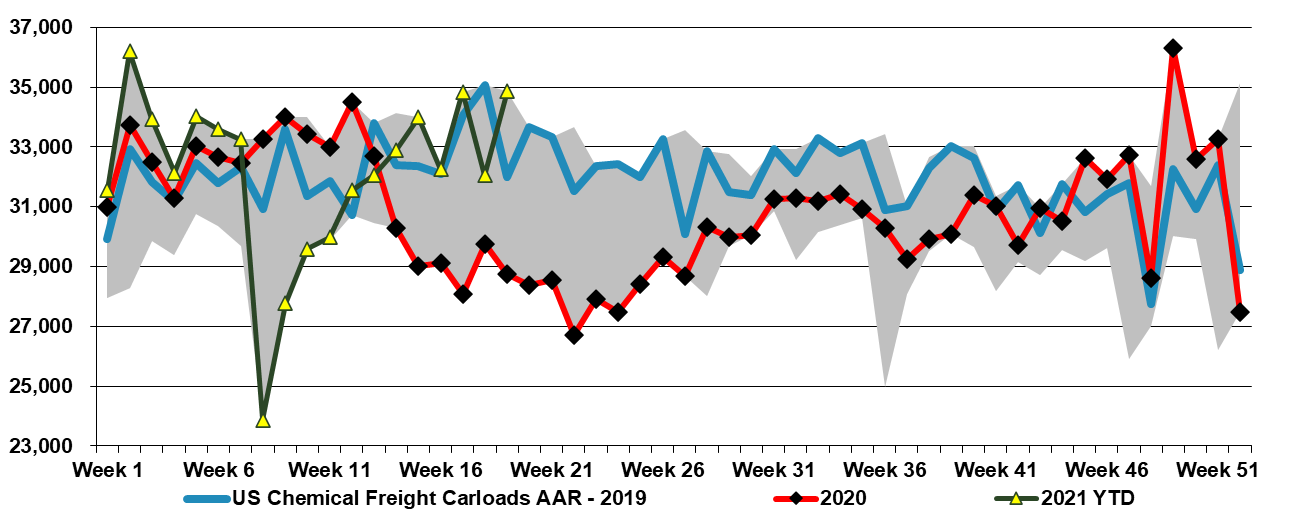

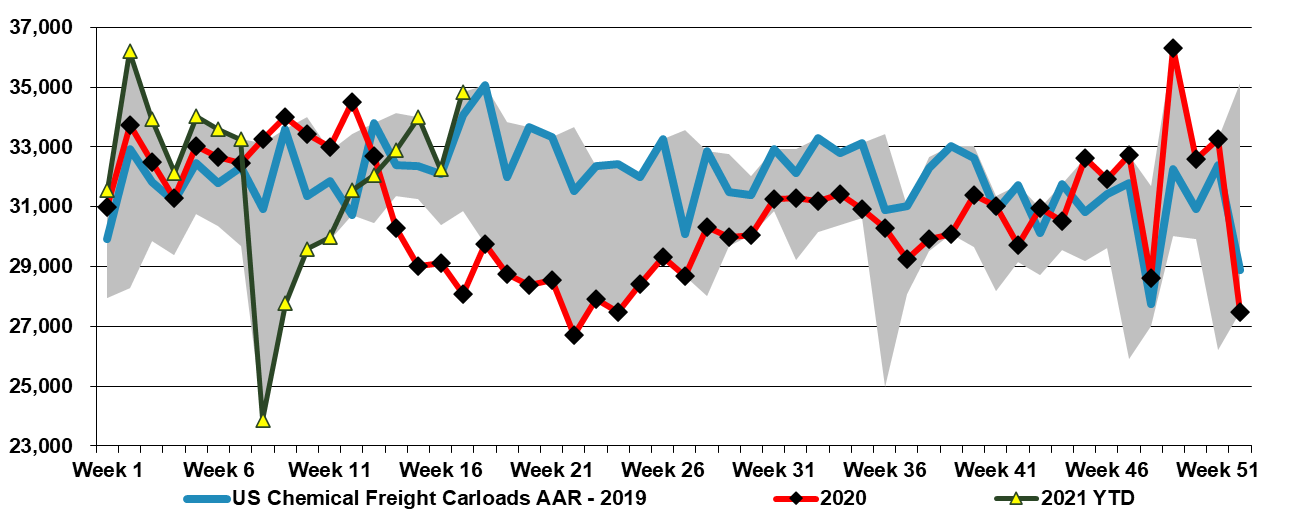

The concerns about supply chain inflation hurting chemical demand are likely very end-use specific. While the packagers and consumer goods sellers are seeing significant inflation in all raw materials, not just polymers, the packaging is a minor component of the cost and value of what they are selling and while it may hurt their earnings, it is unlikely to stifle demand – none of us is likely to stop buying milk, orange juice or cookies if the prices rise a couple of cents because the manufacturers are trying to cover some of their higher costs.

Despite Concerns, Inflation May Not Slow Chemical Demand Materially

May 13, 2021 1:50:33 PM / by Cooley May posted in Polymers, Raw Materials, raw materials inflation, Inflation, Chemical Demand, containerboard, packaging, durables, railcar shipments

There May Be Limited Interest In Surplus US Ethylene

May 12, 2021 1:35:57 PM / by Cooley May posted in Propylene, Ethylene, Benzene, Ethylene Price, Sasol

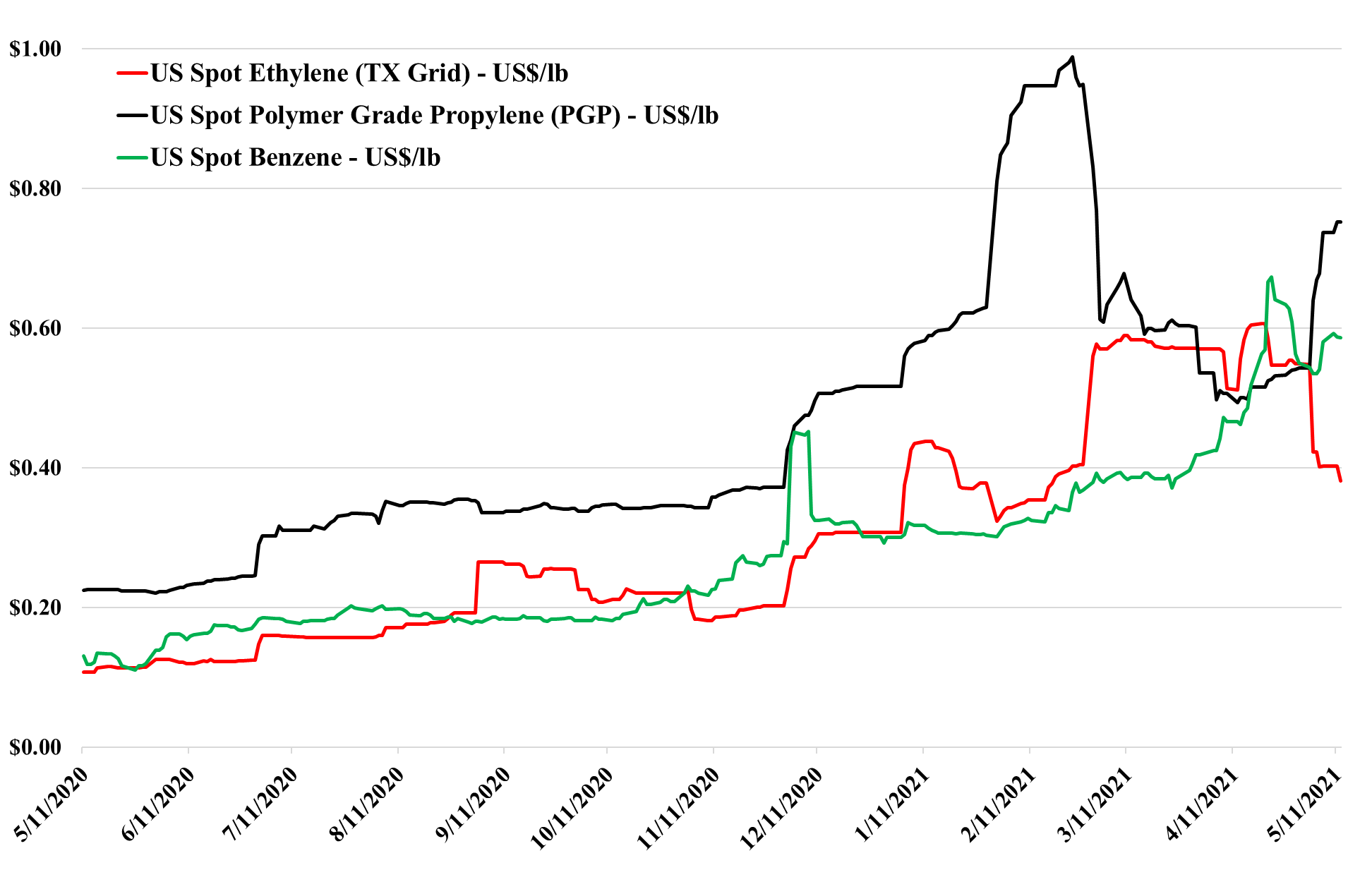

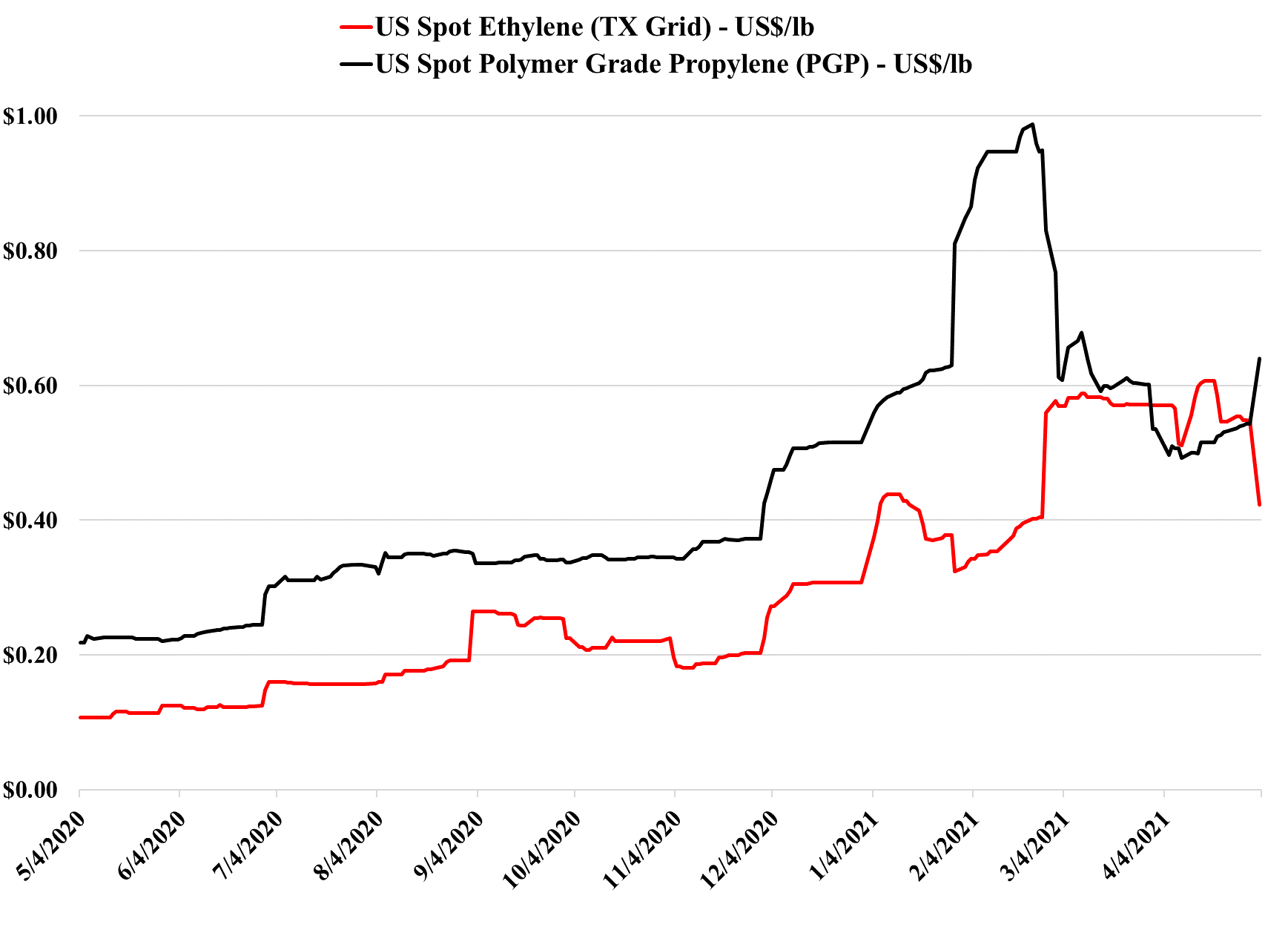

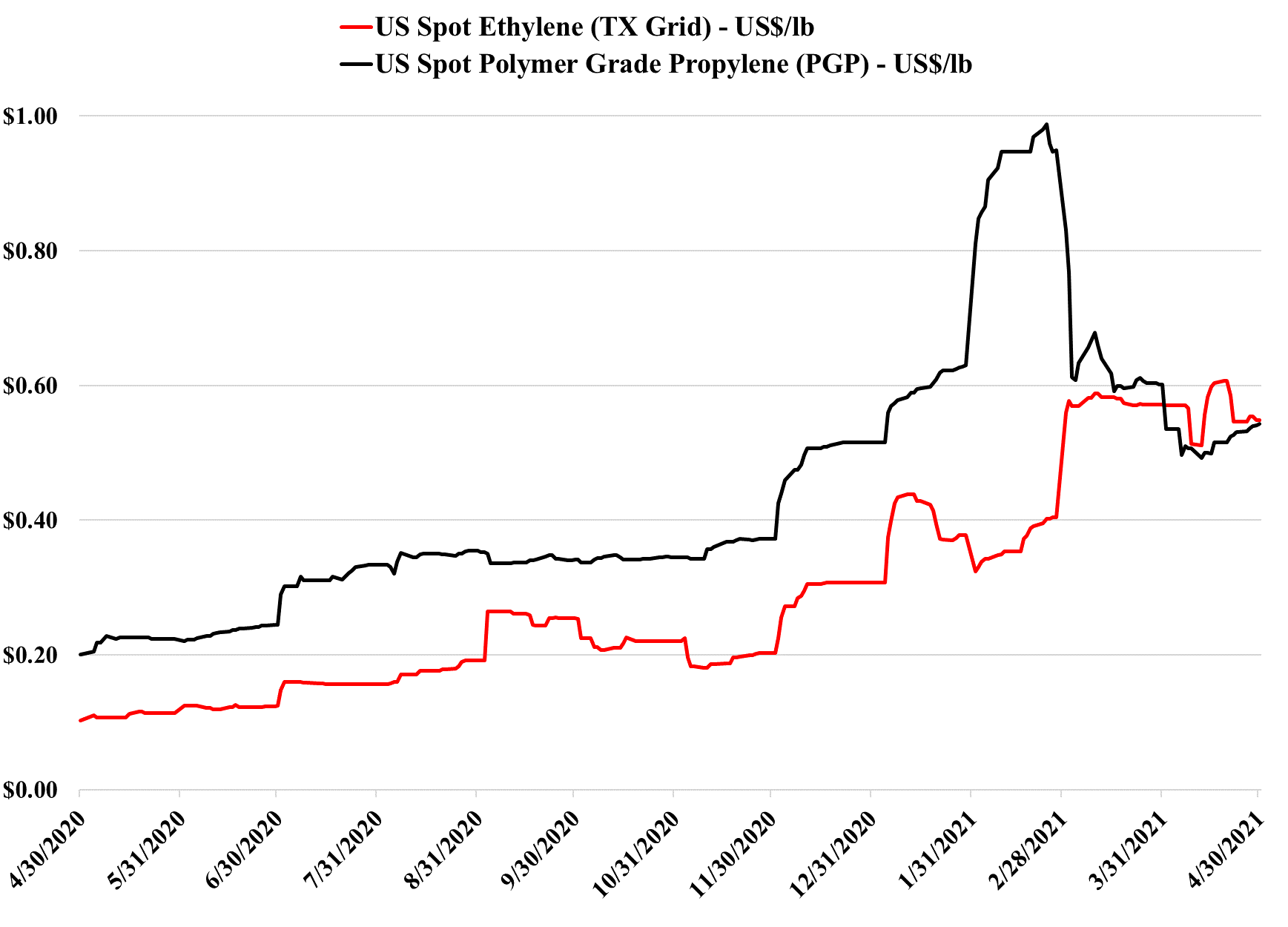

As we highlighted in yesterday's report, ethylene continues to weaken (see chart below) in the US and it is the one product with a true supply/demand-driven problem today – there is simply more capacity to produce ethylene in the US than there is the capacity to consume it. This is a recent phenomenon and has been clouded by the various storm-related outages, the delay in the Sasol start-up. We began to see the length in the ethylene market lats last year and physical export volumes jumped dramatically – fully loading the terminal in Houston for loadings from November through January. This was based on pricing from October through December that created a significant arbitrage to ship to Asia – partly because a few of the China integrated projects had ethylene derivative projects complete before ethylene units were complete. The risk for US ethylene is that it could go much lower – barring outages – as there is no one left in the US who can take a marginal ton, most likely, and China seems well supplied. For more details please see today's daily.

US Ethylene Still Not Cheap Enough To Export, But Likely To Get There

May 11, 2021 11:45:06 AM / by Cooley May posted in Chemicals, Propylene, Ethylene, Ethylene Price

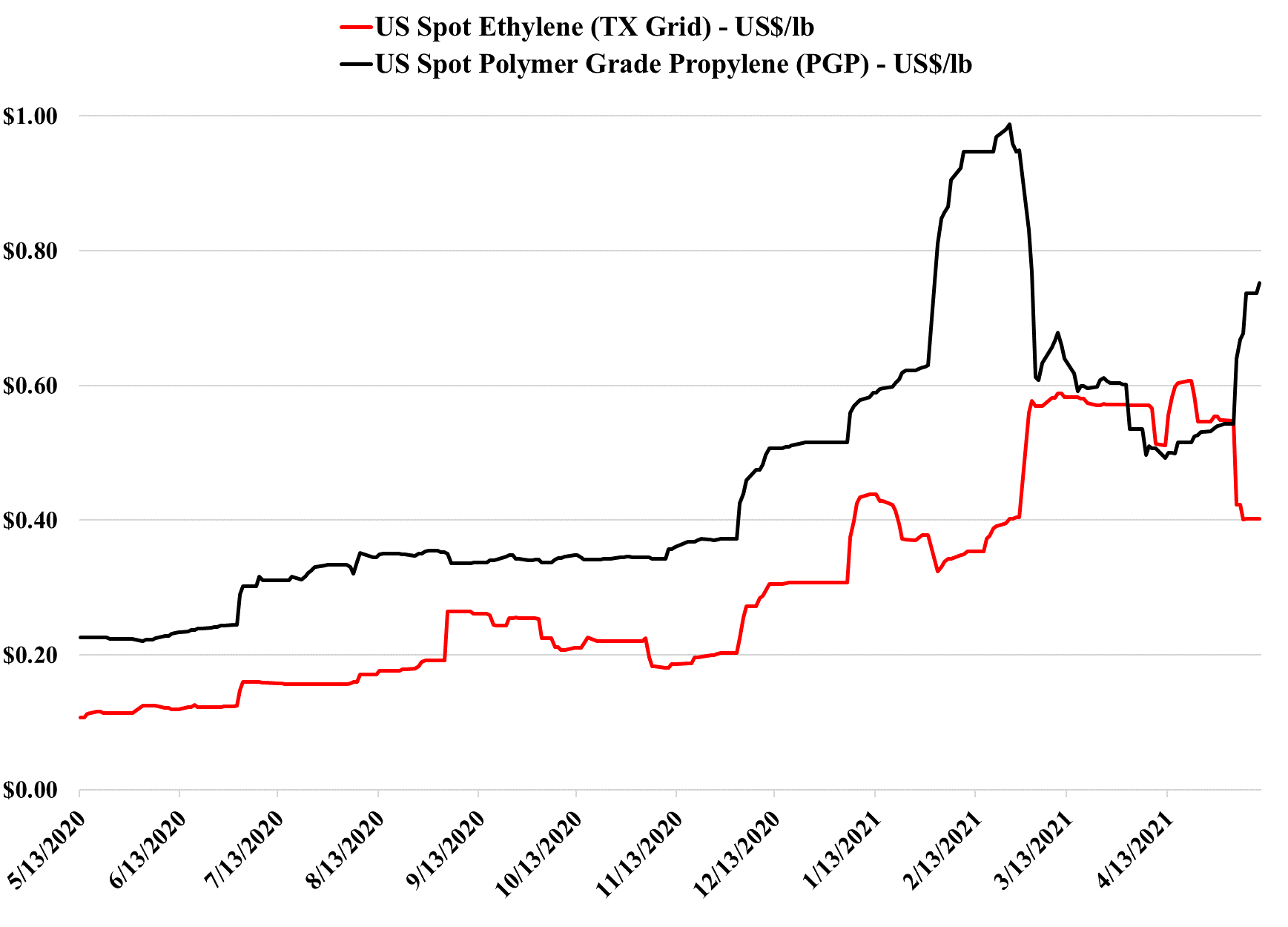

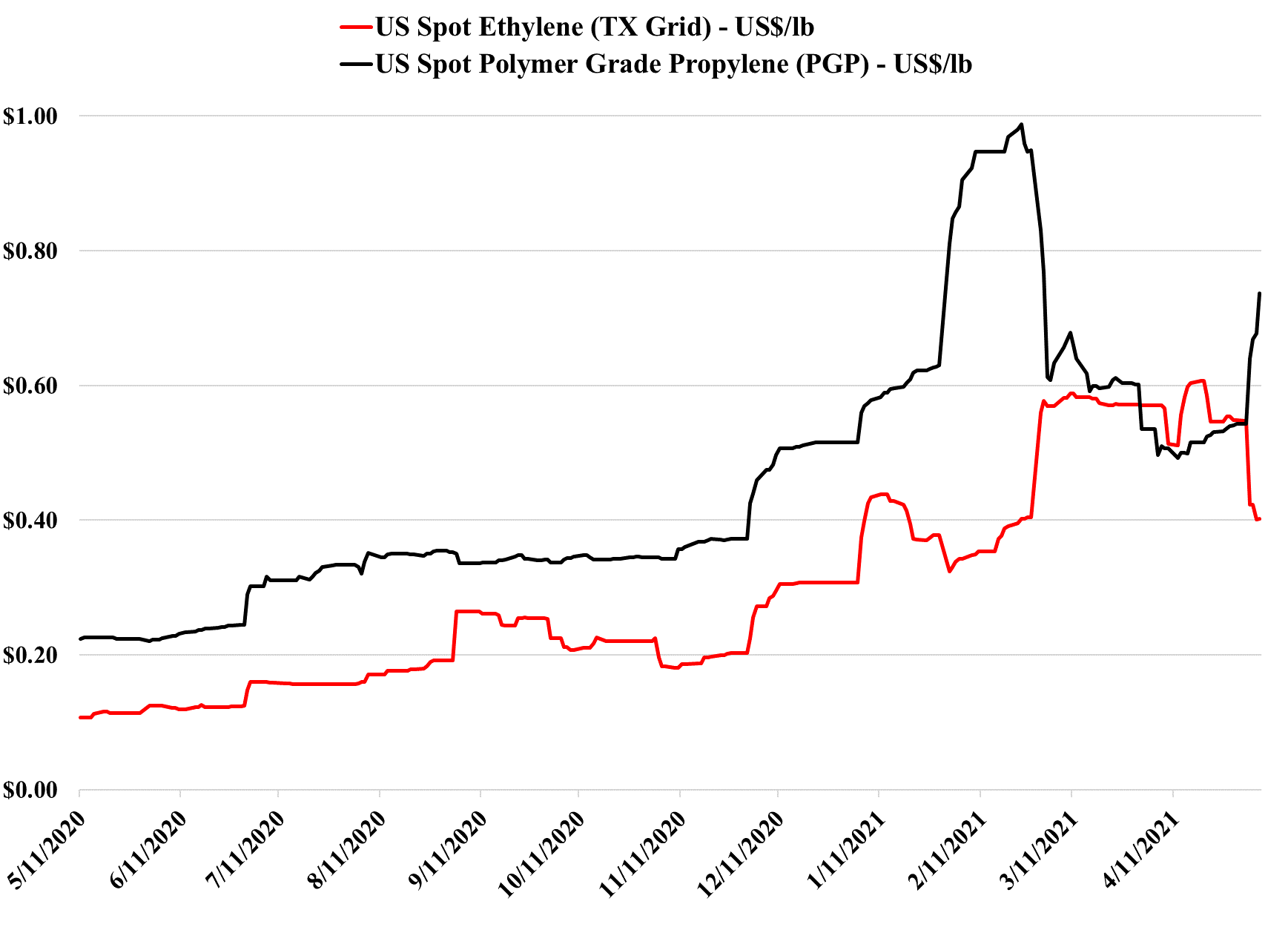

The relative moves in ethylene and propylene prices are not surprising given the news flow – propylene is likely being influenced by concerns around refinery cutbacks again – this time because of the colonial pipeline issues, while ethylene should continue to see downward pressure as the US oversupply emerges from all of the recent production difficulties. See our Daily Report for more.

Monomer Price Volatility Will Linger

May 7, 2021 1:25:37 PM / by Cooley May posted in Chemicals, Propylene, Monomer

The volatility in propylene was something we predicted months ago – there are simply too many moving parts in the market today to predict incremental supply/demand dynamics. We remain of the view that refining rates will improve further over the coming months to address the increasing demand for gasoline and this could swing propylene back in the other direction. See today's report for more on this.

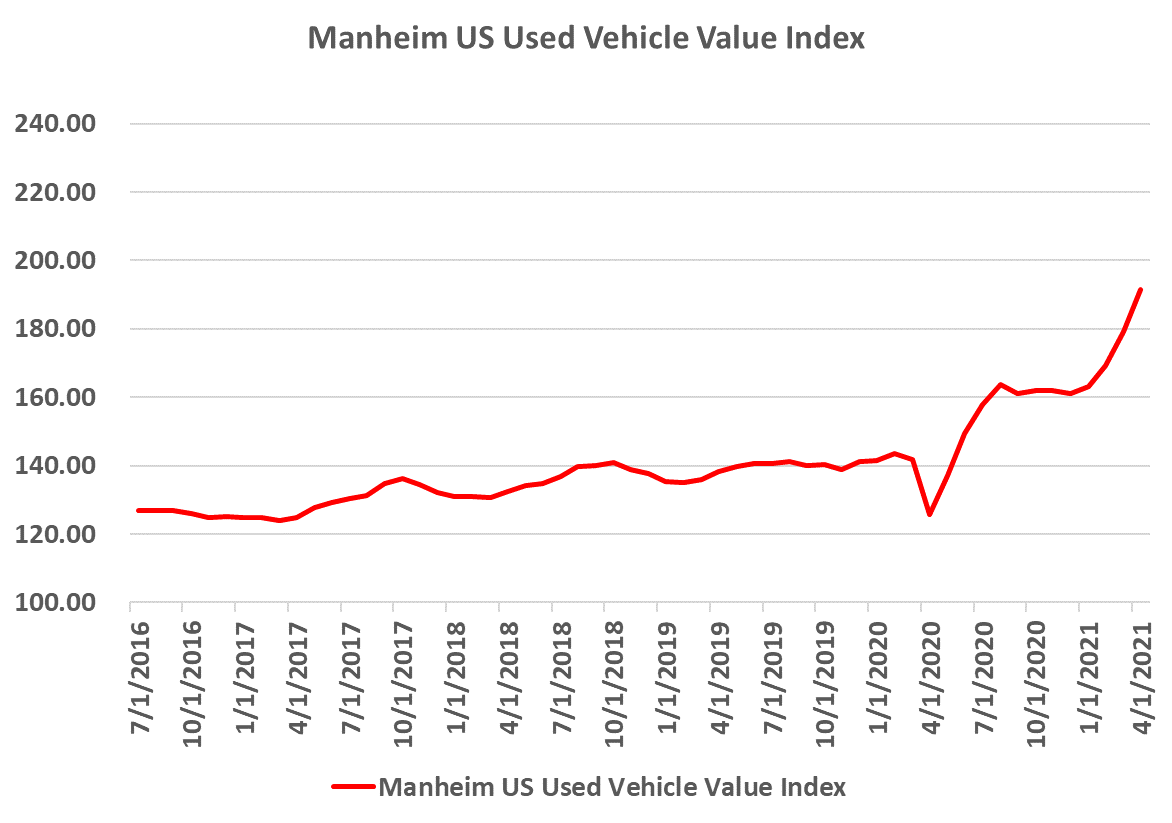

Auto-Mania Driving Vehicle & Materials Prices Higher And Likely Creating A Bubble

May 6, 2021 1:42:25 PM / by Cooley May posted in Materials Inflation, Auto Industry

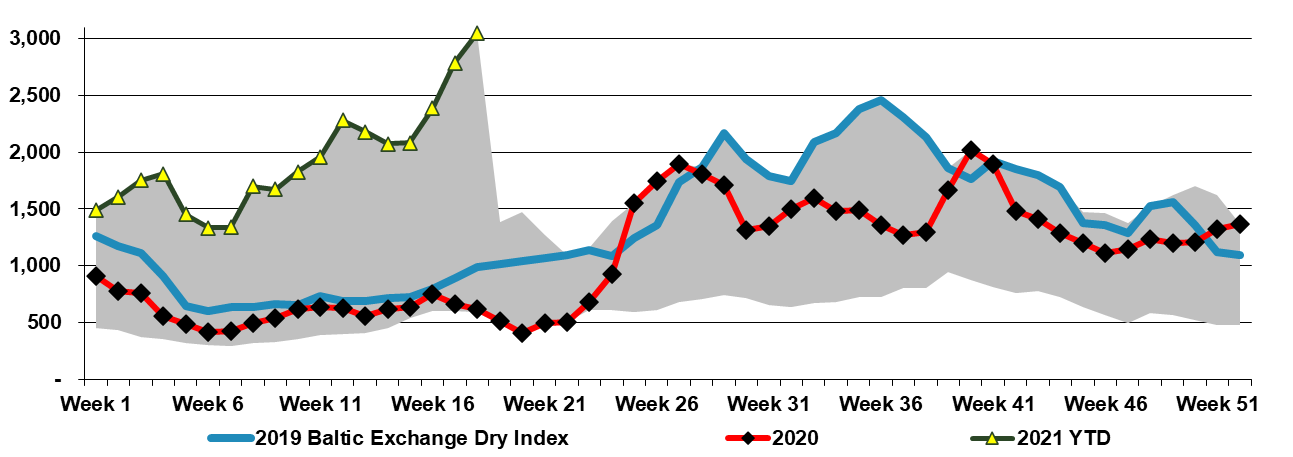

Much Of The Current Materials Inflation Is Likely Not Cyclical

May 5, 2021 12:19:24 PM / by Cooley May posted in Chemicals, Materials Inflation, Shipping Market

The headlines that are of most interest to us this week are the ones that continue the narrative of very strong demand, as they continue to point to materials inflation. While the auto producers have some raw material price protection in their contracts, the very strong results for 1Q 2021 suggest that they are not having to compromise much on pricing, as the demand is there, interest rates are low and consumer spending power is higher because of a year of incrementally adding to savings.

Surplus Ethylene In The US? What's Next?

May 4, 2021 1:45:11 PM / by Cooley May posted in Chemicals, Polyethylene, Ethylene

The movement down in ethylene in the exhibit below is significant, as it begins to show the overhang that the US has with ethylene supply. The price has to fall further before ethylene is likely to find any interested spot buyers outside the US (note that the US exported significant volumes of ethylene from November through January). The more important question is whether the weaker ethylene price starts to undermine derivative prices, especially polyethylene. We believe that will happen either late this quarter or early next, but only when US polymer buyers are satisfied that they have adequate inventory to meet what has been surprisingly strong demand. For more on this see our daily report.

2Q-2021 Likely To Be The Polymer Profits Peak, Weather Permitting

Apr 30, 2021 1:54:54 PM / by Cooley May posted in Chemicals, Polymers, Propylene, PVC, Polyethylene, Polypropylene, Ethylene, Styrene, PET, PTA, Acetic Acid, Polyurethane, Glycol

We still believe that there is a good chance that 2Q 2021 is the peak for polymer profits in the US and Europe, but it very unclear how severe the downside could be, given the growth potential. Seasonal turnaround will keep markets more balanced in 2Q, and the major uncertainty beyond that will be weather in the US. A series of storms like last year could hold the market up through 3Q and into 4Q, but an absence of any weather events could expose US surpluses quite quickly, especially for ethylene and derivatives. The new builds in China have focused on ethylene and polyethylene (and some glycol), propylene and polypropylene, and PTA and PET, and this is where the potential weakness will emerge. There has been some new styrene capacity and that is also a vulnerable segment in our view. PVC, acetic acid, and large parts of the polyurethane chains look much more balanced to us and we have more faith in the projections being made by companies like Celanese, Olin, and Orbia than we do the major polyethylene producers. See today's daily report for more details.

Is This The Start Of the Breakdown?

Apr 29, 2021 1:35:48 PM / by Cooley May posted in Chemicals, Polyolefins, Ethylene

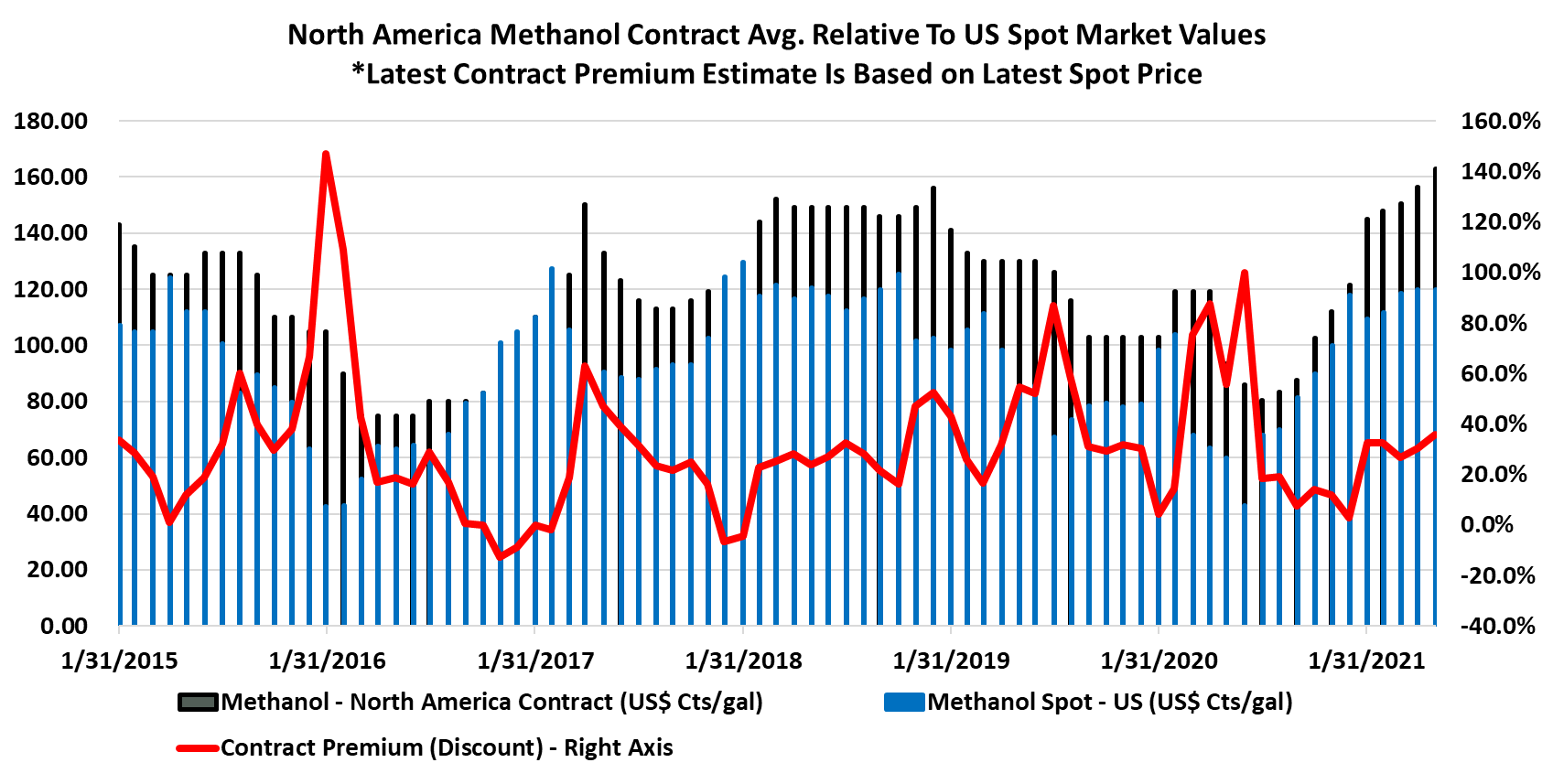

Methanol: The Economics Of NOW Suggest New Capacity Is Likely Under Discussion

Apr 28, 2021 11:28:12 AM / by Cooley May posted in Chemicals, Methanol

This latest data point in the exhibit below highlights the May contract nomination from Methanex relative to the current spot price and compares it to the history of both and the implied contract premium. Based on a historic look at the contract premium, the May producer push for price hikes does not appear aggressive. For more coverage on methanol and multiple other relevant and timely topics see our daily report.

%20(1).png?width=6000&height=6000&name=New%20C-MACC%20Logo%20-%20Final%20-%20Transparent%20(2000%20%C3%97%202000%20px)%20(1).png)