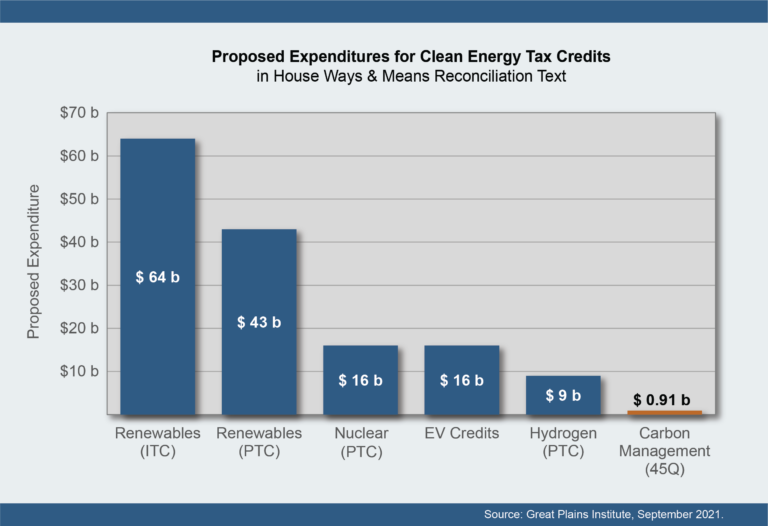

The tax credits suggested for 45Q in the budget reconciliation plan – see Exhibit below – would pay for roughly 18 million tons of CO2 sequestered or used in EOR over the life of the budget, assuming a credit value of $50 per ton of carbon. While this may seem huge in the context of the current levels of CCS in the US, the country had around 2.5 billion tons of emissions in 2019 that could be addressed with CCS (power and industrials), and if we assume 10% of that needs to be dealt with through CCS, the 45Q provisions in the budget reconciliation would cover less than 8% of the volume for one year and the percentage will be even lower if the “CATCH” act is successful in driving the 45Q value to $85 per ton of CO2. So the numbers are either inadequate, or the government is assuming that the levels of CCS in the US will be much lower than the potential – note that the ExxonMobil proposal for a hub in and around Texas talked about the maximum size for the one project being as much as 100 million tons per annum which should equate to $5 billion of tax credits – per annum. See our ESG & Climate report for much more on carbon markets today.

CCS: US Government Funding Expectations Seem Very Low

Sep 15, 2021 12:15:49 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, CCS, CO2, ExxonMobil, carbon credit, carbon value, 45Q

Big Oil Will Struggle To Get Investor Attention With Small ESG Moves

Sep 14, 2021 1:16:08 PM / by Graham Copley posted in ESG, Green Hydrogen, CCS, ESG Investing, ExxonMobil, Gevo, Oil, ESG investment, Chevron, Mitsubishi Power, Engine No1

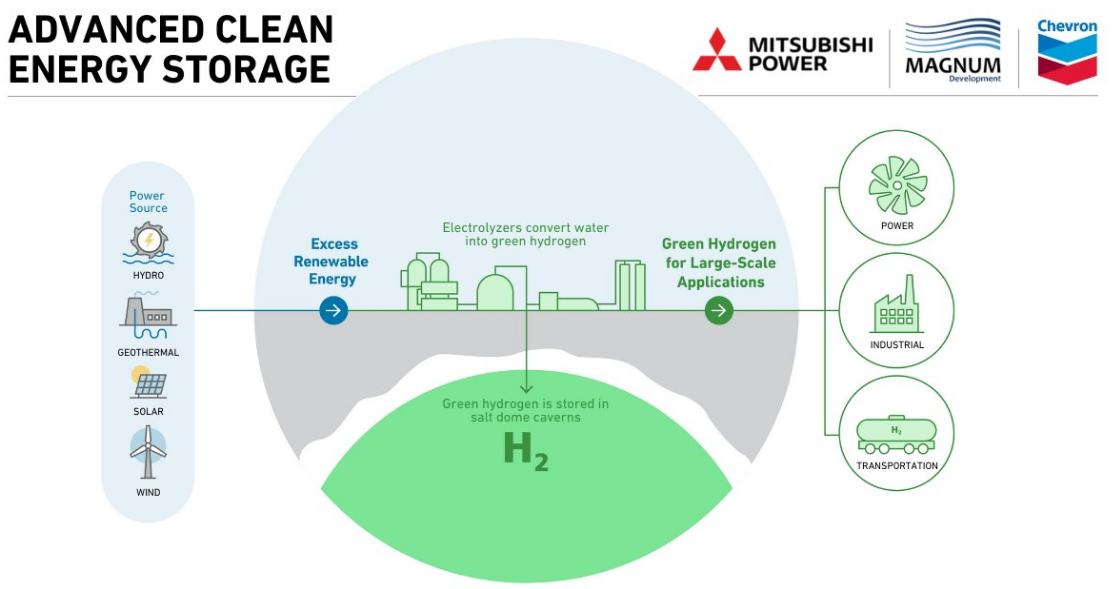

The Engine No1 headline and the Chevron headline are not necessarily the right way to think about the challenges for Chevron and whether or not the challenges are just really beginning for ExxonMobil. The Engine No 1 approach to ExxonMobil was not ESG focused and hit on a larger issue of very poor shareholder returns, with ESG/Climate only one-line item on a list. What Engine No 1 is doing now, is focusing more specifically on climate, and ExxonMobil is likely as large a target as Chevron on this basis. Last week in our Sunday report, we commented on how good the Chevron Gevo deal was for Gevo, but that it did not move the needle for Chevron. Chevron, ExxonMobil, and others are aggressively pursuing renewable fuels, mostly from waste and vegetable oils until the Gevo agreement, and there is another headline today about Chevron pursuing CCS opportunities with Enterprise and the chart below discusses a green hydrogen plan for Chevron. All of these initiatives do not sum to something that investors will take note of for any of these companies yet, and while they might be important building blocks towards a net-zero future, larger tangible investments are probably needed to get any investor buy-in. In the meantime, the activists have a lot of room to work.

Direct Air Capture Is Expensive, But Demand Is There

Sep 10, 2021 1:43:32 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, CO2, Emission Goals, carbon dioxide, carbon offsets, direct air capture, greenwashing, DAC, carbon neutral hydrocarbons

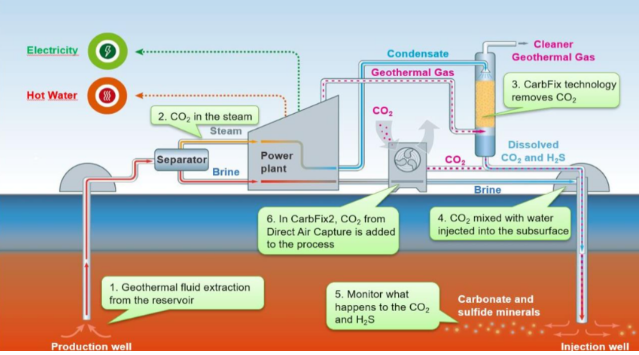

The most notable news from the Iceland CO2 direct air capture (DAC) project, illustrated in the Exhibit below, is not that it is working and how energy efficient it is, but that the CO2 capture costs are extremely high and yet all of the offsets are sold. One report talks about the costs per credit approximating $1000 per ton of CO2, which is likely accurate given that the facility is relatively small scale, at 4 thousand metric tons per year. The same report also states that the credits are almost sold out for the 12 years that they are being offered. We believe that this is indicative of the marginal demand for uncontestable carbon offsets, and this is a topic we have covered at length in our ESG and climate work. Shell, bp, and others are selling what they claim to be carbon neutral hydrocarbons around the world and are buying offsets to do so, but they are coming under quite a lot of “greenwashing” fire because of the less tangible/auditable nature of the credits they are buying – often related to agricultural or specific tree conservation/planting initiatives that are questioned because of the validity of the capture claim or the vulnerability of the credit to weather, fires, and forest maintenance years in the future.

US CO2 Footprint Shrinking, But Not Fast Enough

Sep 9, 2021 1:00:13 PM / by Graham Copley posted in ESG, Sustainability, CCS, CO2, Renewable Power, carbon footprint, climate, EIA, CO2 footprint

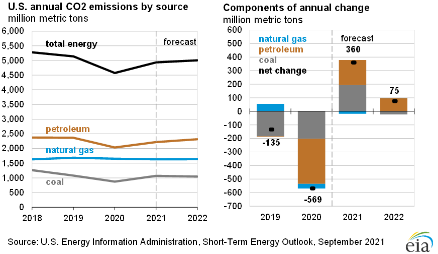

The CO2 emissions chart from the EIA should not be a surprise as the step-up in 2021 and 2022 is a recovery from the economic contraction and habit changes associated with COVID, and the projected increases in 2021 and 2022 are combined lower than the step down in 2020, suggesting that the trend is still negative. The problem is that the trend is not negative enough and as we have written about at length, it will not trend lower fast enough without all corrective opportunities at play – more renewable power, more conservation, and a lot of CCS. See our ESG and Climate work for more.

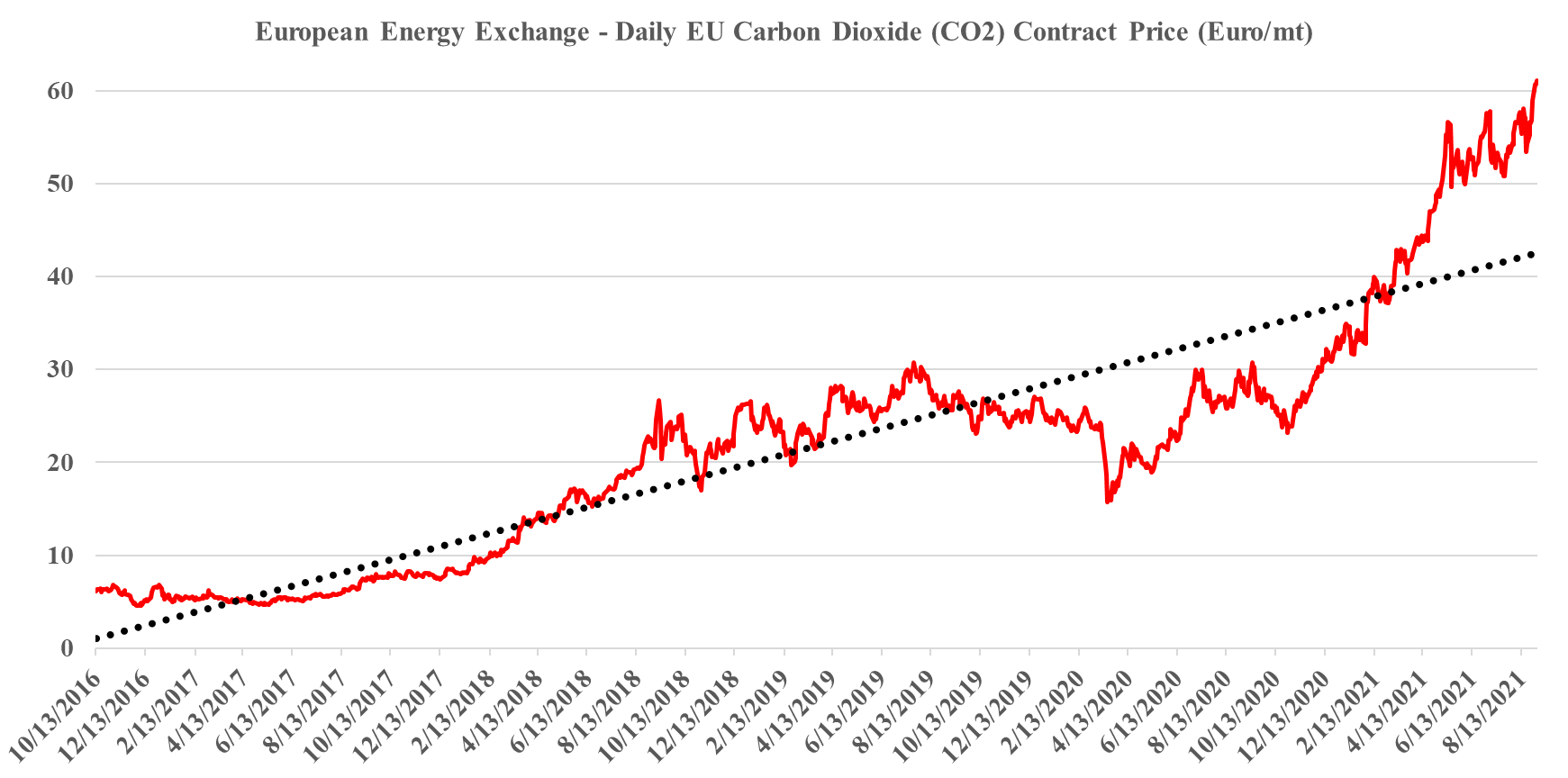

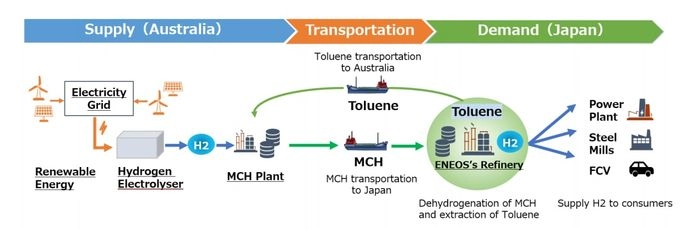

Green Hydrogen: Not So Good If Power Prices Do Not Come Down

Sep 3, 2021 1:14:52 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Methanol, CCS, CO2, Renewable Power, Ammonia, bp, feedstock, carbon dioxide, solar, wind, electrolysis

Last week, and in our dedicated ESG and climate report this week, we talked about the challenges of shipping hydrogen, and the linked bp project for Western Australia will have the same problem to solve – choosing ammonia according to the announcement over the very inefficient toluene/cyclohexane option we discussed last week. The appeal of Western Australia is the unpopulated available land that has little alternative use and sees abundant sunshine. The bp project assumes that the facility can buy attractively priced renewable power from third parties, but the company must have a specific power project in mind for the bulk of the electricity needed. The stumbling block here will likely be when the power project(s) bid out the solar module contract, find out that the suppliers are sold out and are asking higher prices to cover reinvestment and higher material prices, and then have to go back to bp with a much higher than expected cost of power. The advantage of solar and wind projects is that inflation only impacts upfront capital costs, which can be amortized over the life of the project – feedstocks are free! That said, most of the announced projects have declining capital costs per megawatt in their planning assumptions today.

Solar Module Raw Material Costs Reversing Long Term Price Declines

Sep 2, 2021 1:57:21 PM / by Graham Copley posted in ESG, Renewable Power, Energy, Raw Materials, raw materials inflation, solar, renewable energy, renewable investment, solar energy, solar module

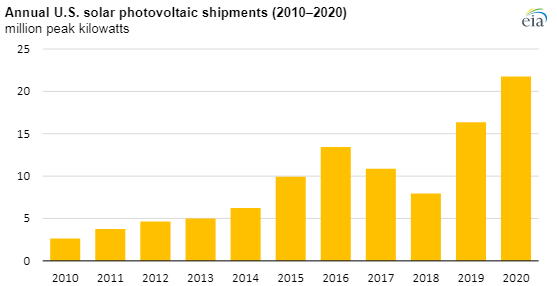

In our ESG and climate piece yesterday we discussed rising costs of climate-related actions, with a focus on some of the likely inflation in renewable power costs. The optimists are looking at the Exhibit below, and what were falling module costs through 2020, and concluding that solar installations can grow and that costs can still fall. While the module shipment growth in 2020 was impressive at 33%, some of the forecasts of what will be needed call for a much more dramatic rate of module growth than we saw in 2020.

Europe's Record Carbon Prices: Not High Enough Yet

Sep 1, 2021 12:54:34 PM / by Graham Copley posted in ESG, Climate Change, CCS, Carbon Price, ESG Investing, carbon dioxide, carbon value, carbon abatement, renewable power investments

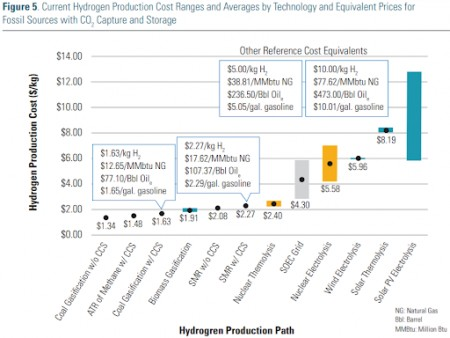

We have maintained all year that the strength in the European carbon price is sustainable and that it should go even higher and consequently, we are not surprised by this week’s move, even if much of the impetus is speculation. The European price is still not high enough to justify unsubsidized CCS or widespread renewable power investments to replace carbon-heavy energy sources, especially as renewable power costs rise. We estimate that a price in the €85-100 per metric ton range would be needed to stimulate investment, but because of the structure of the European market prices could overshoot this level meaningfully and be quite volatile until the level of abatement spending accelerates. When we start seeing investments in Europe to lower carbon that are not highly subsidized by local governments (in addition to the incentive of the carbon price) we will have a better guide around where 45Q needs to go in the US (or other mechanisms) to get investments rolling. Our analysis suggests that the US has some lower-cost abatement opportunities than Europe, especially on the CCS front, but not by much. For more on carbon costs and prices see today's ESG & Climate report.

Shipping Hydrogen: Expensive Anyway You Do It

Aug 31, 2021 2:09:19 PM / by Graham Copley posted in ESG, Hydrogen, Wind Power, Climate Change, Sustainability, Green Hydrogen, Renewable Power, Air Products, Ammonia, renewable energy, solar energy, shipping, transportation, nitrogen, hydrogen electrolyser, toluene, methylcyclohexane

The exhibit below highlights one of the more significant constraints for green hydrogen, which is that the abundant low-cost power opportunities (strong wind and lots of sunshine) are often not where demand for hydrogen exists and the challenge is how to transport it. The problem with reacting it to make something else and then recovering it at the point of use or a distribution hub is that hydrogen is very light and you end up moving a lot of something else to get a little hydrogen. Air Products is looking at making ammonia in Saudi Arabia and shipping the liquid ammonia and the project below is looking at using toluene as a carrier in what appears to be a closed-loop with toluene moving one way and methylcyclohexane moving the other way. The liquid shipping would be cheap, but with the MCH route, only 5% of what you would be moving to Japan would be the green hydrogen. Using ammonia the green hydrogen content is slightly less than 18%, but you have to make the nitrogen on-site. The cost of making the nitrogen would be a function of the local cost of power and these remote locations should have very low-cost renewable power. In the example below, the opportunity is likely unique to the refinery structure and shipping opportunity and we doubt that it is easily replicated in a way that would be more economic than shipping ammonia or shipping compressed hydrogen itself.

Source: H2 Bulletin, August 2021

Offshore CCS Is Good: But Onshore CCS Should Be Cheaper

Aug 27, 2021 12:49:53 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, CCS, CO2, Sequestration, carbon abatement, Offshore CCS, Talos, Onshore CCS

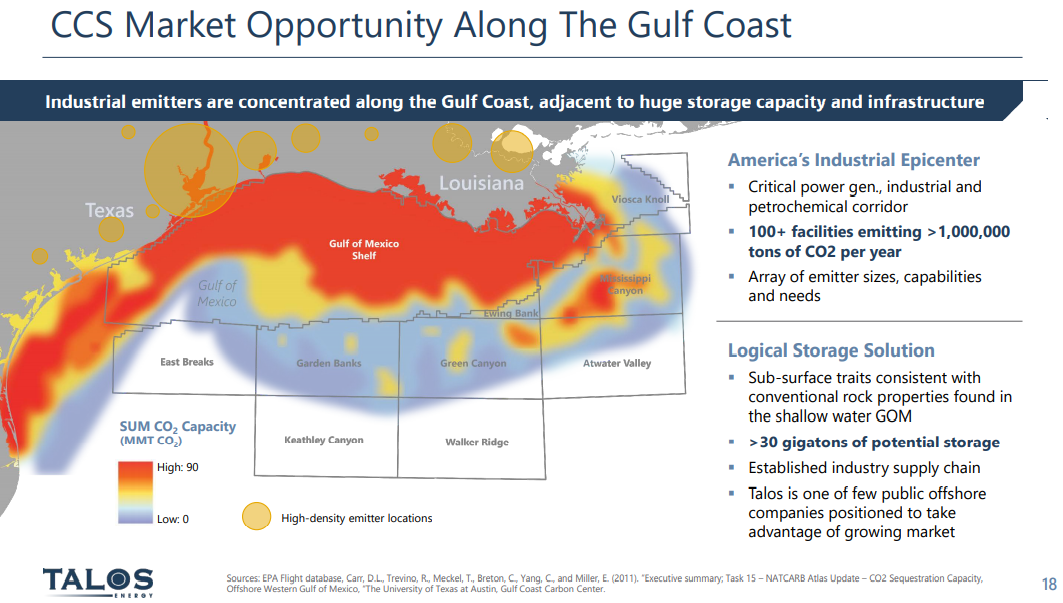

The Talos release and the map shown in the Exhibit below, highlight some of the potential for offshore CCS along the US Gulf Coast. We will likely see some of this developed over time, in our view, but the question of cost is important, not because the US Gulf is likely to be more expensive than some of the offshore locations that are proposed for Europe, but because the same offshore geology on the US Gulf exists onshore, and the onshore opportunities will likely be much lower cost. Given that one of the overriding concerns around carbon abatement is cost and how it will be paid for, who will pay for it ultimately, and what it means for the competitive landscape, finding the lowest cost solutions will be key. This is something that we have covered at length in our dedicated ESG and climate research. Building high-pressure pipelines is expensive, and high relative to the onshore cost of sequestration. Talos might find interest from CO2 suppliers but may be undercut by onshore projects – assuming these get the green light from regulators – not giving them the green light would likely be imposing further unnecessary costs on industry.

Food Grade Plastic Proving Difficult To Recycle - Pyrolysis Is The Answer

Aug 26, 2021 12:40:00 PM / by Graham Copley posted in ESG, Recycling, Polymers, Climate Change, Plastic Waste, Plastics, Pyrolysis, chemical recycling, reuse, food packagers, food-grade polymer

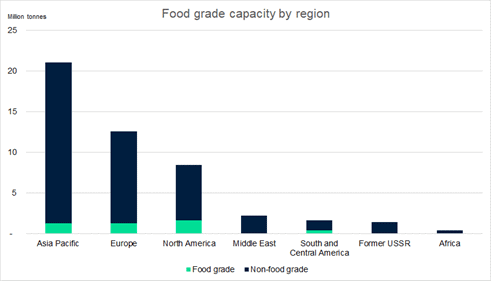

The exhibit below will come to many as a surprise, and it underlines one of the most significant challenges facing the recycling world. It is the food packagers who want the recycled content, but most food-grade polymer is not easily recycled (mechanically) once it has been in contact with food. Shrink-wrap for example is hard to collect and even harder to clean to a standard that is deemed safe and then hard to regrind because it is thin-film. This is where the polymer industry can really push the benefits of “advanced” chemical recycling as the process can take a mixed and not thoroughly cleaned stream of waste polymers with the recycling process itself (pyrolysis) destroying the contaminants and for the output that gets redirected back to ethylene units an additional shot at 1600-1700 Fahrenheit should remove any fears of contamination. You will not get the pound for pound recycle, but 35% is much better than the numbers suggested in the chart. Plus, in the process, you can destroy and reuse a great deal of plastic waste. See our ACC initiative write-up in yesterday’s ESG and Climate report.

%20(1).png?width=6000&height=6000&name=New%20C-MACC%20Logo%20-%20Final%20-%20Transparent%20(2000%20%C3%97%202000%20px)%20(1).png)