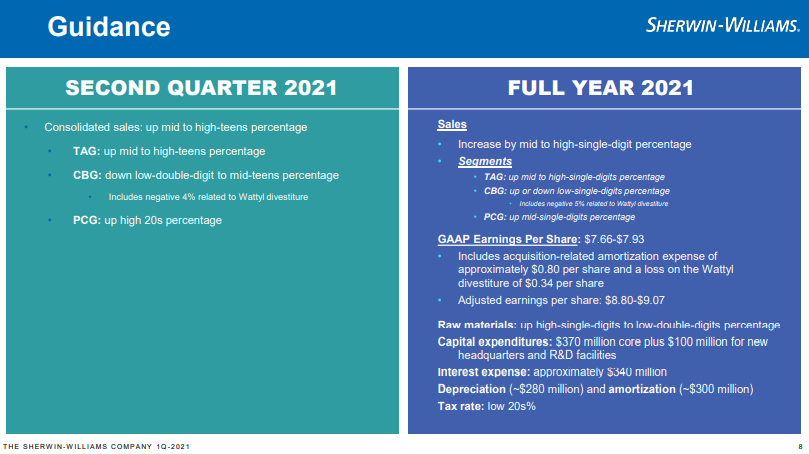

Painting By Numbers; Some Numbers Are Better Than Others

Apr 27, 2021 12:26:09 PM / by Cooley May posted in Chemicals, Paint Companies, Axalta, Sherwin-Williams

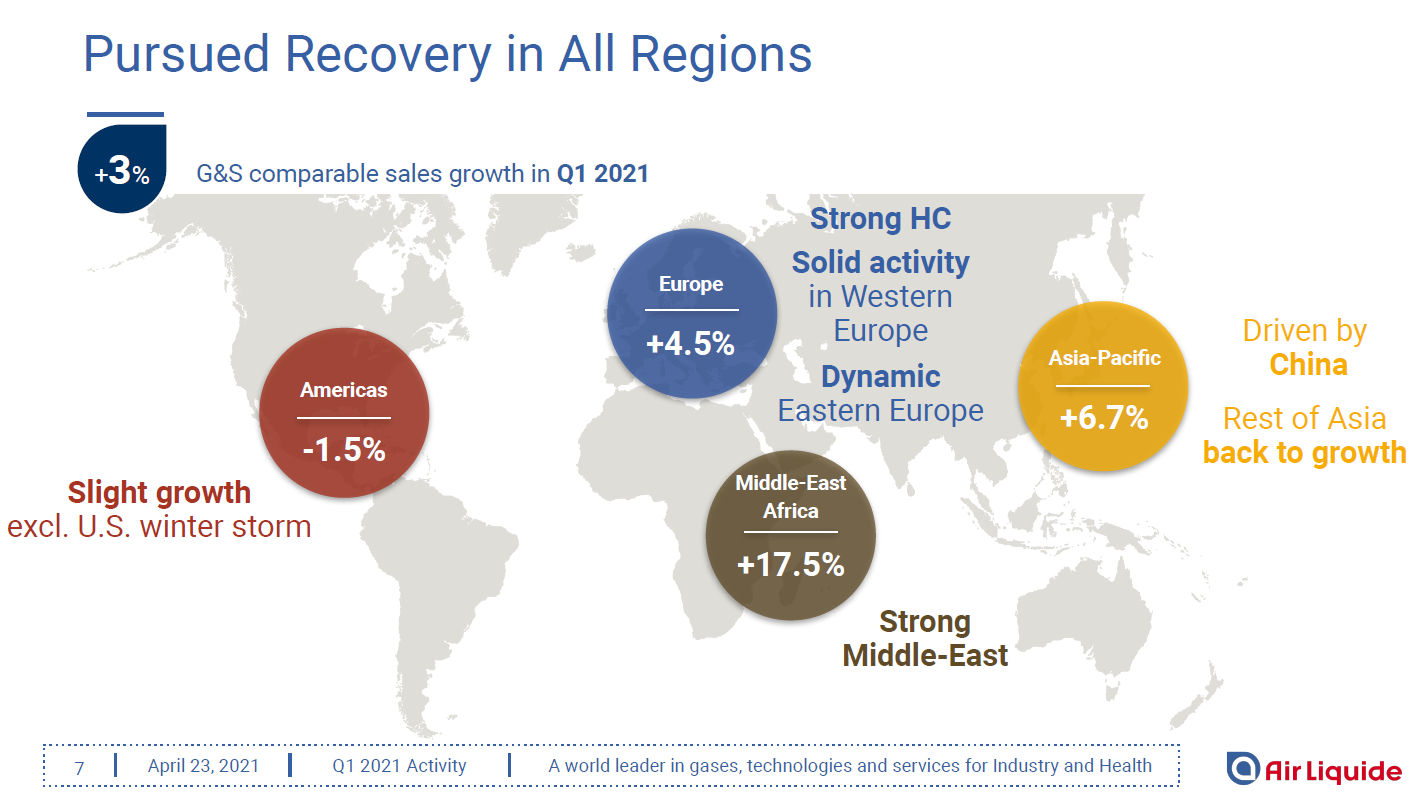

It's Not Just Basic Chemicals, Everything Is Looking Good (Focus on Air Liquide, and Celanese)

Apr 23, 2021 12:14:50 PM / by Cooley May posted in Chemicals, Green Hydrogen, PET

Earnings beats and guidance raises are likely going to be the prevalent theme of 1Q 2021, and after Dow yesterday we have Air Liquide and Celanese today. Economic activity has picked up meaningfully in those segments of the economy that are suffering supply chain problems and while some of this is likely inflated, and will calm down once we sufficient inventory in the chain, it is worth remembering that large segments of the global economy remain depressed and that there are many growth drivers potentially still to come this year.

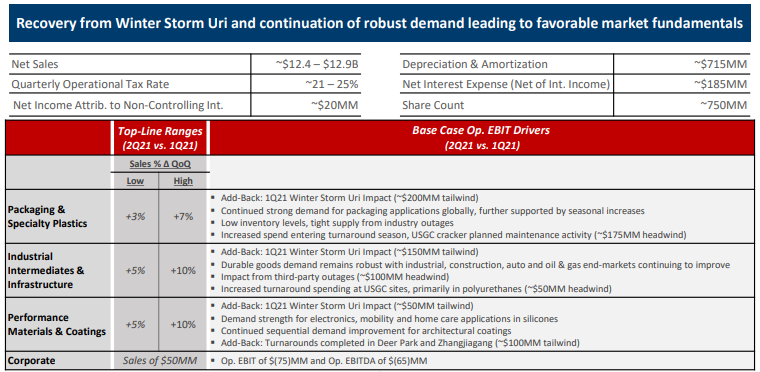

Dow; Impressive On All Fronts

Apr 22, 2021 12:03:05 PM / by Cooley May posted in Chemicals

The highlight of the day is the very strong results from Dow and the even more positive outlook. While we see risks to the supportive supply/demand balances for some products in the second half of the year, especially the 4th quarter, there is no denying that all of the lights on the road ahead currently look green and we certainly would not criticize Dow for the outlook, even if it must rank as one of the most positive that we have seen (see table below), maybe the most credible positive outlook from any company in our careers (we have seen plenty over the years that have been complete nonsense). Dow is very well placed with its products portfolio to exploit both the current shortages and the expected post-COVID growth and it is important to note that the 1Q results were delivered in a quarter where there were still many COVID-driven demand constraints. We would stick by the advice that we gave earlier in the week, which is to keep the capital powder dry – and Dow seems to be doing this – reducing liabilities and not committing to share buyback beyond preventing dilution.

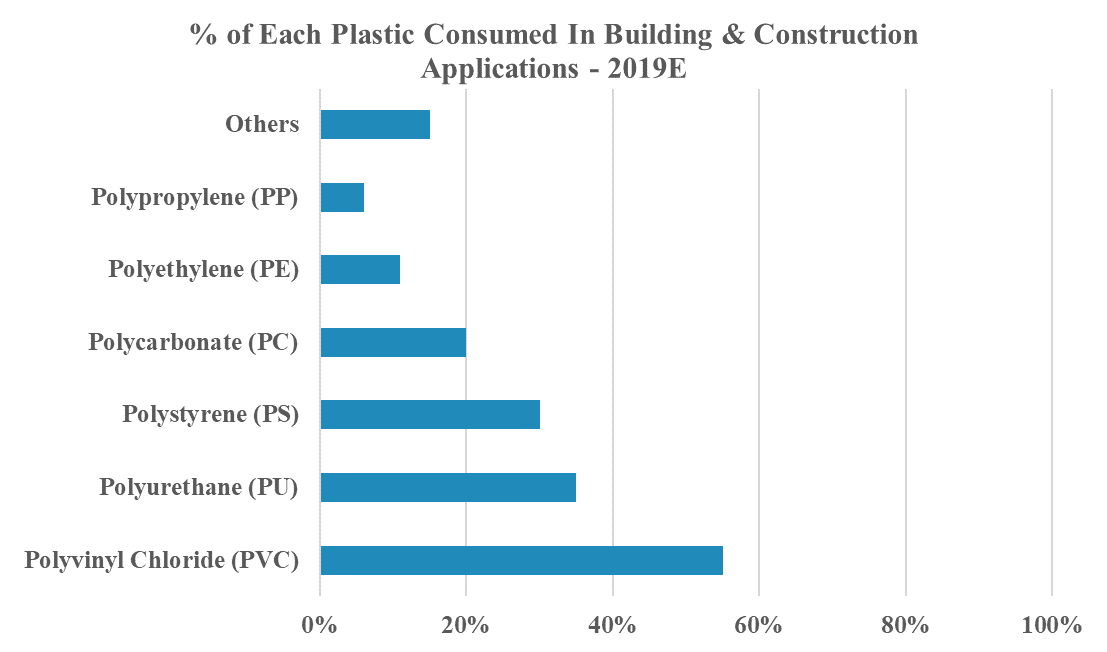

Strong Building Products Demand; Good For PVC

Apr 21, 2021 12:39:13 PM / by Cooley May posted in Chemicals, PVC

Building products demand remains very strong in the US, but the elevated lumber and PVC prices which appear impressively correlated right now are partly a function of supply chain issues. The housing market remains robust, but the winter storm in the South did damage to plants rather than structures – as opposed to Hurricane Harvey, which had a huge impact on building products. Because the housing market is strong, we are likely seeing speculators accelerate refurbishments to move properties faster, while demand lasts (anecdotally, the speculative renovation pace has picked up dramatically in Houston, where the housing market has bounced back quickly). But supply constraints likely are more of the driver – a random trip to Lowes yesterday found many of the shelves very light or empty in the building materials sections. As the chart below shows, building and construction is more than 50% of PVC demand.

Chemical Companies Should Hold On To Their Cash Until The Dust Settles

Apr 20, 2021 12:45:19 PM / by Cooley May posted in Chemicals

The AkzoNobel comment today on completing its share buyback is a reminder that the chemical industry, in general, is reporting earnings that for the most part include record or near-record profits today and very strong momentum into 2Q 2021. They should all be prepared to answer the question of what they plan to do with the cash. The temptation is to build because prices are high and in some cases, customers are short of product and pleading for more supply. We often talk about the economics of NOW being used to justify spending far more than it should be – not just in Chemicals but also in other industries. In some areas, we are genuinely short of materials and semiconductors are a clear example of where underlying global demand has caught up with supply. Materials suppliers into this space are likely to see new capacity well utilized. For many of the other chemical segments, there is too much near-term noise to say with any certainty what is structural versus an immediate shortage. COVID, weather, a blocked canal, and unusual patterns of consumer spending have all played a part in inflating demand relative to supply, and we could be looking at a very different dynamic in 6 months.

US and European Benzene Prices Normalize as Expected

Apr 16, 2021 4:54:05 PM / by Cooley May posted in Chemicals, Polymers, Ethylene, Benzene

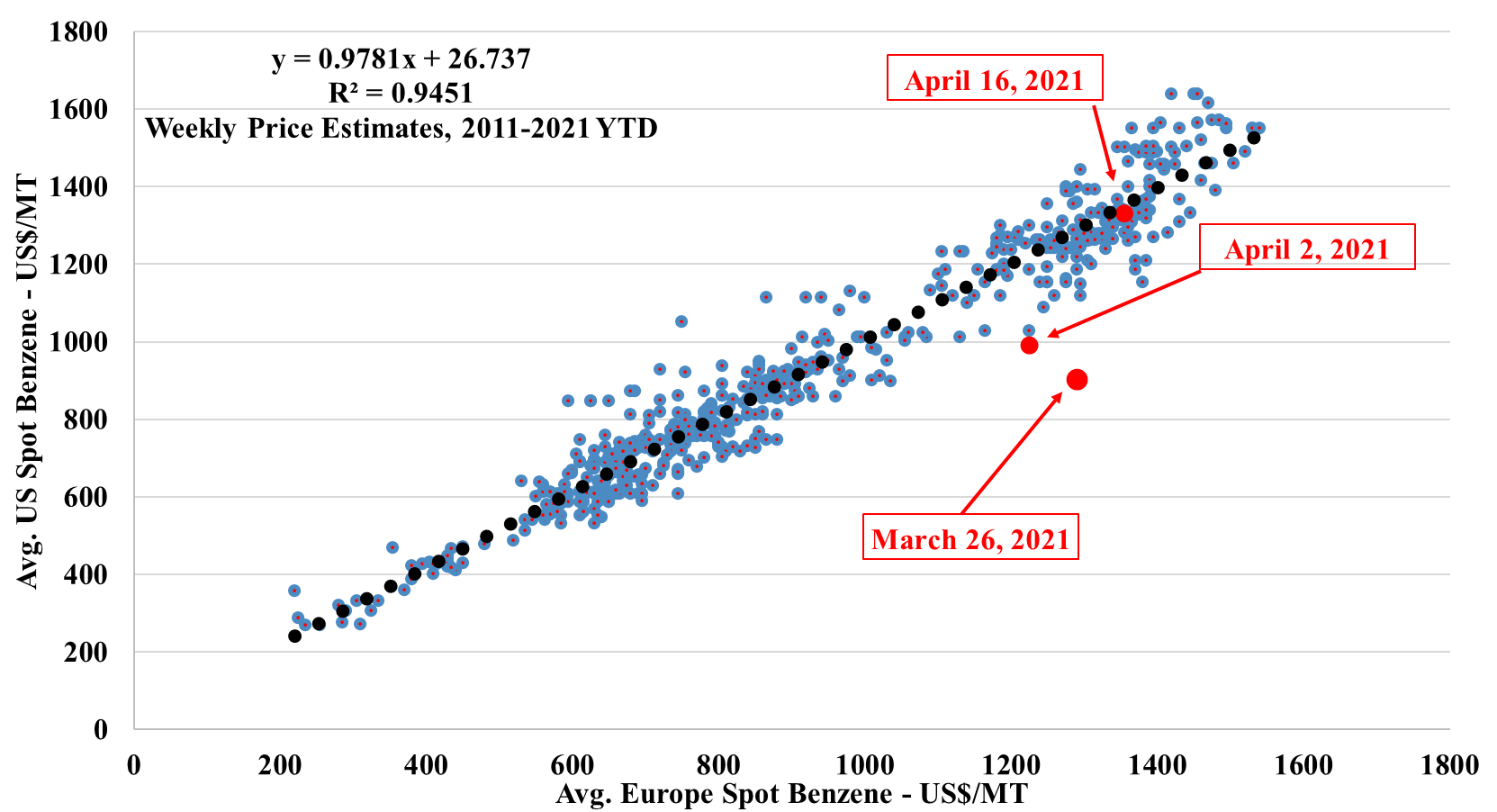

So, if you had been able to play the obvious arbitrage in the exhibit below when we published it first in March, you would have done quite well. You would have done better if you had just bought benzene on both continents, but you would have taken more risk. We like these scatter charts and we will use them more often when there are obvious regional arbitrages or just product arbitrages within a region. The overall benzene tightness has been caused by production outages in the US, shipping issues to Europe, and very strong demand for benzene derivatives. The start-up of the Shell POSM unit in the Netherlands has likely added to the imbalance as the facility is a major ethylbenzene consumer.

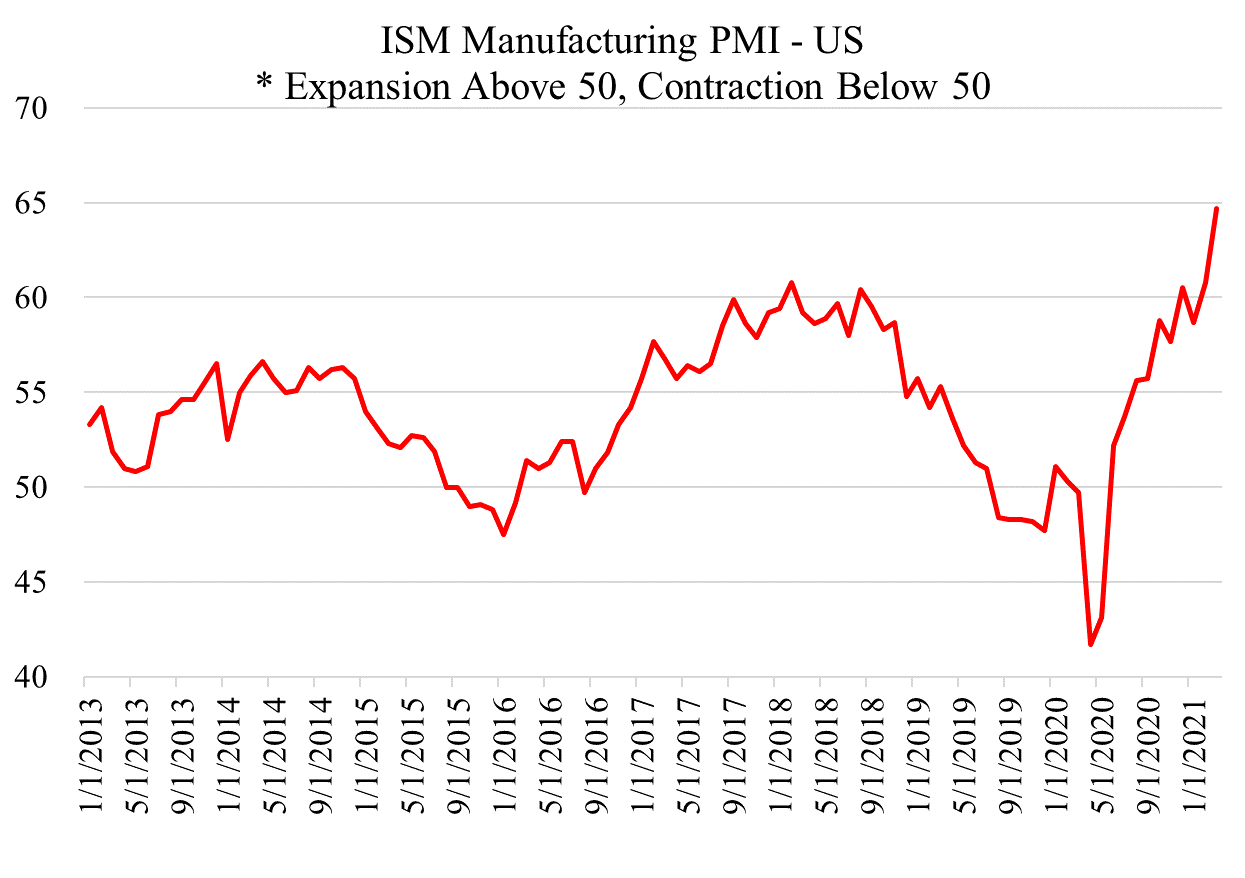

As the Exhibit below shows, the US manufacturing industry is on fire, driven by strong domestic demand and all of the logistic and social issues associated with importing. There is both a consumer and a big box retailer desire to buy “American” and it helps to explain why we are seeing such significant raw material shortages in the US. The China export headline linked is also probably correct as it applies to shipments to the US and to Europe, where the higher costs of freight are adding cost pressure and making the “buy locally” decision easier. For the chemical industry, this is more US domestic demand versus exports for most products, which is a net positive. For Europe, it will likely be more net chemical and polymer imports, which will be good for EU producers as prices will be higher and good for US exporters as Europe is close and has higher pricing.

Strong Chemical Production Growth to Start the Year

Apr 14, 2021 12:33:21 PM / by Cooley May posted in Chemicals

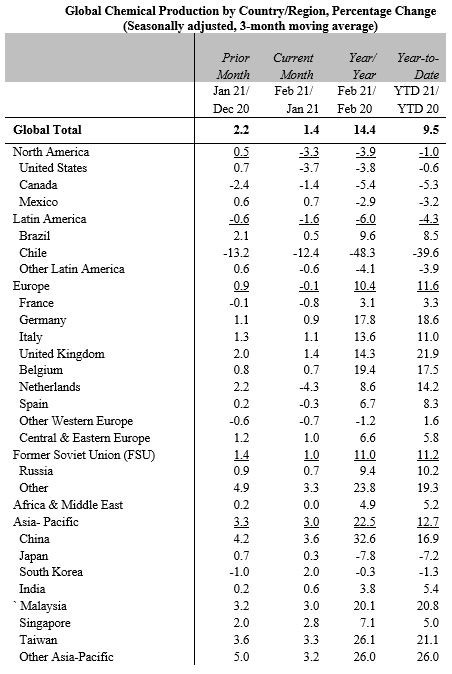

We are seeing some very strong global production growth in the ACC statistics for February – see table below – both on a year-on-year basis and month-on-month. As we look at China and parts of Europe we should remember that the year-on-year comps are easy as the COVID-related shutdowns were in full swing in February 2020 in China and beginning in Europe. But the month-on-month data is as strong for China as it was for January and it reflects both the wave of new chemical capacity and strong domestic demand, both for domestic consumption of durable and consumables and exports of durables – which continue to keep freight rates high (see above) and ports at capacity (see the last section below). February global numbers have been held back by the Texas freeze issues and this helps to explain the step down in plastic resin growth in particular in February, despite the new capacity in China and some new capacity in the US. The lower production growth relative to underlying demand, especially in the US, helps to explain why pricing has been so high.

The Case for Trouble Ahead in Plastics

Apr 13, 2021 1:01:01 PM / by Cooley May posted in Chemicals, Polymers, Plastics

About a year ago we wrote a piece highlighting the longer-term risks to plastics supply and demand because of oil company interest in chasing a market that they perceived to be growing faster than other oil products markets, and potentially running headlong into a plastic market that was either seeing slower growth because of concerns around plastic waste and sustainability or was declining.

A year of COVID-related uncertainty put some of the projects on hold, but as we move through 2021 we have a couple of factors driving the plastic bet again. First, demand for plastics is very high and pricing is “off the charts”, suggesting that converting oil to plastics could be profitable as well as a home for some of the oil. Second, with the climate agenda now front and center in every economy and more discussions around electric vehicles, hydrogen, and biofuels, the future for oil demand is looking incrementally bleaker. The economics of NOW thesis would support large-scale investment in oil to chemicals – either directly – or through refining to more common feedstocks. But…

Propylene and Ethylene Together Again but Not for Long

Apr 9, 2021 1:22:06 PM / by Cooley May posted in Chemicals, Propylene, Ethylene

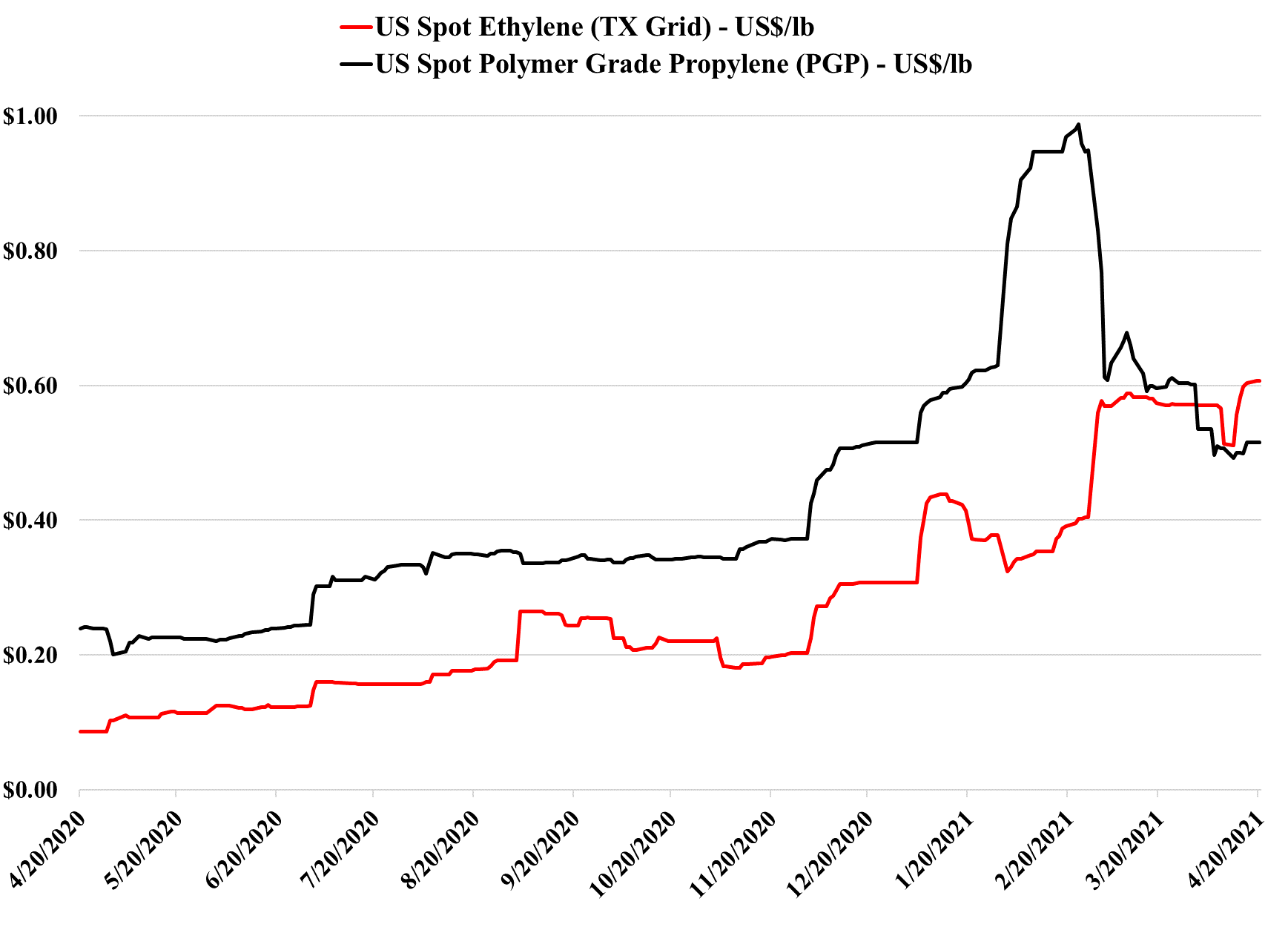

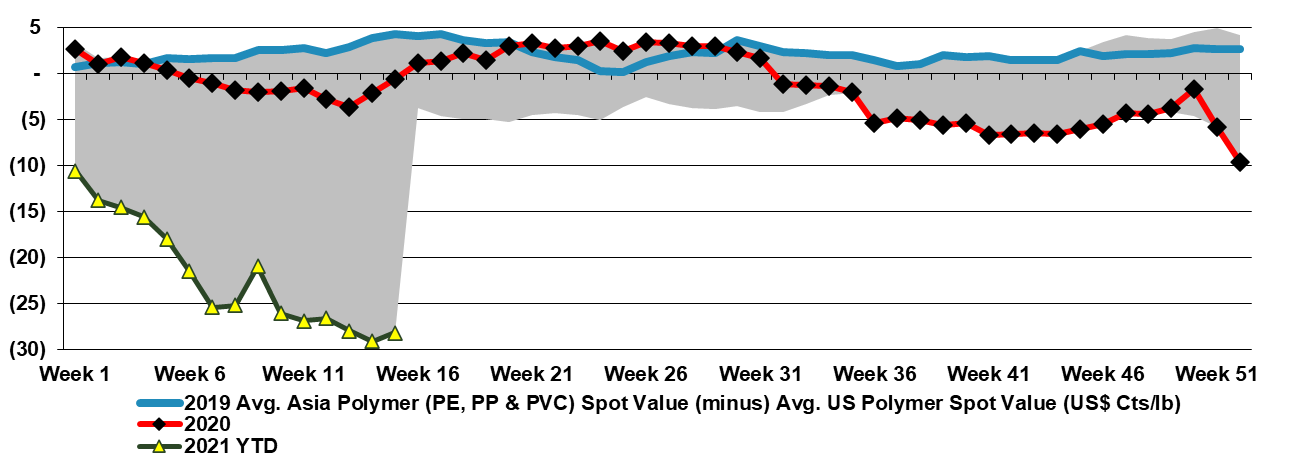

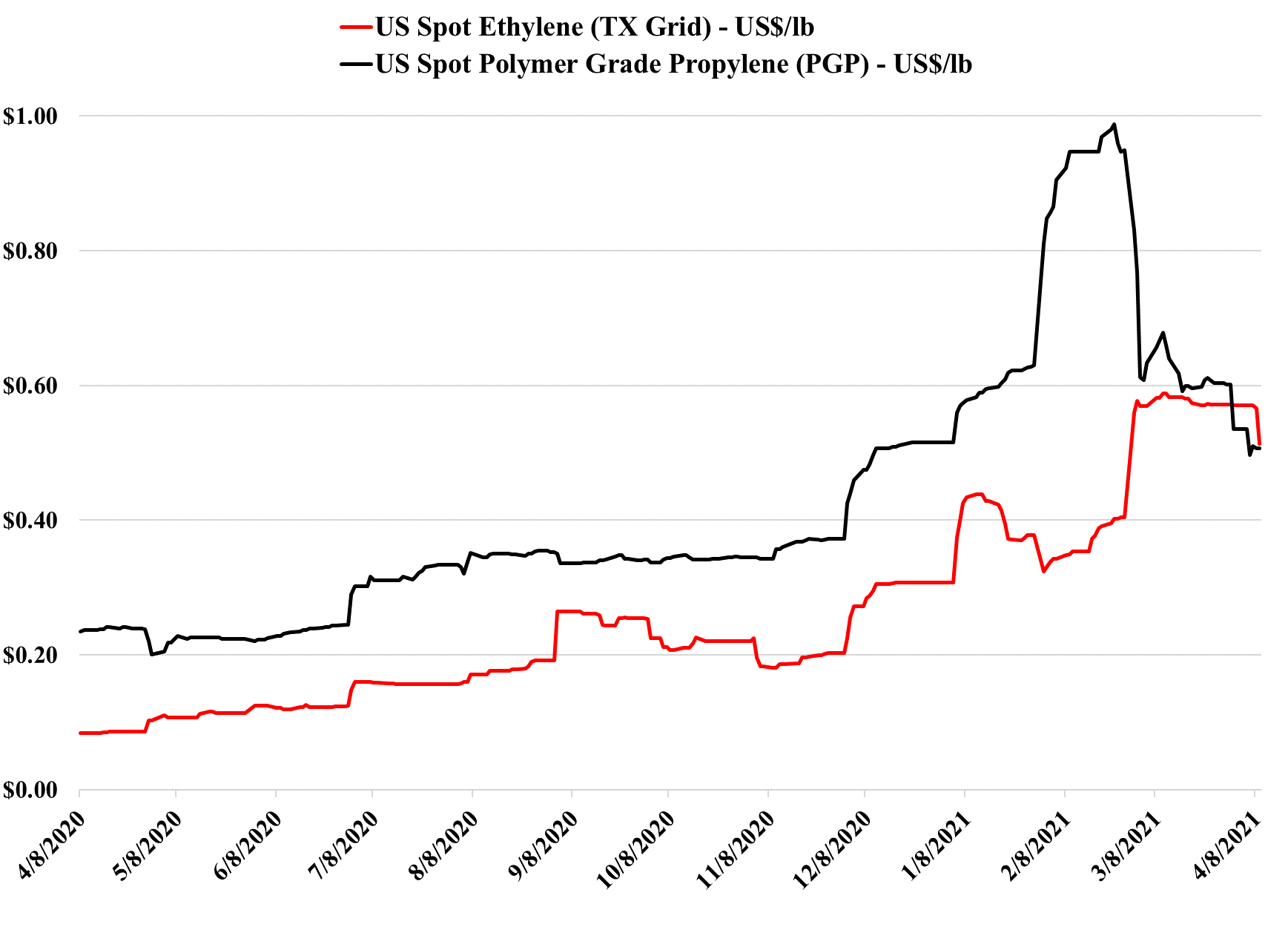

The price dynamic discussed in today's report and shown in the exhibit below looks unusual in a recent historic context and is unlikely to last very long, but it is worth noting that the recent history does not reflect the longer-term history.

%20(1).png?width=6000&height=6000&name=New%20C-MACC%20Logo%20-%20Final%20-%20Transparent%20(2000%20%C3%97%202000%20px)%20(1).png)