The ACC goal of recovering 100% of packaging polymers is bold but likely necessary to show that its members are focused on a full solution, rather than some sort of halfway step. The goal is broken down as follows:

100% Recycling: A Bold But Necessary Ambition For The ACC

Aug 25, 2021 1:33:16 PM / by Graham Copley posted in ESG, Recycling, Polymers, PVC, Plastic Waste, Plastics, chemical recycling, packaging polymers, ACC, plastics packaging, reuse, recycle, recover

Is ESG Investing Making A Difference?

Aug 24, 2021 12:57:09 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, ESG Investing, ESG funds

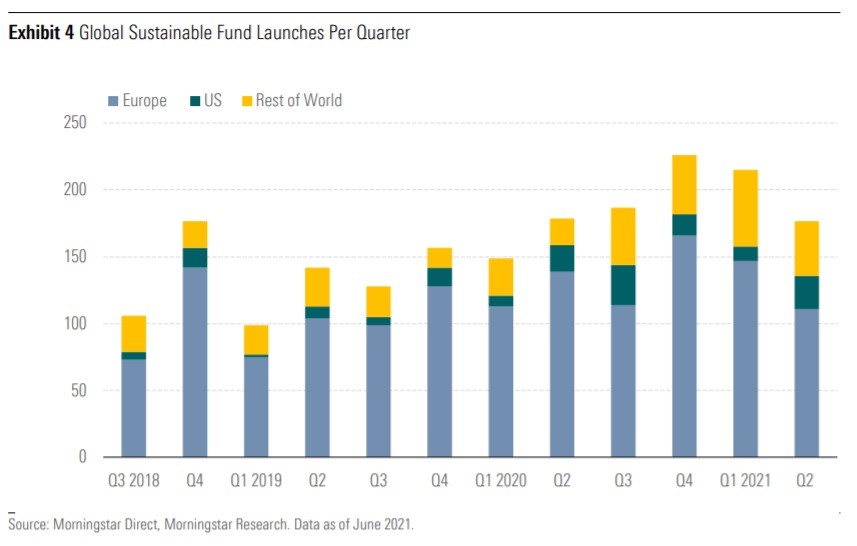

There is a significant increase in the number of commentators taking a swing at ESG investing and suggesting that it is neither effective nor in the best interest of investors as it likely puts them at risk of underperformance. The performance piece has largely been a moot point until now as the funds flowing into the ESG space have been high enough to ensure outperformance from a simple supply/demand perspective, see chart below. However, should the flow of funds slow and investments be judged on their own merits many fund managers are going to find that they own some egregiously expensive stocks with fundamentals that do not support the valuation. If this then leads to a rotation out of a sub-set of names, the future outperformance of the class is far from guaranteed.

Batteries Are Not The Only Way To Store Power

Aug 20, 2021 11:47:43 AM / by Graham Copley posted in ESG, Hydrogen, Raw Materials, raw materials inflation, power, EV, batteries, power storage

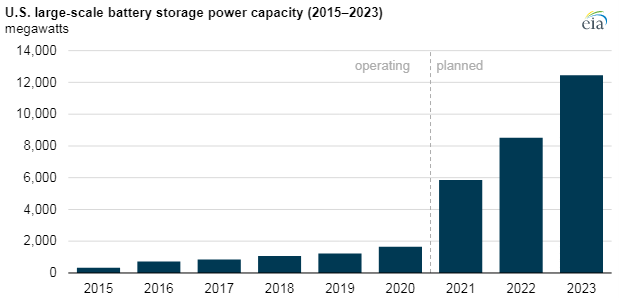

If we look at the battery storage projects highlighted in today's daily report and in the Exhibit below and then read some of the raw material inflationary concerns around batteries, we conclude that batteries will likely not end up dominating the power storage market. Both hydrogen and hydraulic-based storage are likely to be competitive if the battery costs do not come down. Note that storage batteries can afford to compromise on technology as they do not need leading-edge density – weight is not an issue for something that is not going to move. Even so, with battery demand expected to grow rapidly for EVs, it is not hard to see a scenario where other means of fixed location energy storage are more attractive.

It's Hard To Bet On Deflation When You Are Dependent On Commodity Pricing

Aug 19, 2021 11:57:02 AM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, Renewable Power, Raw Materials, solar, copper, silver, wind, Lithium, solar energy, steel, basic polymers, semiconductors, renewable power goals, aluminum, EV batteries, rare earths

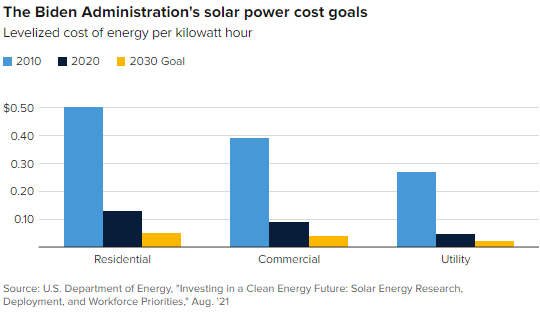

We are back on one of our pet topics today which is the reasonableness around some of the assumptions around the future cost of renewable power. We reference, work done by the US Department of Energy in the Exhibit below, and see two potential pitfalls with the assumptions around continuous improvement in solar, wind, and hydrogen costs, although there is a slight twist for hydrogen. The first is around the dynamics of learning curves. As the exhibit shows, in the early stages of any product development, there are huge leaps in cost improvements, driven by scale, better know-how, more efficient manufacturing, and in the case of solar power, both better processes for installation and some technology improvements. However, as you drive costs lower, the cost of raw materials becomes a much larger component of overall costs, and your ability to lower costs further can be overwhelmed by moves in material costs. Any inability to pass on the costs will result in economics that do not justify additional capital and you find yourselves in a commodity cycle. This is something that we have seen in basic polymers for decades, and no buyer of polyethylene today can claim that they are benefiting from a learning curve improvement. Closer to home for solar, we are seeing the same issue today in semiconductors – not enough margin to invest as everyone has been trying to push costs lower. The expectation in the DOE study and highlighted in the CNBC take on the study below is that annual solar installations in the US need to rise by 3-4X to meet some of the renewable power goals the Biden Administration is looking for by 2030, while similar growth is expected in other markets – the solar panel and other component makers have to be making good money to achieve this.

Everyone Wants A Hydrogen Project: Some Strategies Less Risky Than Others

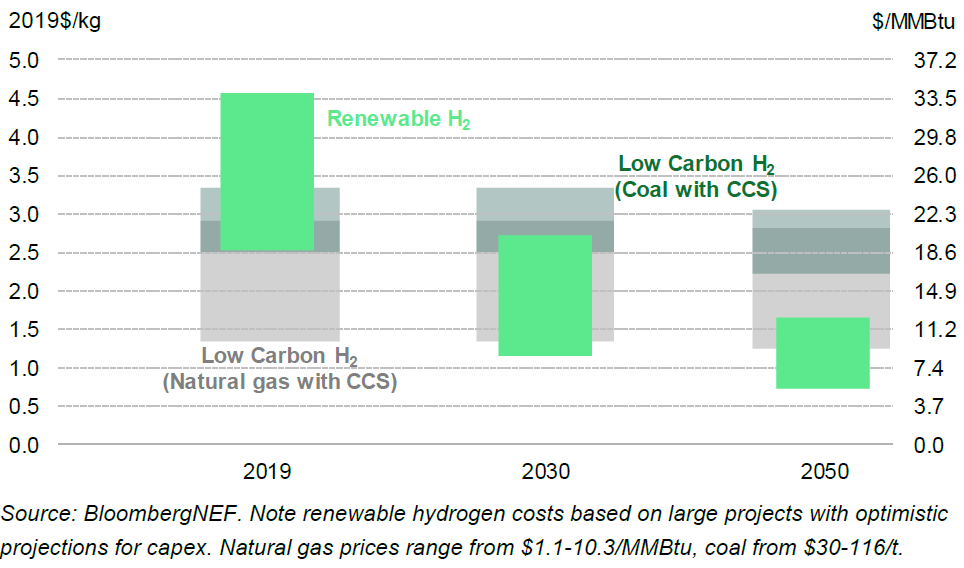

Aug 18, 2021 12:20:35 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Green Hydrogen, CCS, Blue Hydrogen, Renewable Power, Emissions, Ammonia, natural gas, Neom

It is hard to ignore the number of headlines on hydrogen initiatives, today, highlighted in our ESG and climate report, as well as the acceleration in project announcements over the last several months. In the 80s in the UK, it was trendy to drive a VW Golf GTI – everyone had to have one – hydrogen has the same feel today – everyone has to have a project. The projects vary and fall into a handful of categories:

ESG Investing: Reaching Too High vs Staying Too Late

Aug 17, 2021 1:58:20 PM / by Graham Copley posted in ESG, Biofuels, ESG Investing, Fuel Cell, fossil fuel, ESG investment, clean energy stocks, biodegradable polymers

There are two elements/risks to ESG investing and both are highlighted in articles in today's daily report. The first is a reminder that returns matter and this is a reference to the very high multiples that are being applied to some of the more speculative clean energy stocks where there is credit being given today for technology and scale tomorrow. As with the tech bubble, there will inevitably be companies that fail, either because they have an offering that either will not work or will not be economic or because the market moves away from what they are doing. The fuel cell stocks would be at risk if hydrogen remains too expensive to consider as a transport fuel and if batteries or bio-based fuels become the dominant solution. Equally, bio-fuels could fall out of favor if hydrogen is abundant. On the polymer side, better collection and more chemical recycling could make switching to biodegradable polymers unnecessary or uneconomic. There will be winners and losers on this basis and the better strategy is to buy baskets of new technologies rather than bet on just one.

Will The Climate Frenzy Leave Plastic Waste Ignored For Now?

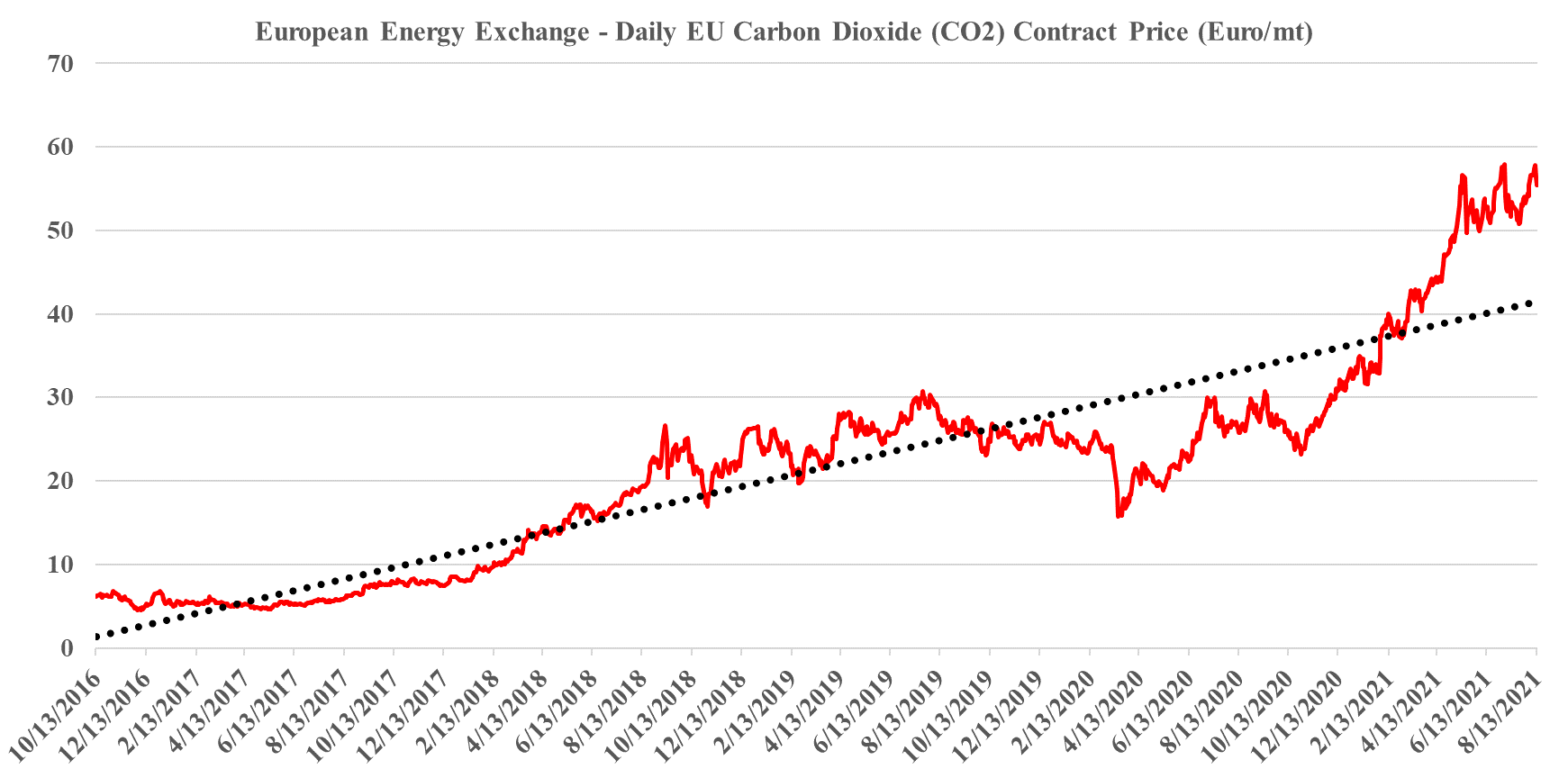

Aug 13, 2021 11:46:37 AM / by Graham Copley posted in ESG, Climate Change, Plastic Waste, Plastics, CCS, CO2, Emissions, Carbon Price, carbon abatement, climate, IPCC, Plastics producers, COP26, virgin plastic, plastic tax

As we sift through the positioning for the upcoming COP26 meeting and the attention focusing report from the IPCC this week, it is a reasonable question to ask what this means for the plastic waste issue. If governments, lobbyists, and activists are likely to be more focused on climate change action over the next few years, which seems to be a reasonable conclusion, will there be the bandwidth for plastic waste? The plastic waste issue is less open to interpretation than the climate change issue and is a visible problem for all, but if governments need to prioritize where they spend their incremental dollar, and/or where they provide incentives of penalties, the climate is going to be pushed to the front of the line in our view. Plastics producers will have to deal with emissions, like any other industrial user of power and heat. The risk is that local governments, looking for revenue to support climate initiatives see taxing virgin plastic (or unrecycled plastic) as a way to both push plastic waste initiatives forward and raise revenue. Adding a plastic tax in the US to the superfund proposal in the infrastructure bill would be hitting the chemicals industry from two sides and would give bodies like the ACC far more grounds for pushback. For more on the IPCC analysis see our ESG & Climate Change report from this week.

A Long Road Ahead To Better ESG Standards

Aug 11, 2021 2:09:15 PM / by Graham Copley posted in ESG, Sustainability, Emissions, ESG Investing, carbon footprint, C02, ESG Metrics, environmental footprints, ESG funds, ESG Standards, social impact, Environmental

Our meetings over the last couple of weeks confirm several developments within the ESG investing world, all of which have been the focuses of our prior work. The first is a very significant step up in ESG oversight among most fund managers, with dedicated ESG teams at many companies scrutinizing sustainability reports and other releases, looking for red flags either from inconsistencies in reporting or from departures from the fund managers standards. Second, there remains a lack of real empirical analysis that allows for accurate comparisons between companies and this stems from the fuzzy reporting frameworks that we have today and the lack of clear and actionable guidance from regulators. As we have discussed several times, the huge inflows into ESG funds and the proportion of overall funds market that now has a “social impact” overlay could lead to real disruptions and some rapid valuation changes if and when the regulators provide tighter guidance on both corporate reporting and fund labeling.

The UN Report Is Alarming - Right or Wrong, We Cannot Ignore It

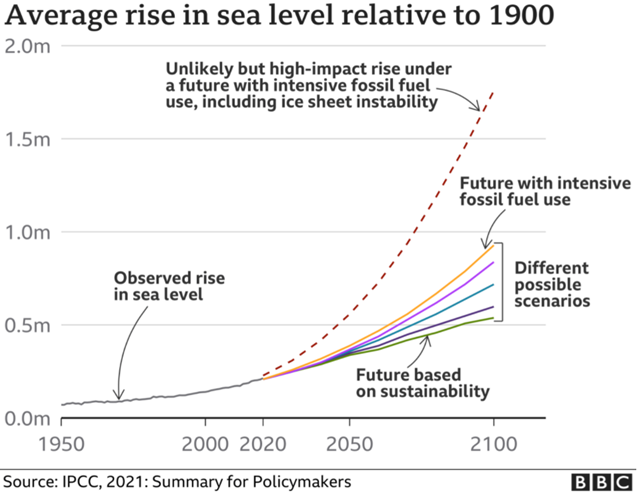

Aug 10, 2021 12:30:31 PM / by Graham Copley posted in ESG, Climate Change, Emissions, climate, UN, United Nations, IPCC, abatement, Sea Levels

The IPCC (UN) report is all over every news outlet and its content and the ramifications of the analysis will be the core of our ESG and Climate piece tomorrow – in the Exhibit below we show a chart that was republished by the BBC which looks at projections around sea level increases. While the UN report has compelling academic and government backing and is certainly the most coordinated analysis on climate change, it is still littered with “most likely” and “more likely” comments, suggesting that the projections are still shrouded in uncertainty. There is a very good chart that shows “observed” climate change data over the last 50 years, and the ranges around the primary causality (human versus natural) conclusions are significant, suggesting that different models are telling very different stories, some less scary than others.

Friday Trio: Troubling US EV math, PET Tires, & New Exxon?

Aug 6, 2021 2:18:25 PM / by Graham Copley posted in ESG, Recycling, CO2, PET, ExxonMobil, Net-Zero, decarbonization, EV, carbon emissions, US Gasoline, electric vehicle goal, recycled PET, Continental

There are several things worthy of comment today. First, the math looks wrong in the Biden EV executive order, especially when combined with tighter fuel efficiency standards that are also on the table. The US consumes around 340 million gallons (approx. 8.1 million barrels) of gasoline a day and a reduction of 340,000 would only be a 1% reduction by 2030, even assuming growth in driving over the next 10 years we would expect the fuel standards and EV introduction to have a much more meaningful impact if successful. We will write more on this is our dedicated ESG and climate work.

%20(1).png?width=6000&height=6000&name=New%20C-MACC%20Logo%20-%20Final%20-%20Transparent%20(2000%20%C3%97%202000%20px)%20(1).png)