNG, Oil Industry, Energy, Inflation, Net-Zero, natural gas, renewable energy, renewable investment, natural gas prices

The commentary on oil reflects the opposing views that OPEC+ capacity is looming and that every piece of incremental negative demand news is frightening, versus that OPEC+ is disciplined and wants higher prices, resulting in every incremental positive being welcomed. We are firmly on the side of higher oil prices as we cannot see any stakeholder in oil wanting anything except opportunity profits for as long as it may last from here.

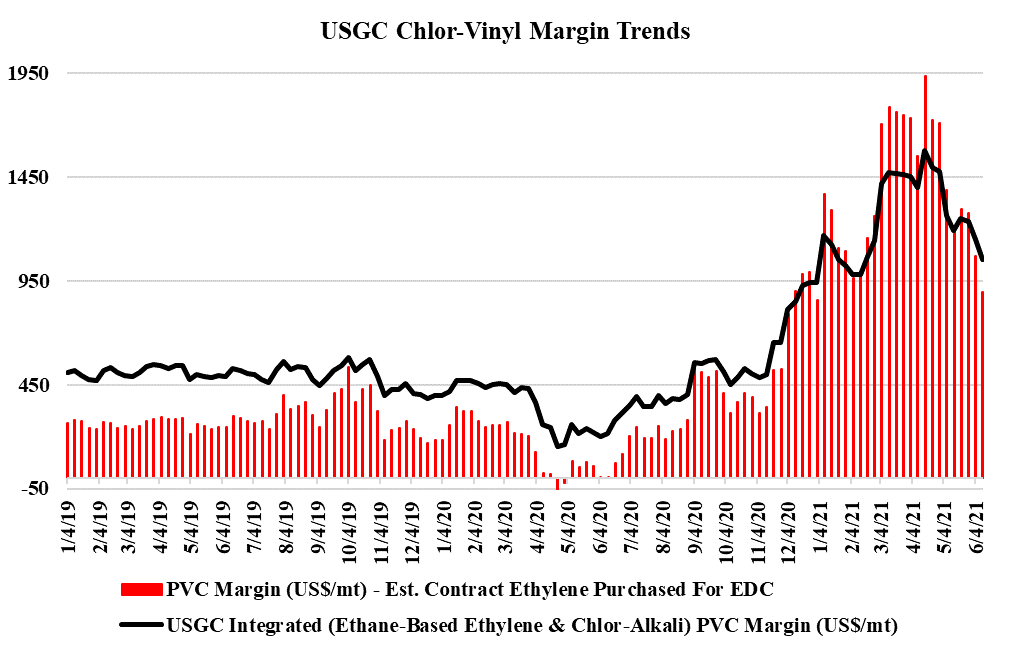

PVC Off Its Peak, But It's Long Term Outlook Remains Compelling

Jun 16, 2021 2:04:55 PM / by Cooley May posted in Chemicals, PVC, Polyethylene, Oil, PVC Margins, US Ethane

PVC margins are off their highs, as pricing is falling through June. The building product markets remain robust in our view, albeit off their highs, and some of the strength in PVC in April and May was a consequence of production shortages caused by the winter freeze in February. While PVC may be falling faster than polyethylene today, we see support for US PVC at higher prices and margins than for polyethylene in a weaker market unless oil climbs further relative to US ethane. See more on our daily report.

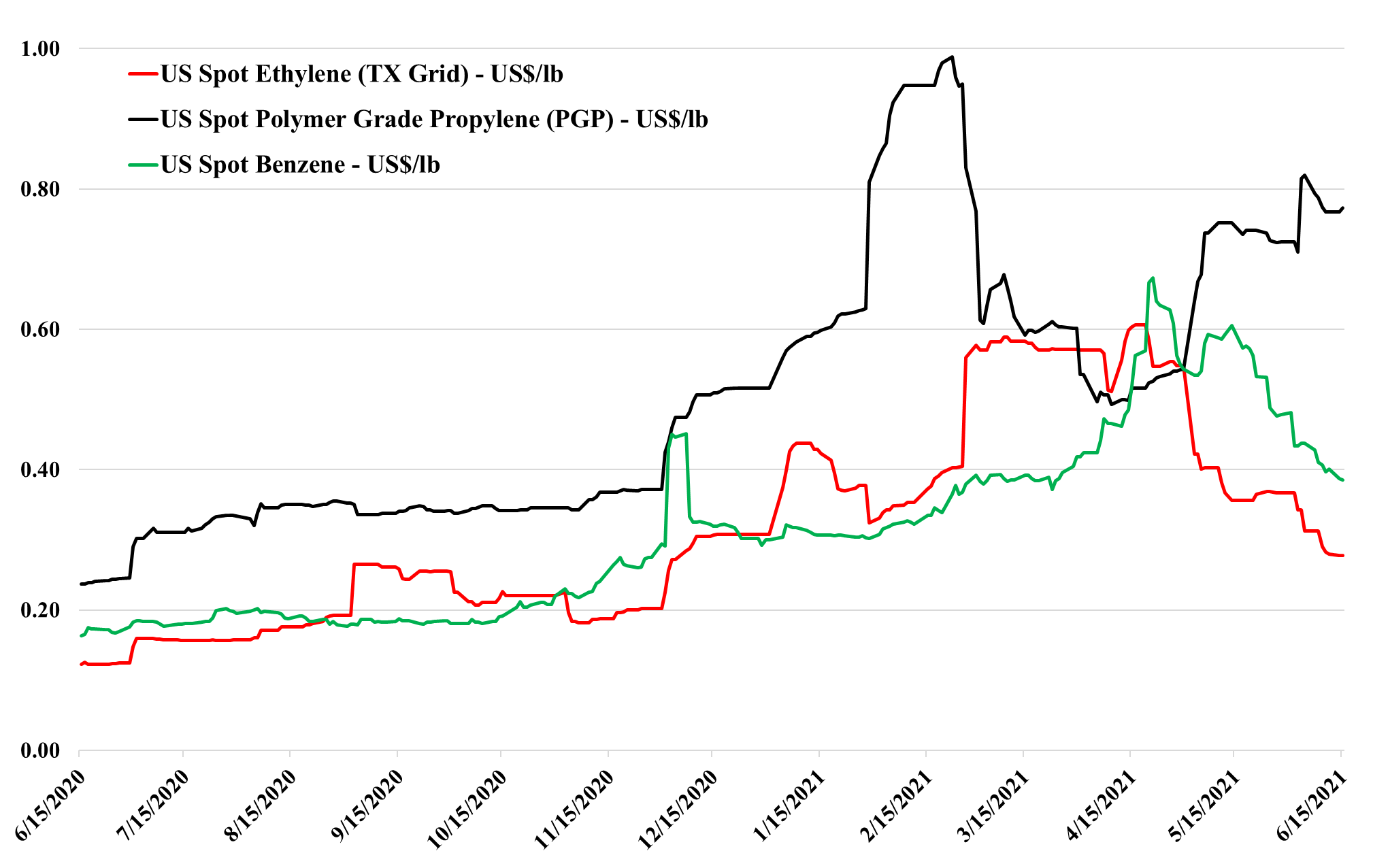

Propylene Too Expensive, Ethylene Cheap Enough

Jun 15, 2021 2:18:27 PM / by Cooley May posted in Chemicals, Propylene, Polyethylene, Polypropylene, Ethylene, Auto Industry, polymer pricing, consumer spending

The weakness in polymer pricing in Asia and the drag that auto sales had on US consumer spending in May (spending was up ex-autos) should begin to undermine the very strong polypropylene market in the US, and the fall may happen at a reasonable clip. Polypropylene is more fungible than polyethylene, in that much more of the customization of polypropylene comes post-production rather than during production. There are several unique polyethylene technologies, especially for linear-low where the process drives the properties and adds value. For polypropylene, while there is some of this, most product is compounded and consequently, there is more fungibility before compounding and less risk from experimenting with suppliers. If freight rates were not so high as discussed in today's daily, we believe that we would have seen a notable amount of polypropylene moving from Asia to the US by now.

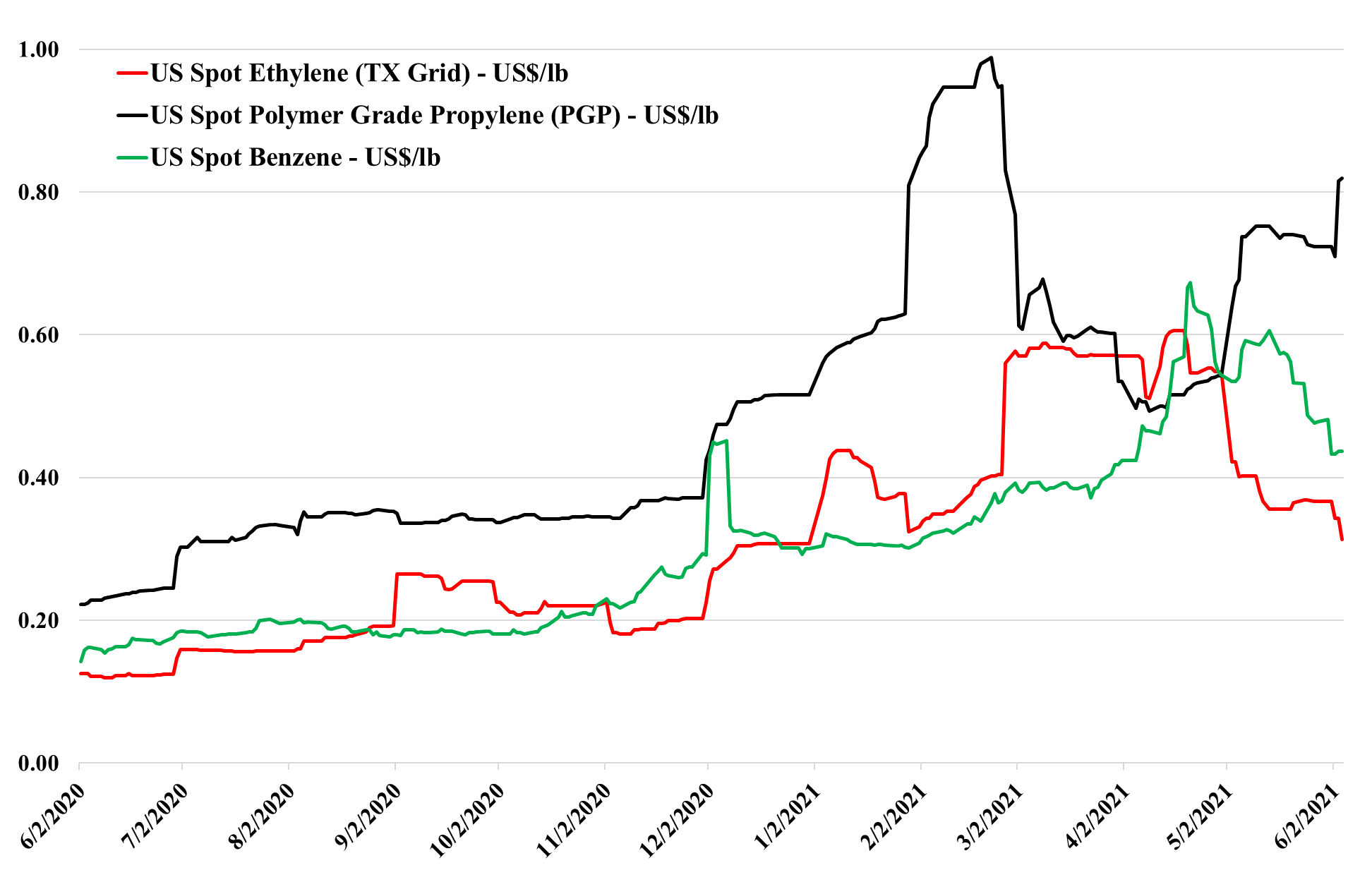

Ethylene Weaker Again - Is Propylene On The Edge?

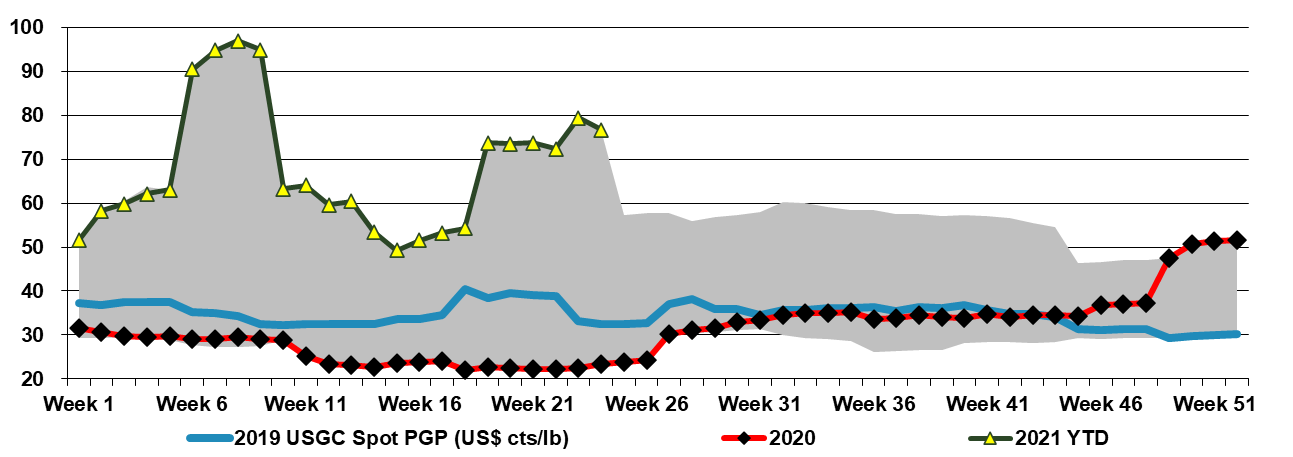

Jun 11, 2021 1:19:33 PM / by Cooley May posted in Propylene, Ethylene, Monomer, polymer pricing, polymer grade propylene, PGP, USGC, RPG, refinery grade propylene

USGC ethylene spot prices have weakened since reaching a multi-year peak in mid-April, something we have discussed for some time. This week's downtick in propylene values is a bit more unique as it has occurred alongside weakness in other monomer markets, which is a general trend that appears likely to gain momentum. Most monomer markets are weakening from recent 2Q21 highs in the US. We broadly find an increasing level of support for our view that many commodity chemical product prices will peak for the year in 2Q21. Exhibit 1 in our Daily Report shows an Asia arbitrage that should allow US ethylene to move to Asia, but is in the potential to take it because of local Asia surpluses, Asia prices will remain under pressure, although ethylene values in this region are fast approaching costs. We will soon be back to the previous equilibrium in an oversupplied ethylene market, where the economics of Asia production sets prices, and US exporters make a margin based on their cost advantage. The question now is how long it is before polymer prices follow.

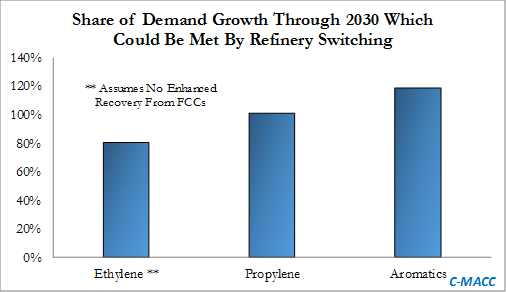

Could Big Oil Capital Reallocation Drive More Chemical Supply?

Jun 10, 2021 1:27:19 PM / by Cooley May posted in Chemicals, Polymers, Climate Change, Oil Industry, Ethylene, Carbon, ExxonMobil, fossil fuel, hydrocarbons, Dow, Base Chemicals, Sabic, JV, Engine No. 1

The ExxonMobil board headline linked has come up a couple of times since the Engine No.1 victory at the board meeting. There is no doubt that capital spending plans will be reviewed with the changes at the top, and we expect more management changes, which could also drive spending priorities. Over the last couple of years, several more macro studies have been done talking about oil demand in a climate change-centric world and all have highlighted chemicals as one of the likely longer-term growth avenues for fossil fuels. We would expect ExxonMobil and other oil majors to look at investments in chemicals as a route to more captive consumption of hydrocarbons and believe that this could ultimately keep basic chemical and polymer markets oversupplied through the balance of this decade – we have been writing about this risk consistently since early 2020. ExxonMobil is already building ethylene capacity in the US in a JV with SABIC, but more oil company investments could come in the US. The caveat is that, as Dow covered in its MDI press release yesterday, any new investment is likely to need a carbon plan to get stakeholder and regulatory approval.

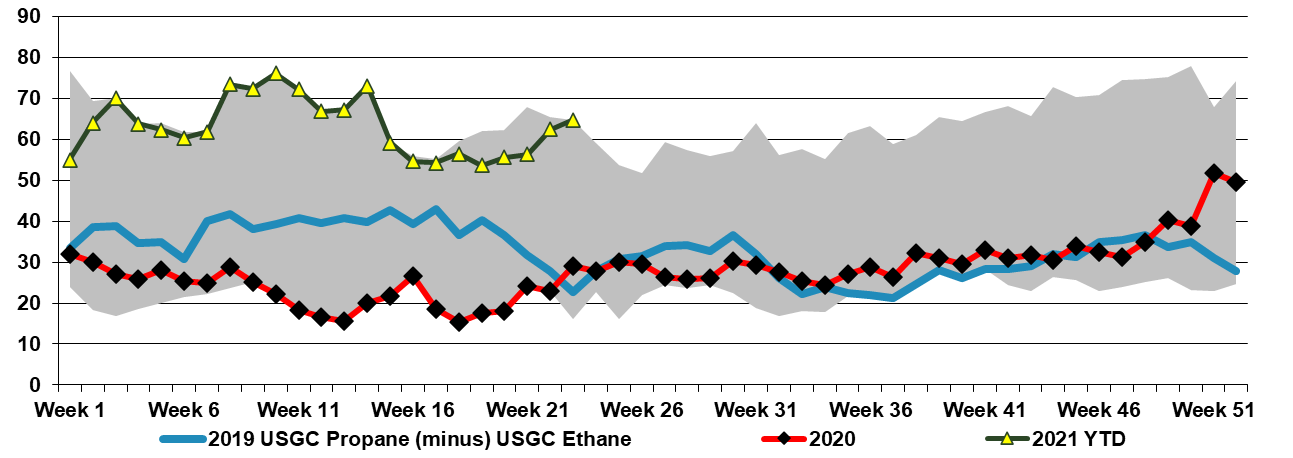

Will High Propane Prices Limit Propylene Demand Growth?

Jun 9, 2021 1:39:34 PM / by Cooley May posted in Chemicals, Recycling, Polymers, Polypropylene, Chemical Demand, Chemical Industry, propane, polystyrene, paint additives, ethane

The relative strength in US propane versus ethane is something we have talked about before, with the strong export pull on propane, pushing prices higher, despite equally strong demand for ethane in US ethylene units and for export. The projects to consume propane coming online in the next 12 months overwhelm the projects to consume ethane in our estimate and consequently, we believe that the delta (in chart below) will remain high and may widen further. On a cost basis, this could put US propylene and a distinct disadvantage to US ethylene and at the margin might help ethylene derivative demand relative to propylene derivative demand – most likely in paint additives, but also in some polymers where polypropylene can be substituted with other materials – it may provide a bit of a lifeline for polystyrene if the polystyrene recycling initiatives gain traction. See our daily report for more.

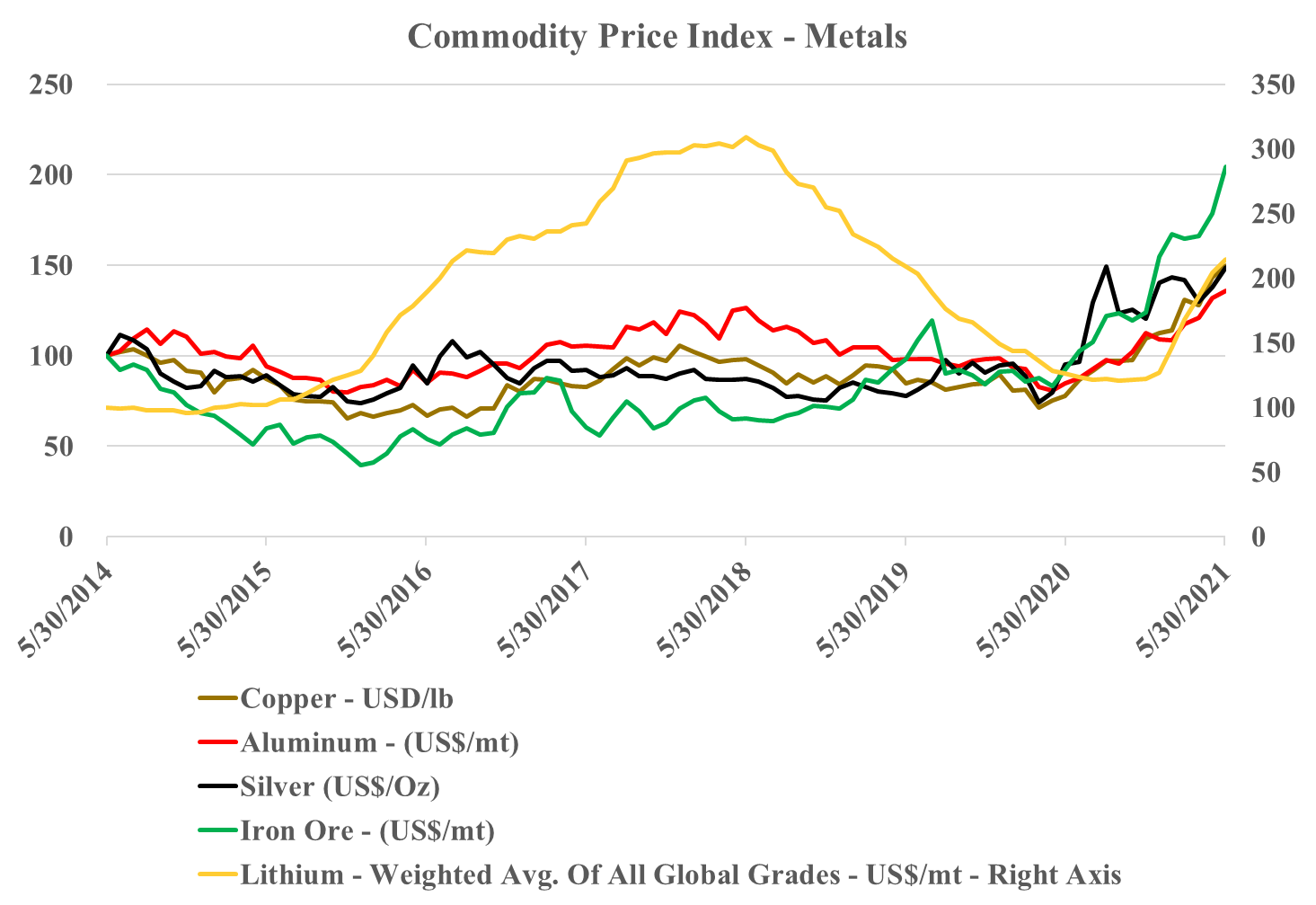

Base Chemicals May Be Weaker, But Nothing Else Is

Jun 8, 2021 12:35:56 PM / by Cooley May posted in Chemicals, Polymers, Commodities, Ethylene, Base Chemicals, intermediates, downstream, Capacity shortages, derivatives

There is an interesting difference between the base chemicals markets and some of the other broad commodities and intermediates, and we have economic growth that is testing the capacity limits for many commodities and downstream products, but the overbuild in basic chemicals, most recently in China, is putting significant downward pressure on pricing, as we highlighted in yesterday’s Weekly Report. Capacity shortages in intermediates and some specialties, which are driving the investments we highlighted in today's daily report and which are a steady flow of news this year, are leading to some expanding margins over base chemicals in select areas where capacity has not kept pace with demand.

A Very Disorderly Olefins Market: More To Come?

Jun 4, 2021 12:57:49 PM / by Cooley May posted in Propylene, Commodities, Ethylene, olefins, China, oversupply, derivative capacity

The oversupply in China for many commodities is becoming more evident daily. Our research depicts this as supply-driven, based on the surge of ethylene and propylene and derivative capacity since 3Q 2020. Notwithstanding the Dow commentary (in our daily report today), the weakness in Asia in polyethylene will ultimately impact the US, as the US relies on international demand for at least 25% of its polyethylene production – much less for polypropylene. The gyrations in the ethylene and propylene markets, as shown in the chart below, indicate the US dealing with the differences between the two monomer chains. Far more ethylene and ethylene derivatives move offshore than propylene and propylene derivatives. Despite the ongoing strength in derivatives, the ethylene market is loosening. At the same time, propylene shows extreme volatility because demand remains strong and has seen greater production issues on a relative basis, per our estimate. Supply is barely keeping up, even as refinery rates increase, because of problems with PDH units, pipelines, and splitters, which would not be meaningful in a more normalized market, but make a difference when refinery supply is constrained. High propane prices, which could move even higher, keep upward pressure because of PDH economics and because they keep propane out of ethylene units.

What Happens When The Sell-Side Runs Out Of Money - No Proactive Analysis

Jun 4, 2021 12:39:45 PM / by Graham Copley posted in Chemicals, Polyolefins, Commodities, Dow, Research, Buy-Side, Sell-Side, polymer producers, CDI, IHS, olefins

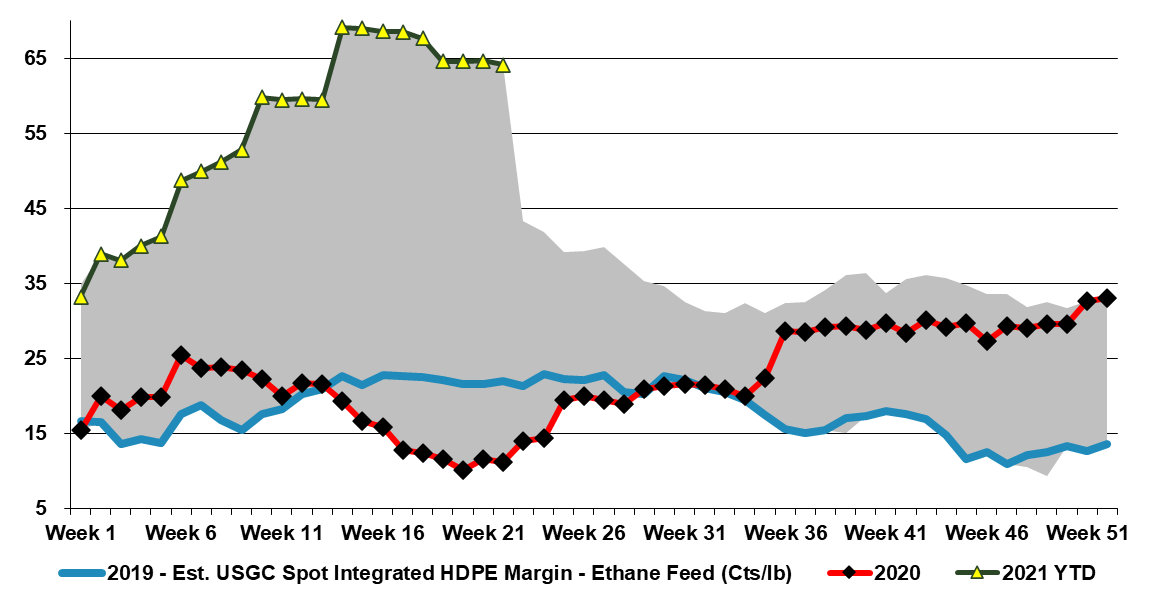

The Dow announcement yesterday speaks to a much larger issue within the investment community in our view, which is that research fees have come down so much over the last ten years that the sell-side gets paid very little for doing any real research. We talked about the upside in 2Q for the commodity polymer producers for months. Still, we know that we cannot get paid for maintaining the models needed to get to the numbers with enough confidence to publish estimates. The buy-side does not have the budget. In the past, as sell-side analysts, we would subscribe and talk to price discovery consultants, such as the predecessor companies of IHS (now in the middle of an acquisition by S&P) and CDI (in the middle of a merger with ICIS). This data and these dialogues would allow us to adjust earnings estimates during the quarter and keep up alongside our other work (e.g. corporate marketing/roadshows, etc.) as analysts. There is enough data in our weekly report – published each Monday to do this for many companies. (See an example in the chart below). Today, IHS has made its service so expensive that it is difficult for sell-side analysts to justify the cost when they are not getting paid by clients for real, fundamental research. The JP Morgan alleged base fee for research for an entire platform would not cover 25% of the IHS subscription cost for olefins and polyolefins data alone, per our estimate. Plus, all the merger activity at the data providers is causing some to question quality. The result is limited mid-quarter analysis from the sell-side and moves like Dow’s so that they can have realistic conversations with investors. In the case of Dow, it was to get the message out ahead of the Bernstein Conference.

%20(1).png?width=6000&height=6000&name=New%20C-MACC%20Logo%20-%20Final%20-%20Transparent%20(2000%20%C3%97%202000%20px)%20(1).png)